Chancellor denies 'foot-dragging' to give banks time to reform

Legislation will be in place before 2015 general election / Ring-fencing retail operations may require a separate Bill

Britain's banks will be given until 2019 to implement sweeping reforms designed to ensure taxpayers never have to bail them out again, George Osborne announced yesterday.

The Chancellor rejected Labour charges of "foot-dragging" and promised that all the legislation to bring in the changes would be on the statute book before the next general election, due in 2015.

He welcomed in principle yesterday's blueprint from the Independent Commission on Banking (ICB), that called for firewalls to be built between the banks' high street and riskier investment operations. It also said the large retail banks should have bigger "cushions" so they can absorb losses or survive a future financial crisis.

The commission, chaired by Sir John Vickers, called for a new system to help customers to switch current accounts through a free redirection service to be formed by September 2013 and said the sell-off of hundreds of Lloyds branches should be used to bring in a competitor. The cost of the changes was estimated at between £4bn and £7bn.

In a Commons statement, Mr Osborne pledged that some changes would be included in a Financial Services Bill, which will put the Bank of England in charge of regulating the banks, due to become law by the end of next year.

But he hinted that the proposal on ring-fencing the retail and investments arms would require a separate Bill at a later stage because it would be too complex to include in an already weighty measure. This could provoke a battle with the Liberal Democrats, who are keen to see swift progress and may table amendments to the Financial Services Bill to implement ring-fencing more quickly.

Vince Cable, the Liberal Democrat Business Secretary, who has led calls for a shake-up of the banks, welcomed yesterday's report and the timetable set out by Mr Osborne. Government insiders said Mr Cable and Mr Osborne, who had previously clashed over the reforms, joined forces last week to persuade David Cameron to back the Vickers report when he had a "wobble" after being lobbied by the banks, who said the changes could harm the fragile recovery.

Lord Oakeshott, a Liberal Democrat peer and close ally of Mr Cable, said: "Doctor Vickers has issued a strong prescription and the banks have got to take their medicine."

Although the 2019 final deadline was included in the Vickers report, Ed Balls, the shadow Chancellor, accused the Government of foot-dragging. The former City minister said he was "deeply sorry" for the part that he and the last Labour Government had played in the "global regulatory failure" that led to the financial crisis.

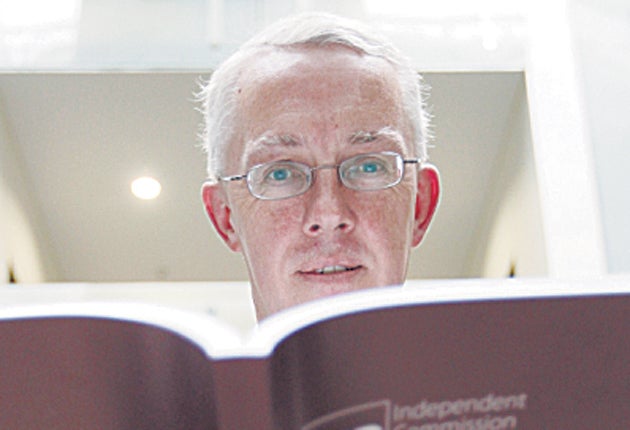

Presenting his report, Sir John called on the Government to enshrine the banking reforms in law as soon as possible to make sure they were not watered down or left on the shelf. He warned against rejecting any of his proposals, which he said worked together as a package. The ICB is concerned that without swift enactment of its proposals, the banks might mount another lobbying operation and persuade the Government that radical change is unnecessary.

Sir John said: "On the question of pick and mix ... we think that would be a great mistake. We have designed this very much as a coherent package. If you take one bit away, you weaken it very greatly. If you start to weaken the ring fence... you can blow apart the whole point it seeks to have."

Martin Wolf, another commissioner, emphasised the need to remove a free guarantee provided by taxpayers for investment banking operations. "Governments have written an astonishing free insurance policy to investment banks. As a result, they have become too big and too dangerous. We believe it is strongly in the interests of Britain and a properly competitive investment banking industry to eliminate that form of subsidy."

Commissioners denied they had bowed to pressure from the banks by allowing them until 2019 to implement the reforms.

Sir John said: "These are fundamental, far-reaching reforms and they take serious time to implement. This isn't a seven-year delay. It will take time to get to the right place."

Commission members rejected as empty threats suggestions that their reforms could drive banks such as Barclays and HSBC from the UK. Mr Wolf said an investment bank could only regain the benefits of funding itself with retail deposits if it bought another big retail bank, which was highly improbable. He also cast doubt on whether other countries would want to take on the risks of adopting one of Britain's investment banks.

Q&A: Commission aims to minimise public's risk and taxpayer costs

What is the Independent Commission on Banking?

* The Chancellor, George Osborne, set up the commission in June last year to come up with reforms that would reduce risk to make the UK banking system safer and increase competition to benefit customers.

Chaired by Sir John Vickers, a former Bank of England chief economist, the commission also includes Clare Spotiswoode, the former gas regulator; Martin Taylor, the ex-Barclays chief executive; Martin Wolf, a senior Financial Times journalist; and Bill Winters, an ex-investment banker.

What has the Commission recommended?

* Its big proposal is that banks with retail and investment banking under one roof, such as Barclays and Royal Bank of Scotland, should "ring-fence" retail deposits, small business lending and other economically important business from risky trading and activities not deemed socially useful. The idea is that if a bank gets into trouble, consumersavings, which are guaranteed by the Government, will be protected.

The ring fence is also meant to stop the taxpayer subsidising the banks by guaranteeing retail deposits that they can use to gamble in the "casino" of investment banking. The ICB wants banks to hold bigger capital buffers against losses than in other countries and has called on the Government to make sure a proper competitor is created when Lloyds sells more than 600 branches.

What do the banks think?

* They hated the ring-fence idea, as set out in the ICB's initial report in April, and have lobbied hard against it. They were worried that the ring fence would cut their profits and claimed that if it was too rigid it would prevent them lending to credit-starved businesses. The ICB estimates its proposals will cost the banks up to £7bn, with at least half the cost caused by cutting the Government guarantee, and will reduce their profitability because they will have to pay more to borrow money. But the ICB claims that letting them lend retail savings to non-financial customers kills the argument that the economy will be hit by lack of lending. One banking analyst summed up the market reaction as: "Today's ICB report is unwelcome and unhelpful but it could easily have been a whole lot worse."

Will the reforms work?

* That depends. History is littered with recommendations for banking reform that never got acted upon. Although he's given the banks a few years to set up the ring fence, Sir John has called on the Government to enact legislation by the end of this parliament (2015) at the latest. He says passing the law early is vital to stop the measures gathering dust under pressure from the banking lobby.

Sean Farrell

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments