Exclusive: Lib Dems declare war on the rich with raids on pensions and property in 2015 manifesto

It is not “fair or sensible” to go into the next election promising to cut the deficit solely with spending cuts, a senior figure said

The Liberal Democrats are planning a double election tax raid on the rich, with commitments to introduce new levies on property and pension pots in their 2015 manifesto.

Under plans being drawn up by Danny Alexander, the Chief Secretary to the Treasury, the Liberal Democrats will commit to raising £2bn a year from a banded “mansion tax” on multimillion-pound properties.

The party is also planning to reduce the total amount people can save tax-free for their pensions by 20 per cent to £1m. The move is expected to raise a similar figure. The measures will form key Liberal Democrat demands in any possible coalition negotiations after the next election, as well as being used to differentiate the party from the Conservatives in the run-up to 2015.

Liberal Democrat sources said the Treasury had already drawn up detailed and costed plans to introduce new banded charges on properties worth more than £2m and more than £5m. The work was done in preparation for the 2012 Budget, but the proposals were vetoed at the last minute by David Cameron.

Mr Alexander is expected to say that this policy analysis will form the basis of the Liberal Democrat manifesto.

At the same time, the Liberal Democrats will commit to reducing the lifetime tax-free limit on pension contributions from £1.25m to £1m. The limit currently stands at £1.5m but is due to fall by £250,000 in April. The move would raise between £1bn and £2bn a year. A senior Liberal Democrat figure told The Independent that the party did not think it was “fair or sensible” to go into the next election promising to cut the budget deficit solely with spending cuts.

“This is about showing that we have fully costed plans to reduce the deficit by a more equitable distribution between spending cuts and tax rises,” the source said.

“The Treasury has already looked in great detail at how you would make a mansion tax work in practice. Danny is going to be able to use the Treasury papers to make that case. We’re looking at pension tax relief. The lifetime allowance is now £1.25m. We’d like to see that coming down to £1m.”

Another Liberal Democrat source added: “We have always been clear that those with the broadest shoulders should bear the greatest burden.”

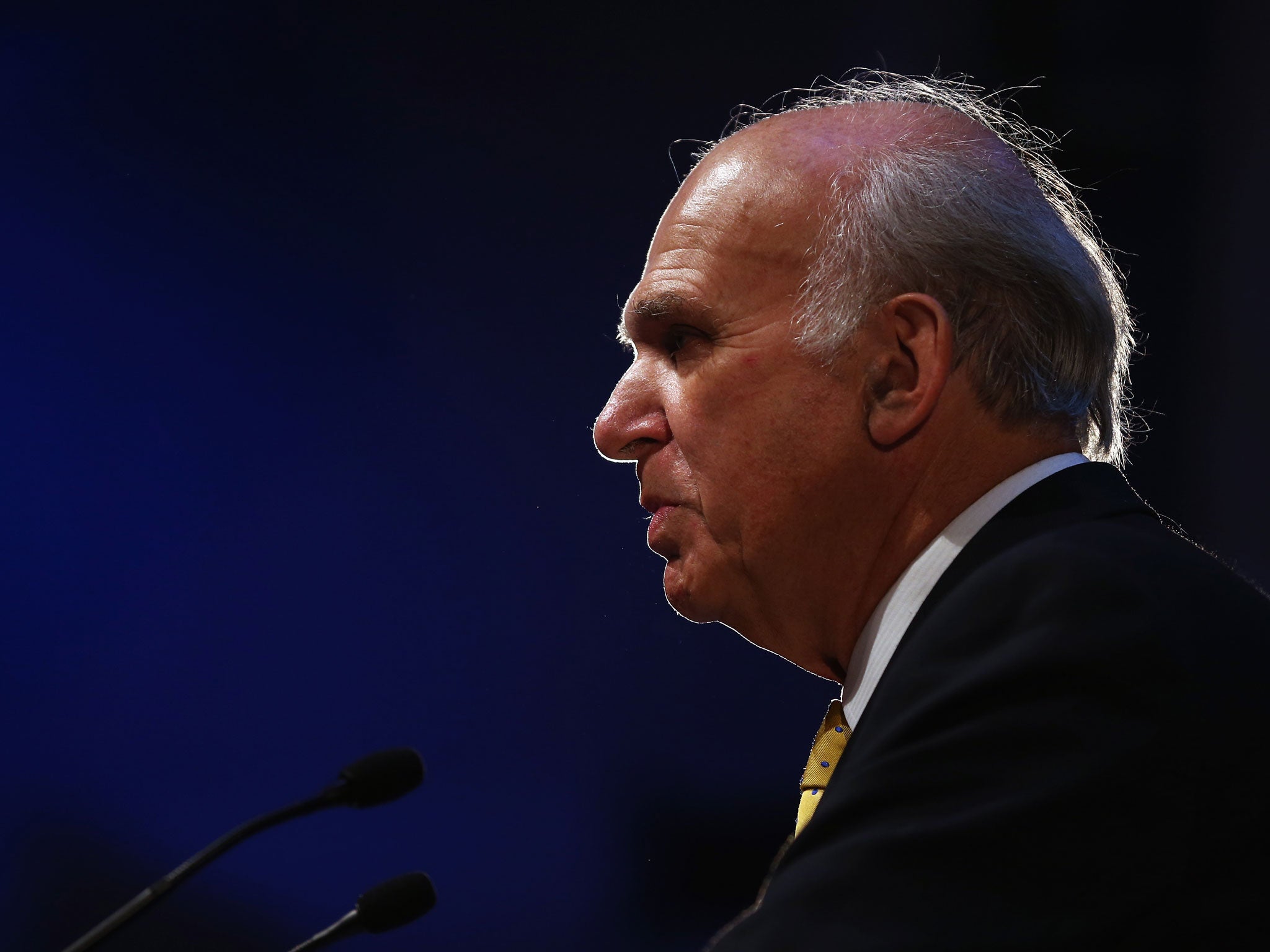

The growing divisions between the Liberal Democrats and the Tories on tax and spending policies were highlighted last night by Vince Cable, the Liberal Democrat Business Secretary, who accused George Osborne of pursuing a “small state” agenda by cutting for its own sake. He warned that the Chancellor’s efforts to boost the housing market could create another “property boom and bust”.

Speaking to the Royal Economics Society at the Bank of England, Mr Cable said the Liberal Democrats believed in “finishing the job we started” on the budget deficit, but warned that his party would not sign up to Mr Osborne’s plan for £30bn of extra cuts after next year’s general election, which he said was “a political and ideological commitment”.

Mr Cable made clear that the Liberal Democrats would seek to raise the incomes of low and middle earners through further increases in the personal tax allowance, offset by tax rises for the rich. “The Lib Dems will reduce the debt burden but ensure this isn’t done at the expense of public services and the most vulnerable in society,” he said.

He suggested that the Liberal Democrats could allow public spending to rise after the election, a move which could make it easier to reach a deal with Labour in another hung parliament.

“There are different ways of finishing the job,” he said. “Not all require the pace and scale of cuts set out by the Chancellor. And they could allow public spending to stabilise or grow in the next parliament, whilst still getting the debt burden down.”

Although GDP figures to be published today are expected to confirm a strong recovery, Mr Cable insisted that Britain is at the end of the beginning rather than the beginning of the end.

He said: “Recovery is welcome, but much hard work remains… Despite these encouraging signs, the shape of the recovery so far has not been all we might have hoped for. Exports are still too weak and the trade balance has deteriorated as import demand has outstripped export demand, leaving a current account deficit of 4 per cent of GDP. Too many businesses – which often have healthy balance sheets – are sitting on their cash and not investing it.”

Mr Cable accused the Tories of jeopardising the fragile recovery by flirting with withdrawal from the European Union, which created political uncertainty.

“The actual risks of leaving may be small, but one of the most useful contributions to recovery our Coalition partners could make, in the national interest, would be to do more to remove this unnecessary risk,” he said.

On housing, Mr Cable said: “The spurt in prices is also a warning of potential threats to stability. There is a chronic imbalance between supply and demand. One way out of the dilemma would be a massive and rapid increase in house construction.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments