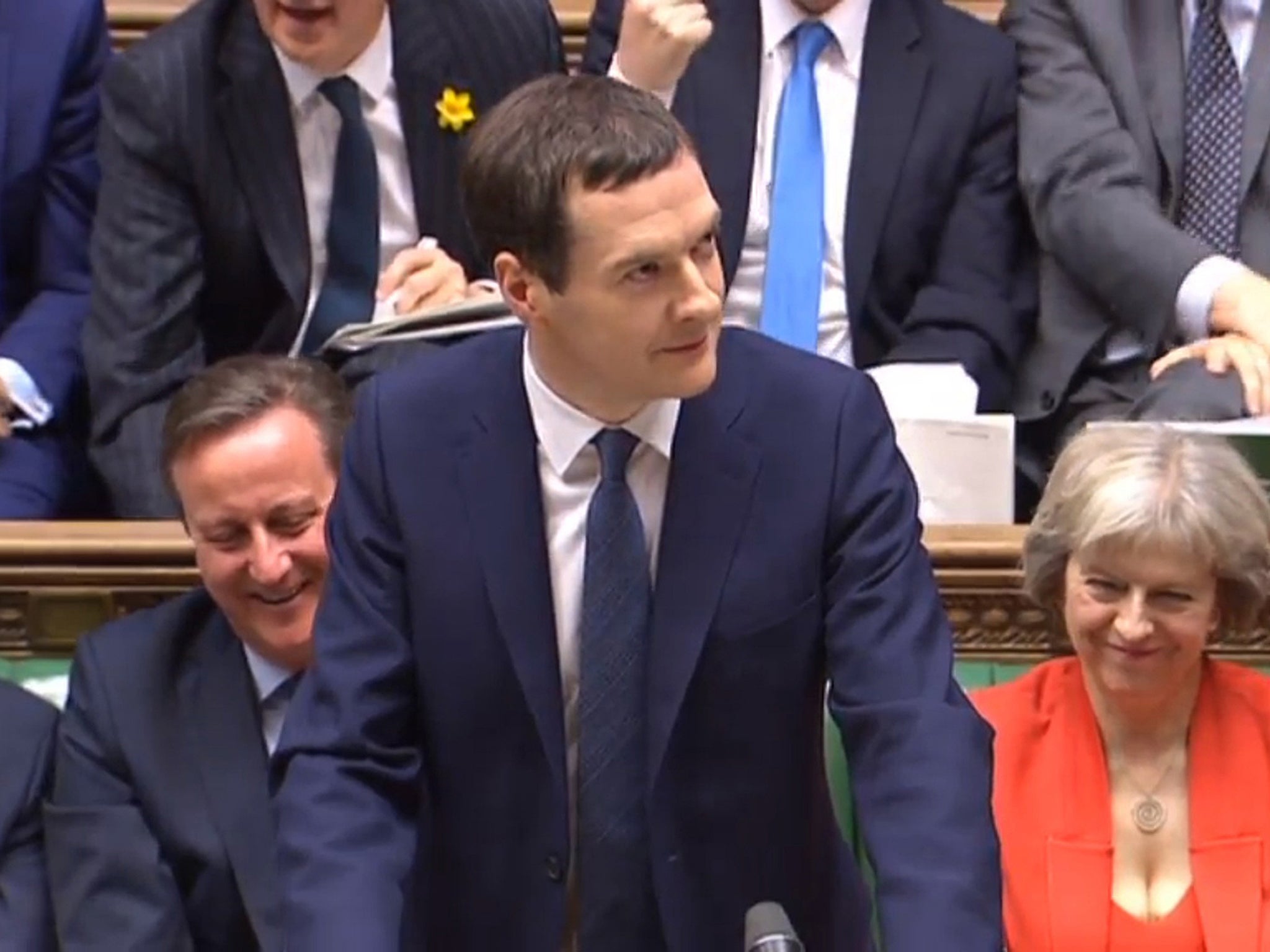

George Osborne's tax breaks for millions of working Britons 'mask how much poorest families will lose out'

Resolution Foundation says poorest Britons will suffer big annual income losses, while richest will see significant rises

The tax-breaks for millions of working Britons announced by George Osborne in last week’s budget mask the extent to which the poorest families will lose out, according to a new analysis by the Resolution Foundation.

The think tank, chaired by former Conservative cabinet minister Lord Willetts, has examined the gains and losses since last year’s budget. The findings reveal that the poorest families in Britain are set to suffer big losses in their annual income, while the richest will see significant rises.

This echoes the recent criticisms of the Government made by Iain Duncan Smith, who has cited the tax cuts given to higher earners as one of the reasons for resigning as Work and Pensions Secretary last week.

The new analysis predicts the impacts of tax, benefit and minimum wage policies announced since the election on ten typical household types by 2020. It warns that while most working families received small cash gains from last week’s Budget, these are outweighed by the losses they are faced with because of changes announced last year.

The richest 30 per cent of households will be £255 better off a year by 2020, as a result of the tax cuts. In contrast, the poorest 30 per cent of households will be just £50 better off according to the Resolution Foundation. But the gulf is even greater after the various major policy announcements since the election are taken into account – with the poorest 30 per cent of households set to lose around £565 by 2020, while the richest 30 per cent will gain around £280.

“The richest half of households are due to receive the strongest income growth over what we call the “continued recovery” during this Parliament, while the poorest quarter of households are actually set to see their income fall over the next five years as a result of slower wage growth (despite the National Living Wage) a freezing in all working age benefits, and significant cuts to in-work support,” states the research.

The analysis shows that a low-paid single parent – working full-time and earning £11.50 an hour – gained £70 as a result of the increase in the Personal Tax Allowance announced on 16 March. But this is overshadowed by a £1,510 loss in income which will be incurred as a result of cuts to Universal Credit announced in last year’s Budget – something which will not be fully realised until 2020.

Laura Gardiner, senior policy analyst, the Resolution Foundation, said: “For many low-income families smaller gains are dwarfed by the significant cuts to Universal Credit announced last Summer which will leave many working families thousands of pounds worse off by the end of the parliament.”

She added: “Last years’ Summer Budget was highly regressive, with big losses for low-income households and gains for many richer ones. The tax cuts announced in last week’s Budget have widened this divide.”

Families have been disproportionately hit, with lower earners without children likely to be in a better position than they were before. A full time worker on the minimum wage without any children will be £1,400 better off – a 10.2 per cent rise in their income.

But a couple on the minimum wage with three children are set to be £3,430 worse off than they were before - mainly due to planned reductions in Universal Credit which include the withdrawal of any in-work support for a third child.

This will mean that their income falls by 11.7 per cent by 2020 – making them the worst off of the ten demographic groups looked at. Single parents working in low earning jobs are the next hardest hit, with those working in part-time or full time jobs set to see their total income fall by 6.7 per cent and 7.4 per cent respectively.

A single parent with one child, working full time in a low earning job, can expect to be £1,510 a year worse off. In contrast, high earning couples with two children can look forward to being £430 better off. And a couple without children, who earn £157,050 a year, will be £620 richer.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments