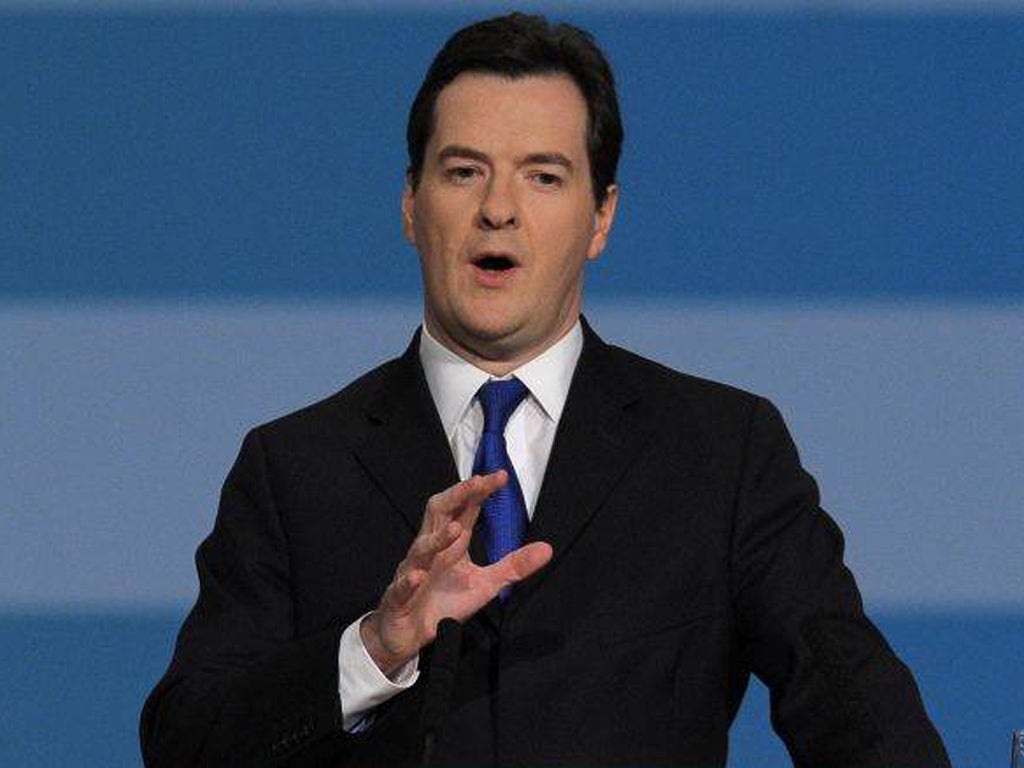

How can Osborne get Great Britain plc moving again?

Chancellor, take note: as he prepares to lay out his plans, economists, politicians and business leaders offer their own ideas

John Cridland

Director-General, CBI

"Now is the time to create a 'Plan A plus' growth strategy, to boost the economy at little extra cost to the Exchequer. The Chancellor must unlock private sector investment by tackling planning and regulation road-blocks. The Government must prioritise bringing forward major road infrastructure projects and introduce road tolling. Tackle youth unemployment, unfreeze the housing market, and protect our energy-intensive industries."

Cost: £50bn – but ministers hope to use private money and pension funds for house- and road-building

Ruth Porter

Institute of Economic Affairs

"At the heart of Osborne's Autumn Statement must be specific, concrete and comprehensive deregulatory measures – abolishing (or, at the very least, regionalising) the minimum wage, creating exemptions for small businesses on a whole raft of obligations (such as flexible working), simplifying the tax code and scrapping unfair dismissal rules. The list goes on... Not only are these regulations often hurting those they were brought in to protect, they have become a major barrier to economic growth. It might not be a headline-grabbing area, but it is the key to recovery."

Cost: Revenue neutral

Josh Ryan-Collins

New Economics Foundation

"At the heart of the economic crisis is the collapse in private investment, allied to the collapse of the old, inefficient model of growth. To create employment and develop a sustainable economy, the Government should grant the Green Investment Bank the same powers to create loans as other commercial banks. The beefed-up bank would issue bonds to fund the first steps in transforming the British economy, investing in a new generation of energy-efficient housing, backed up by home insulation for the existing stock, overhauling our public transport infrastructure and providing seed funding for community and offshore wind power."

Cost: £775m for green loans

Adam Marshall

Director of policy, British Chambers of Commerce

"Follow through on the reform of our sclerotic planning system. Only in Britain are big infrastructure projects and local businesses' expansion plans held up unnecessarily for months and years on end. Unblocking the planning system will deliver jobs, confidence and the momentum for future growth."

Cost: Revenue neutral

Tony Dolphin

Chief economist, Institute for Public Policy Research

"To ensure people who have been out of work for a long time keep in touch with the labour market, George Osborne should guarantee a job lasting up to six months to anyone who has been claiming Jobseekers' Allowance for 12 months or more. This guarantee should be matched by an obligation to take up the offer or find an alternative."

Cost: £1.7bn – to pay £6,500 to fund jobs for the 265,000 on the dole for more than a year

Martin Lewis

Creator of MoneySavingExpert.com

"If we're printing money anyway, why not stop feeding the banks, who never pass it on. Use the quantitative easing cash to give to real people to spend or pay utilities (use vouchers so it can't be saved). That way it gets out in the real economy. This would boost growth and help fragile finances at the same time."

Cost: Revenue neutral – spending existing money on something different

Matthew Whittaker

Senior economist, the Resolution Foundation

"Weak consumer demand is not just a reaction to recent economic difficulties, but reflects a long-established stagnation in wage growth for millions of workers. With neither the income-boosting effects of ever-more-generous tax credits nor the ready availability of borrowing looking sustainable in the medium term, we need to consider methods for improving the pay prospects of ordinary workers. More immediately, however, serious consideration should be given to a short-term fiscal boost targeted at those hard-pressed low- to middle-income households most likely to spend any giveaway."

Cost: £13bn to reverse the VAT rise, from 20 per cent to 17.5 per cent

Elizabeth Truss

Conservative MP

"The number of childminders, the most affordable form of childcare, fell from 100,000 in 1997 to 55,000 in 2010 with increased regulation including a compulsory curriculum. The Government should exempt those looking after fewer than four children in their own home from regulation, putting them on the same footing as nannies and au pairs. Affordable childcare would enable more parents to work and provide childminding opportunities to others."

Cost: Nothing – cutting red tape

Andrew Harrop

General Secretary, Fabian Society

"Unlock housing wealth. UK households are sitting on £3.5trn of housing wealth. Unlocking just a tiny share would equal billions of economic stimulus. Learning from the car scrappage scheme, the Government should launch a time-limited voucher to encourage people to cash in their wealth and get spending. For those who want to downsize to a cheaper property, the money could be put towards the upfront costs of moving (that would free larger homes for families, too). If you want to stay put, the voucher would be a discount for an equity release or second mortgage."

Cost: Revenue neutral

Matthew Sinclair

Director, the TaxPayers' Alliance

"Lower spending and lower taxes have a well-established record in delivering growth. The Government should end plans for new spending like the drastic rise in foreign aid or the high-speed rail white elephant. Remove unnecessary obstacles to growth by merging income tax and national insurance to make tax simpler and more transparent. Scrap the carbon floor price, or protect energy-intensive industry properly, so that we don't risk jobs. Abandon gestures like the 50p rate – which will reduce revenue and mean the rest of us have to pay even more – and overall leave families and businesses with more of their own money to spend on their priorities."

Cost: £2.3bn average annual revenue from 50p tax rate

Charlie Elphicke

Conservative MP

"Jobs and money are created by business, not government. Lowering business taxes, making it easier to set up in business and incentivising job creation all help increase growth. Banking reform can provide business with the funds to grow, while an emphasis on export assistance will boost our international trade."

Cost: £3.8bn from cutting corporation tax to 12.5 per cent

John Redwood

Former Conservative cabinet minister

"Creating competition and capacity in banking is essential to stimulating growth. The Government should spin off three new banks, using assets and branches, staff and equipment from the holdings of RBS. They should sell shares in these banks, raising new money for them from the private markets at the same time. This would create more lending capacity for business and for the new power stations, toll roads, broadband networks, reservoirs, pipelines and the infrastructure the Government could initiate with permits, competitions and licences."

Cost: Revenue neutral

Dr Ros Altmann

Director general, Saga

"Instead of buying gilts with £75bn of newly created quantitative easing money, Government should announce a national insurance holiday for all employers adding additional staff. Growth and job creation could also be stimulated by channelling money from large pension funds (such as the local authority funds) into small company lending and infrastructure investment projects, underpinned with government guarantees."

Cost: £900m for NI holiday for firms taking on new staff

Jean-Paul Floru

Director of programmes, Adam Smith Institute

"A flat 15p rate of income tax and corporation tax. Short-term revenue shortfall to be paid for by privatisations (including RBS) and cost cutting. Will create a truly massive economic boom within the year, resulting in far greater revenue. Reagan, Kennedy and Thatcher successfully raised tax revenue by cutting taxes to create growth. A tax rate of 15 per cent makes us competitive with Hong Kong, which itself has a massive budget surplus. The announcement alone would ensure a deluge of foreign investment. Growth is likely to be 6+ per cent. Employment would rise dramatically. The savings could be found through a new James Review."

Cost: At least £50bn estimated loss in revenue from a flat rate of 15 per cent income tax

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies