'Is there no limit to what this Government will privatise?': UK plasma supplier sold to US private equity firm Bain Capital

Sell-off puts blood supply at risk, warns Lord Owen

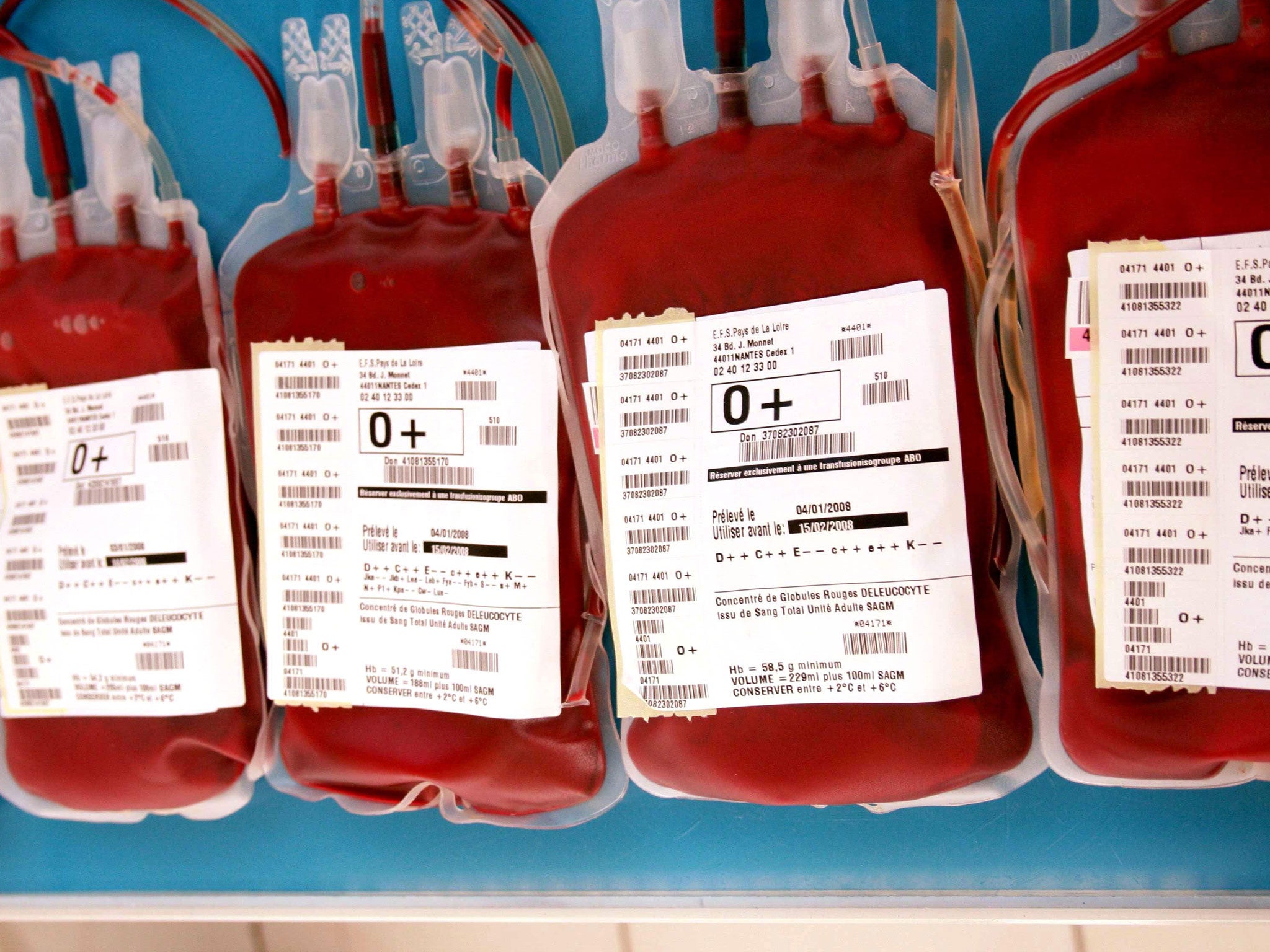

The Government was tonight accused of gambling with the UK’s blood supply by selling the state-owned NHS plasma supplier to a US private equity firm.

The Department of Health overlooked several healthcare or pharmaceutical firms and at least one blood plasma specialist before choosing to sell an 80 per cent stake in Plasma Resources UK to Bain Capital, the company co-founded by Republican presidential candidate Mitt Romney, in a £230m deal. The Government will retain a 20 per stake and a share of potential future profits.

PRUK has annual sales of around £110m and consists of two companies: it employs 200 people at Bio Products Laboratory (BPL) in Elstree, Hertfordshire, and more than 1,000 at DCI Biologicals Inc in the US. DCI collects plasma from American donors and sends it to BPL where it is separated into blood proteins, clotting factors and albumin for supply to NHS hospitals in the treatment of immune deficiencies, neurological diseases, and haemophilia.

British jobs are being safeguarded in the deal and Bain, which has invested in dozens of private and state-owned health companies worldwide, is prepared to spend £50m in capital investment on the Elstree laboratories.

However, critics of the deal warned the Government that Bain Capital was the wrong company to own the NHS plasma supply line.

Lord Owen, the former Health Minister, wrote to David Cameron earlier this year asking the Prime Minister to intervene and halt the sale. “In 1975, against some resistance from those guarding the finances of the DHSS budget, I decided as Minister of Health to invest in self-sufficiency in the UK for blood and blood products,” he wrote. “I now believe this country is on the point of making exactly the same mistake again. The world plasma supply line has been in the past contaminated and I fear it will almost certainly continue to be contaminated.”

After hearing of the sale Lord Owen told The Independent: “It’s hard to conceive of a worse outcome for a sale of this particularly sensitive national health asset than a private equity company with none of the safeguards in terms of governance of a publicly quoted company and being answerable to shareholders.

“Private equity has a useful function, as I saw in years past on the advisory board of Terra Firma, but Bain Capital should not have been chosen for this sale. Is there no limit to what and how this coalition government will privatise?”

Blood from UK donors, typically collected in vans and centres by NHS Blood and Transplant, is not supplied to PRUK, a separate organisation. Plasma donors at DCI centres in the US receive cash for each donation, typically around $25 for the first visit and $20 for any subsequent visit. People can donate up to twice a week.

Due to safety concerns following the emergence of ‘mad cow disease’, or vCJD, NHS hospitals only use plasma from around 20 per cent of blood collected from donors in the UK with the remainder used for diagnostic and research purposes. As the UK was unable to secure a long-term ‘safe’ blood supply for the NHS following the vCJD outbreak, the Government spent £50m in 2002 on the US firm that provided all of BPL’s plasma.

The majority of NHS hospital plasma supplies come from PRUK, which sources all its plasma from low contamination risk groups in the United States across DCI’s network of 32 donor centres.

Lucy Reynolds from the London School of Hygiene and Tropical Medicine wrote an academic paper earlier this year strongly arguing against the sale of PRUK.

She said the Coailtion deal undervalued the company adding: "Plasma supplies have a long record of being operated on a not for profit basis, using voluntary donors where all the necessary checks take place. The difference with a commercial firm is that they will want to have as many donors as possible and be looking to secure large profits first and foremost.

"This amounts to the government abandoning UK blood products users to the tender mercies of the cheapest supplier."

The PRUK deal is the latest move from Bain Capital into the expanding privatised UK health market. The Independent reported last month that the Hospital Corporation of America (HCA), co-owned by the assets management firm, already caters for around half of all private patients in London and runs three joint NHS ventures, renting building space from public hospitals for exclusively private treatment. HCA is also a large buyer of plasma-derived products.

Devin O’Reilly, managing director of Bain Capital in London, said: “We have completed over 50 healthcare investments in companies such as HCA and we will ensure that all of this experience and expertise is applied to building PRUK into a true global leader.”

Health Minister Dan Poulter said: “This deal will ensure that patients will have access to high quality plasma products for years to come and it is good news that Bain are investing in medicine and the life science industry in the UK.”

Everything must go? Put up for sale

Royal Mail

A fresh attempt to privatise the Royal Mail was announced earlier this month with the Government pinning hopes on offering 10 per cent shares to postal workers to dilute opposition to the scheme. It was the privatisation Margaret Thatcher balked at, saying she was “not prepared to have the Queen’s head privatised”.

Forensic Science Service

The closure of the Forensic Science Service in March 2012 means courts are now dependent on private companies and independent police laboratories for forensics analysis. The FSS was losing £2m monthly.

Student loans

Having ensured students pay much more for higher education by jacking up tuition fees, the government plans to sell off the student loan book, potentially raising the cap on the rate of interest as a lure for investors.

School playing fields

In the past three years the Education Secretary Michael Gove has approved the sale of more than 50 playing fields. On average 17 are sold annually, a fall from the last Labour government’s average of 28.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments