Now Osborne throws out the 'skip tax'

Government 'clarifies' position on taxation of rubbish dumped in landfill after outcry

The Government has killed off plans for a massive hike in charges for dumping rubbish after waste firms condemned the so-called "skip tax."

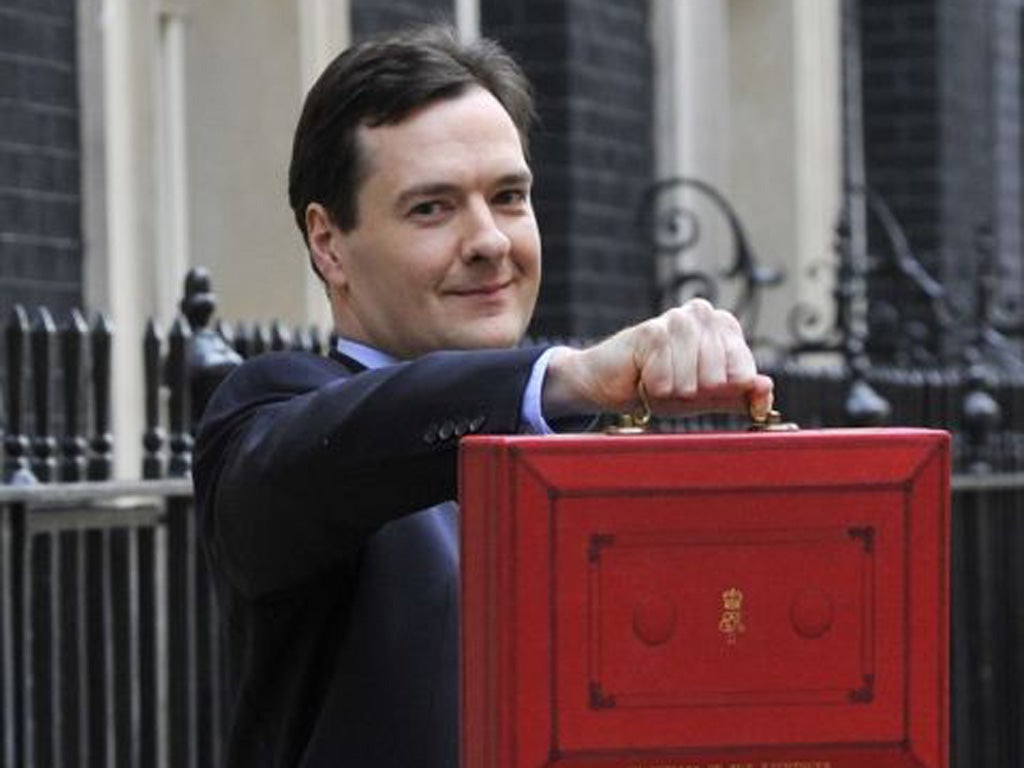

The companies declared victory last night after HM Revenue & Customs (HMRC) issued new guidance aimed at ending the controversy. The Independent revealed on Thursday that skips full of rubble could go uncollected after a rise of almost 2,500 per cent in the tax for dumping certain types of rubbish in landfill sites. Ministers denied making another U-turn at the end of a week which saw George Osborne dump some of the key measures in his March Budget. But the revised guidance is as an embarrassment at a time when the Government's competence is being questioned.

Last week, HMRC issued guidance to help operators identify the rates to apply to different materials, after complaints from the industry that some tips were not applying the rules correctly. Some tips then started levying tax on waste dumped from skips at £64 a ton, rather than the previous £2.50.

But HMRC said yesterday that the huge increase was based on a misunderstanding. "This is not a U-turn, it is a clarification," said an HMRC spokeswoman."The rules have been in place since 2009 and the rules have not changed. The operators need to look at the rules." Richard Hunt, chairman of the Plant and Waste Recycling Show, which organised a petition against the landfill tax increases, said the fresh guidance resolved the problem and urged operators to call off plans to disrupt Diamond Jubilee celebrations this weekend by staging roadblocks.

John Walker, chairman of the Federation of Small Businesses, said: "The sudden announcement and imposition of this huge tax increase threatened to put hundreds of small firms out of business, almost overnight. We are delighted ministers have acted so quickly."

The Treasury denied that a "black hole" would be left in the public finances by the U-turns over the so-called pasty tax, the caravan tax, tax relief on charitable donations and the rate of VAT on church repairs. Sources said the cost, estimated at between £150m - £180m, was a relatively small amount.

David Gauke, the Exchequer Secretary, said: "The reality is that the Budget in March was fiscally neutral, but indeed there was, if you like, a buffer zone there. This still remains a fiscally neutral budget. Even taking into account that those three changes... the Budget does not add to our borrowing."

However, the Treasury faces accusations of double standards because it often rejects pleas for extra spending on the grounds that there is no money available. Rachel Reeves, the shadow Chief Secretary to the Treasury, said: "This series of U-turns shows what a mess this Government is in."

2,500% The rise in tax for dumping certain types of rubbish that had been proposed

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments