Years of austerity beckon for the next election’s unlucky winner

Jeremy Hunt’s tax giveaway comes at the price of our crumbling public services, as Sean O’Grady explains

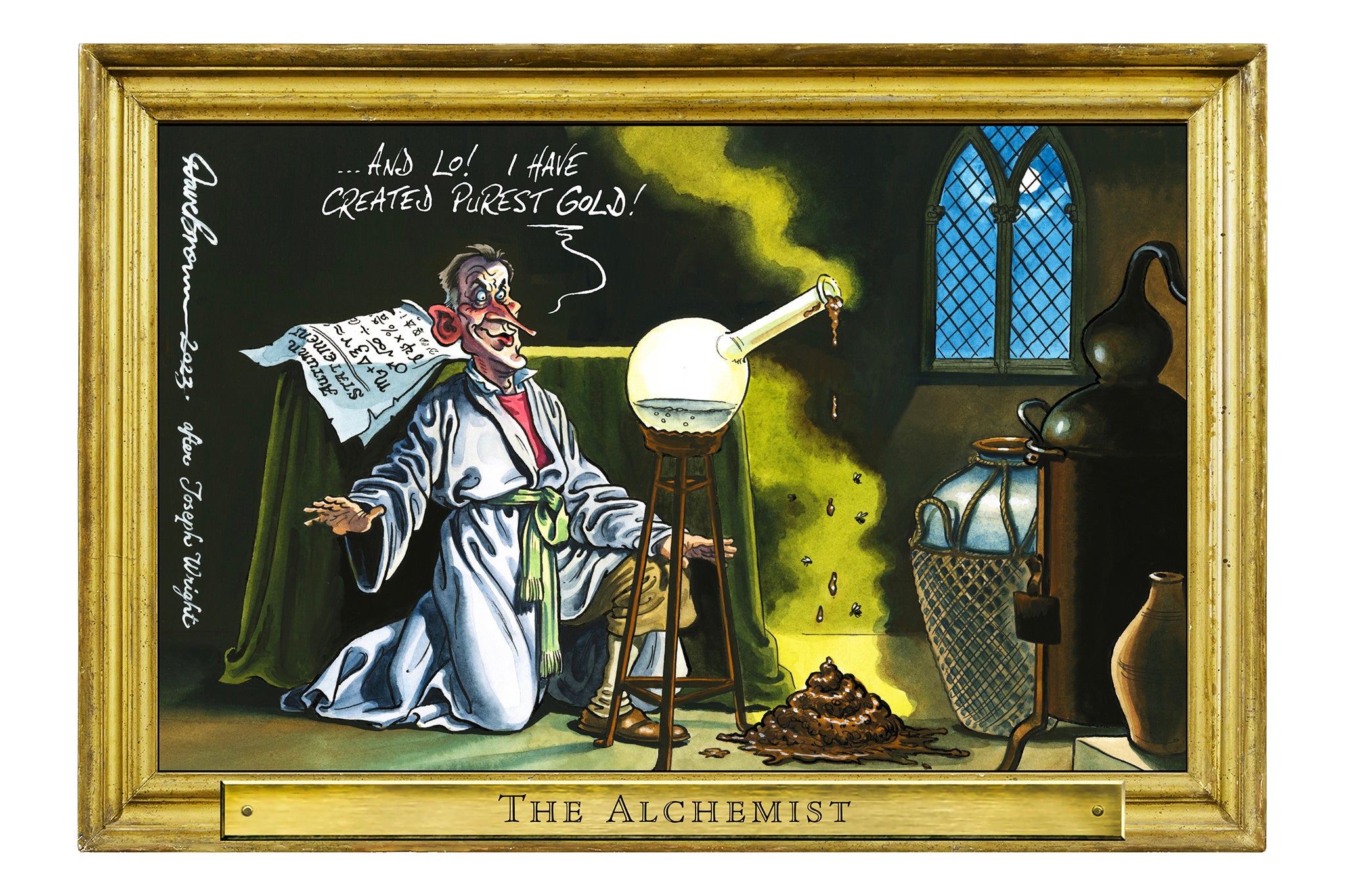

There’s a belief that the worst Budgets are those that get a great reception on the day, only for the horrible underlying truths to emerge thereafter. This certainly seems to have been the case with Jeremy Hunt’s autumn statement, when the initial euphoria about tax cuts was supplanted by a realisation that the tax burden is actually still set to rise – and for years to come.

So how did Hunt pay for the “tax cuts that never were”?

One obvious answer is through future stealth taxes imposed on working people for many years. The freeze in tax thresholds that began in 2021 is scheduled to continue until 2028, yielding something like £100bn in extra tax revenues. By contrast, the chancellor has “given back” a mere £20bn – very welcome but not so munificent when set in context.

The underlying cause for this bonanza is inflation, because as wages have risen to keep pace with prices, the amount of that income going to the Exchequer also goes up, robbing workers of a chunk of their pay rise.

Is it as simple as that?

Not quite. Inflation is pernicious for any economy, but shouldn’t be an easy way of repairing the public finances. That’s because inflation cuts both ways. It bloats tax revenues in cash terms but not in real terms when cost inflation is taken into account. So what might have happened is spending the additional tax revenue on meeting the higher cost of providing public services – everything from new police cars and school textbooks to nurses’ pay. But instead of granting the £20bn the public sector it needs to keep up with rising costs, Hunt has diverted it to reducing national insurance contributions. Mr Hunt has assumed that the £20bn “lost” from public services can be found through efficiency savings of 0.5 per cent a year.

Does that matter?

Certainly. Since 2010, the public sector has been subject to an almost continual regime of austerity, and we are standing at the dawn of a new age of stinginess. In the short run, we may see more local authorities going bust and an even more stressed winter season for the National Health Service. In the longer term, there seems little chance of restoring the cuts to international aid and there’ll be virtually no rise in defence spending at a time of obvious international tension. Public sector strikes in hospitals and on the railways seem likely to return.

On balance, the experience of recent years is that strikes, deterioration in public services, longer NHS waiting times and a shoddy rail service tend to be blamed on the Conservatives. Thus, some at least of what has been politically gained by the national insurance cuts will be lost in dissatisfaction over public services. If winter is bad or there’s another strong Covid wave, some hospital trusts may have to declare emergencies.

So has Mr Hunt set a fiscal timebomb?

Assuming he loses the next election, yes. It is as if he and Rishi Sunak have swaggered into a bar and shouted: “The drinks are on us!” before leaving Keir Starmer to pay the tab.

The next government will have to claw back these substantial tax cuts, or borrow more, or squeeze public services even further. Starmer, Rachel Reeves (shadow chancellor) Wes Streeting (shadow health secretary) and Liz Kendall (work and pensions) seem to sense this, which is why they talk so much about reform and economies within public services. Ironically, Labour seems much more wary about hiking taxes than the Tories have been in recent years.

It all adds up to the 2024 election victory being a poisoned chalice.

What do the public think?

It’s not yet clear. One public opinion poll saw the Conservatives slip by one percentage point, to 21 per cent, albeit well within the margin of error. Another revealed a four-point bounce, putting the Tories back to where they were in mid-September, registering 25 per cent support. Interestingly, the public doesn’t seem especially impressed by the cuts in national insurance contributions or business taxation but is far more motivated by aggressive curbs on welfare benefits. It’s not a particularly welcome insight into the mind of the typical British voter, but one the parties might want to bear in mind.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments