Pre-Budget report: Pain postponed

The Chancellor's electioneering budget yesterday put off difficult questions about cutting debt. Will it work?

In case there was any doubt, we know for sure now. The next general election will be won and lost over the economy. The famous dividing lines are in place and the course is set. The arguments will not change. The policies will not do very much either. All that is uncertain is the outcome.

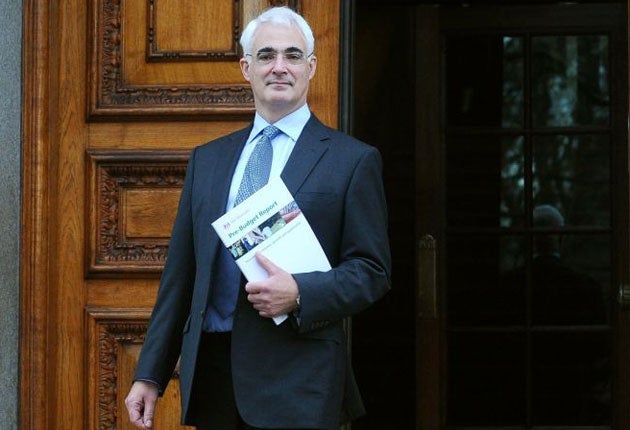

The Chancellor, Alistair Darling, went for the equivalent of a jog in a prison cell as he unveiled his pre-Budget report, the last before the general election. His task was momentous and yet his room for manoeuvre was virtually non-existent.

Mr Darling faced the almost impossible challenge of justifying high levels of spending for another year while reassuring the markets that he had a plan to bring debt under control. Politically he had to make the case for a government that plans over time to put up taxes substantially and cut spending, not a combination that is normally seen as a vote-winner. In particular the proposal to increase national insurance contributions worried some Labour MPs in marginal seats, aware that it would be portrayed by opponents as a tax on middle income earners. Some interpreted last year's pre-budget report as the death of New Labour. For them New Labour will have died again.

The political argument was paramount from the beginning of his speech. Within seconds of standing up in the Commons Mr Darling argued that voters faced a choice between two "competing visions". He summarised the divide as one in which the government would generate growth as portrayed by opponents as a tax on middle-income earners. Some interpreted last year's pre-Budget report as the death of New Labour. For them New Labour will have died again.

The political argument was paramount from the beginning of his speech. Within seconds of standing up in the Commons Mr Darling argued that voters faced a choice between two "competing visions". He summarised the divide as one in which the Government would generate growth, against the Conservatives, who would put the recovery at risk. In his opening paragraph Mr Darling spoke three times of the need to promote growth. He might as well have sat down again.

In essence this is Labour's strategy in the run-up to the election. The way Gordon Brown and Mr Darling plan to make their case is now clear. Labour will go into the election having pledged to more or less maintain spending levels for another 12 months. It will seek to project the Conservatives' proposed emergency budget after the election as a threat to public services.

Taxes will rise under Labour, although quite a lot of them not until the year after the election. The better-off will pay more and those on very low incomes will be protected. There will be substantial spending cuts for most departments, although Mr Brown and Mr Darling have decided to keep the precise reductions vague. As Vince Cable, the Liberal Democrats' Treasury spokesman, pointed out, most of the cuts announced so far, or taxes raised, are reallocated to other departments rather than serving to cut the deficit. Mr Darling will be committed to halve the deficit during the next term, but he does not know how he will do so. Or, if he does, he has taken a strategic decision to keep quiet for now.

Virtually every sentence by Mr Darling exploded with political messages. Several times he stressed that because the Government "chose" to act, the recession was not as damaging. Throughout his speech he claimed that the prospects for the unemployed now were better than in the 1980s and early 1990s because of government initiatives. At one point he paused to declare: "Government action has made a real difference", as if he was speaking at a pre-election rally rather than delivering a statement about economic policy.

Whichever party wins the next election will have little room to act and yet the divide between the two sides is greater than it has been for more than a decade. The shadow Chancellor, George Osborne, argued that Labour stood for higher debt and, therefore, higher interest rates. In contrast the Conservatives would face up to the challenge of reducing the debt, maintain low interest rates and make clear that Britain was "open for business" once more. Mr Osborne was jogging in a similarly confined space and yet the differences are real and significant.

The pivotal divide at the next election is one of timing. In his barrage of sentences aimed at the Conservatives, Mr Darling repeated more than once that "to consolidate too soon endangers recovery". Mr Osborne was adamant the consolidation cannot come quickly enough. There can be a thousand leader's debates between now and the election and two thousand press conferences, but this will be the fundamental difference on polling day.

Mr Darling's statement also contained other, refined dividing lines. He claimed fairness and responsibility would determine his approach to taxation. Predictably, he scrapped some of his plans to reduce inheritance tax, leaving the Conservatives more exposed as they justify proposals that extend to the wealthy. The much trailed one-off tax on bankers' bonuses was duly announced, a proposal that becomes increasingly necessary if any government wants to win support for tax rises on those who earn much less.

Other policies will play an important part in the forthcoming campaign, not least the "guarantees" to provide training for those over 16. Part of Mr Brown's wider message is that the global economy will double in size in the coming years. For him, more widely available education and training are key to Britain benefiting from the growth – once more there is an implicit challenge to the Conservatives. Will they protect education spending in the way they are committed to do for the NHS and international development?

Mr Brown is often accused of contriving dividing lines. David Cameron and George Osborne have erected quite a few of them of their own volition. They chose to oppose the fiscal stimulus during the recession and called for spending cuts. Similarly they have decided to retain their proposals for inheritance tax. Conversely they have avoided some potential divisions by supporting tax rises for high earners, when Mr Brown had hopes they might oppose them.

Mr Brown and Mr Cameron are acting cautiously and yet taking big risks. The Government will face criticism for being evasive about its detailed plans to cut spending from most departments. Yet the evasiveness is understandable with an election moving closer. In theory, most voters approve of public spending cuts except those that impact them. The Conservatives' popularity has fallen since they gave examples of where they planned to wield the axe. Perhaps this is a coincidence, but they are gambling on the voters' hunger for immediate and deep cuts and cannot be sure the appetite is there.

The Government, lagging behind in the polls, plans to enter an election proposing substantial tax increases and tough restraint on pay. Yet it takes a risk in not doing more. This morning Mr Darling will view the markets nervously, those non-elected forces that determine economic policy as much as elected politicians.

Both sides seek to hide behind the protective shield of others as they make their moves. Mr Brown and Mr Darling cite the economic approach of equivalent countries. Yesterday, Conservatives quoted various business organisations that have given Mr Darling's statement the thumbs down.

As Mr Brown has acknowledged, leaders across the world are in "uncharted waters". Mr Darling's pre-Budget report – and Mr Osborne's response – suggests the seas will be choppy for several years and the direction of travel subject to change. But the contours of the debate are in place. The Conservatives moved into a strong lead in the polls after last year's pre-Budget report. Mr Brown and Mr Cameron will be awaiting the next batch of polls with even more nervy anticipation than usual.

Budget at a glance...

BANK BONUSES

Discretionary bonuses of more than £25,000 will face a 50 per cent levy. The banks, rather than the bankers, will pay the tax, which will be introduced immediately. The Government is also introducing anti-avoidance measures.

THE ECONOMY

Alistair Darling amended his growth forecasts. GDP will fall by 4.75 per cent in the current year, more than the 3.5 per cent predicted in April's Budget. GDP growth would rise to 3.5 per cent by 2011-12. Inflation will be around 3 per cent next year.

PUBLIC FINANCES

The UK will borrow £178bn this year, more than the earlier forecast of £175bn, and £176bn next year. Borrowing set to fall to £82bn by 2014-15. The Fiscal Responsibility Act makes it a legal requirement to cut the deficit in half within four years.

NATIONAL INSURANCE

National insurance contributions for both employers and employees on more than £20,000 will increase by 0.5 per cent, from 2011. The rise is in addition to the 0.5 per cent the Chancellor announced in April's Budget.

INCOME TAX

Tax rates left unchanged. All thresholds frozen in April, raising the number of people in each tax band. Further freeze on higher-rate tax threshold in April 2011, taking up to 70,000 taxpayers into top tax bracket.

VAT

The Chancellor confirmed that the VAT rate will return to 17.5 per cent on 1 January, after being cut to 15 per cent last November. No other VAT changes were announced despite speculation that the rate could rise higher.

PUBLIC SECTOR PAY

All public-sector pay increases will be capped at 1 per cent for two years from 2011. Pension contributions for teachers, NHS staff and the Civil Service will be capped by 2012, and any Civil Service salary above £150,000 will need Treasury approval.

STATE PENSIONS

The basic state pension will rise by 2.5 per cent in April next year. The rise is the equivalent of £2.40 a week for a single pensioner, with a pensioner couple seeing their payments rising to £156.16.

GREEN MEASURES

Scrappage scheme to help homeowners install new boilers. Electric vehicles will be exempt from company car tax for five years. Incentives for homes that sell wind or solar generated power back to the National Grid.

EDUCATION/TRAINING

Undergraduates from poor backgrounds will be offered short-term internships in industry. A guarantee of training for 16- to 24-year-olds who have been out of work for 12 months will be brought forward to cover those out of work for six months.

STAMP DUTY

The temporary stamp duty holiday, under which anybody buying a house for £175,000 or less avoids paying the 1 per cent tax, will end on 1 January. The threshold will go back to £125,000 at the start of next year.

BUSINESS

A 10 per cent tax on income from patents to be introduced. The Time to Pay scheme, allowing firms to spread tax payments, and empty property relief both to be extended.

SMALL BUSINESS

1 per cent hike in corporation tax for SMEs deferred for 12 months. Enterprise Finance Guarantee, under which the Government backs loans, extended by 12 months.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks