Scottish anger at Chancellor's corporation tax offer to Northern Ireland

SNP leader says Scotland needs same range of powers as those being given to Northern Ireland

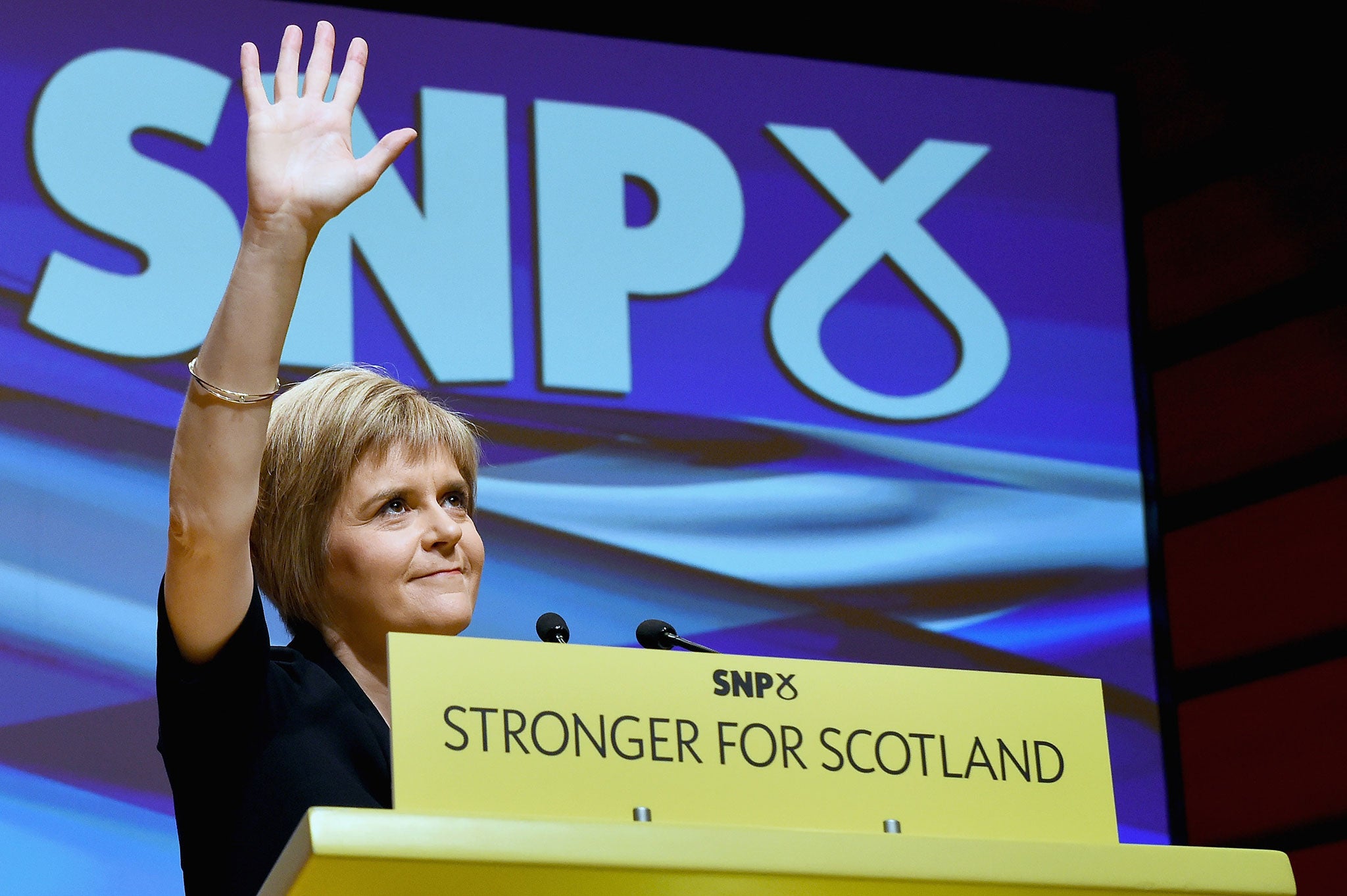

Chancellor George Osborne will inflame a political row with Scotland's First Minister Nicola Sturgeon this week, when he is expected to confirm plans to let Northern Ireland set its own corporation tax.

The Scottish National Party's new leader told The Independent on Sunday yesterday that handing Northern Ireland responsibility for setting tax rates on business profits would "blow apart any claims that it was not possible for Scotland, too". Last week, the Smith Commission on Scottish devolution recommended that Scotland should be allowed to alter its own income tax rates, but did not include corporation tax.

Ms Sturgeon warned of dire consequences for the three major Westminster parties at the polling booth north of the border for failing to hand Holyrood a tax that, excluding North Sea oil, generates £2.9bn in Scotland, only to go to the Treasury in Whitehall.

At the same time, David Cameron has argued there is a "strong" case for the Northern Ireland executive in Stormont to have that power and has promised an announcement in Wednesday's Autumn Statement. The SNP wants a fuller range of tax-raising responsibilities than those proposed by Lord Smith, who was asked by the Prime Minister to set out devolution proposals. Westminster leaders had promised "extensive new powers" for Holyrood in response to the sudden surge in support for Scottish independence just ahead of the September referendum.

Ms Sturgeon said: "I very much hope Northern Ireland is given control of corporation tax. [But this] also demonstrates very clearly that the Smith Commission proposals, welcome though they are, do not include the range of the key job-creating powers we need.

"It is the lack of a range of key powers which means the package on offer to Scotland doesn't meet the 'home rule' pledges made, and the Westminster parties now face paying a heavy price for that when the people of Scotland have their say in May's election."

A senior Liberal Democrat source said that Danny Alexander, the Chief Secretary to the Treasury, had warned Conservatives of the likely political consequences of devolving corporation tax to Northern Ireland at a time when Scotland is seeking more powers. Northern Ireland politicians want to be able to cut corporation tax to attract big business, but its parlous finances have made negotiations with Westminster difficult.

"It's complicating the political narrative," said the source. "Danny was robust about this: it might not be economically the right time for Northern Ireland – and politically he sees the big picture."

A source close to the Smith Commission added that Mr Osborne and Mr Cameron were also under "no illusions" about how the SNP will play the issue. "They know how strongly people in Scotland feel about this," the source added.

Labour's Northern Ireland spokesman, Ivan Lewis, said that any decision must be made in the "best interests of Northern Ireland" rather than driven by "short-term political motivations".

UK corporation tax is 21 per cent. The Republic of Ireland has been hugely successful in attracting US multinationals such as Apple and Facebook with a rate of 12.5 per cent, and the poorer north wants to be able to match that rate.

Lord Smith did recommend devolving responsibility for air passenger duty to Scotland. A letter signed by Shadow Cabinet members Ed Balls, Chuka Umunna and Michael Dugher has urged the Chancellor to ensure that airports such as Newcastle and Leeds-Bradford, are not disadvantaged under the move.

Many Labour MPs with northern English seats fear that the Smith Commission proposals will leave their constituents worse off and damage their regional economies as businesses take advantage of tax cuts in Scotland. They also worry that Ed Miliband's response to the Scottish referendum and the English devolution question, including holding a constitutional convention after the election, is not urgent enough.

New balls, please

Ed Balls gave a masterclass in how not to respond to an Autumn Statement last year. Red-faced and angry, the Shadow Chancellor's voice soon grew hoarse as George Osborne and David Cameron laughed heartily at a performance that left Labour backbenchers contemplating whether Mr Balls should be sacked.

Still, it was a learning experience and he'll do an awful lot better this time around if he follows our top tips:

1. Keep your voice calm and quiet. The House of Commons will then fall silent as everyone tries to hear you. Also, everyone will think that you are thinking very carefully about the technical flaws in George Osborne's economics.

2. Be bipartisan. Praise one or two measures extravagantly and claim that they were Labour's ideas. This will surprise people who think you are a divisive figure, and make your attack on the rest of Mr Osborne's statement so much more effective.

3. Tell Ed Miliband and Harriet Harman to look on admiringly. The Shadow Chancellor's cause was hardly helped last year as both the leader and deputy leader of the party grimaced as the Tories openly mocked his speech.

4. Consider anger-management classes. Therapists talk of avoiding confrontational situations, using cognitive relaxation and spotting anger "triggers". We suggest deep breathing and positive thoughts – such as Mr Osborne being chased by irate Highlanders.

5. Retreat from economic la-la land. Any thought of deploying "hypothesised incremental growth production co-efficients" should be resisted. We say: think austerity-lite and keep it simple, Ed.

John Rentoul, James Cusick, Mark Leftly

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments