Scrap stamp duty to give Britain a real help to buy, Government told

Property experts and MPs mount campaign against tax as rising prices make it ‘unfair’ and ‘inefficient’

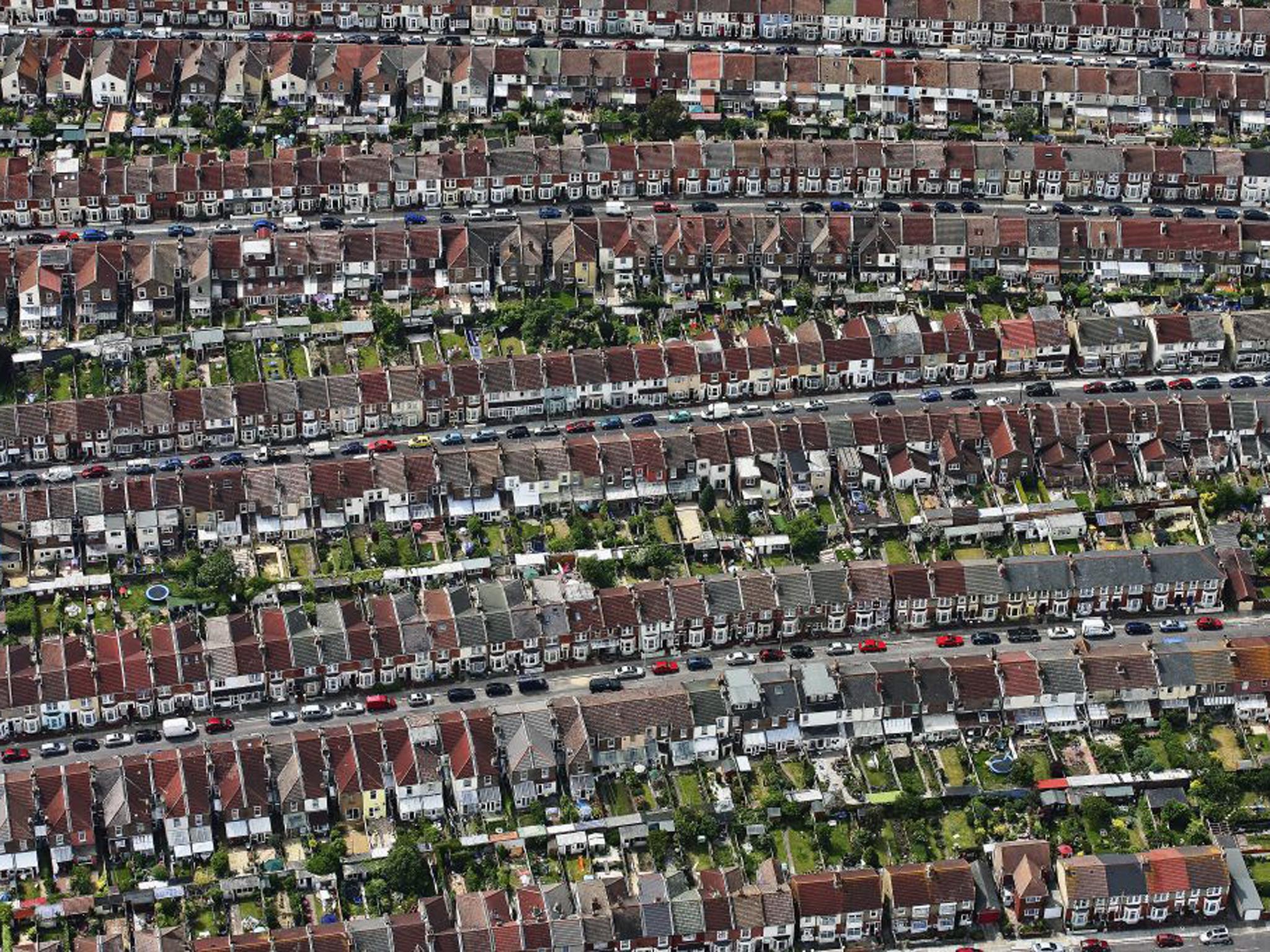

Tens of thousands of homebuyers face paying three times as much in the stamp duty ‘stealth tax’ because soaring property prices have tipped their home into a higher rate band – leading to property experts and MPs calling for an urgent review.

Official figures published last week showed that the average UK house price reached £250,000 in December. Anyone buying at that price is forced to pay three times as much stamp duty than if they got a cheaper home – 3 per cent rather than 1 per cent.

Central to complaints about stamp duty is the way it is charged in bands, which were set years ago and have taken no account of price inflation.

If you buy a home at £250,000, you pay stamp duty at 1 per cent, a total of £2,500 – but spend just £1 more and the charge soars to £7,500.

“It’s an unfair tax that distorts the property markets,” said Peter Bolton-King, residential director at the Royal Institute of Chartered Surveyors. “It stops people easily moving around the country and makes the market inefficient.”

Financial experts agree. “Stamp duty is out of date and the Government needs to modernise the thresholds and the way it operates so that the tax moves with the times,” said Susan Spash, tax partner at chartered accountants Blick Rothenberg.

Campaigners at pressure group Stamp Duty Reform said: “It adversely impacts on people at every stage of their life. The Government only gets away with because most people don’t even think about it – until they decide to move.”

A five-year study of the UK tax system undertaken by the Institute of Fiscal Studies described the duty as “highly inefficient, discouraging mobility and meaning that properties are not held by the people who value them the most.”

The report was particularly scathing of the tax bands. “The slab structure, with big cliff-edges in tax payable at certain thresholds, creates particularly perverse incentives.”

But rising house prices have made the Government less inclined to make the tax fairer. The Revenue’s calculations predict that the tax take from stamp duty will climb to £9bn by 2017, tripling in a decade.

The Council of Mortgage Lenders said: “The prospect of increasing government revenue from stamp duty reinforces the need for reform. As well as creating market distortions it hampers efficient use of the existing housing stock.”

Experts disagree on how the tax should be reformed. “The tax should be abolished altogether for first-time buyers and swapped from being a purchasing tax to a selling tax,” said Guy Meacock of buying agency Prime Purchase.

“There is strong evidence that transaction levels have been markedly affected since Labour introduced new brackets in the late 1990s and despite the Government’s assurance that it wants to reward aspiration, stamp duty does precisely the opposite, firmly acting as a deterrent to those wanting to improve their lot,” he said.

Andrew Hagger, analyst at Moneycomms, believes the lower end of the scale needs the most urgent review.

“The Government has pushed ahead with Help to Buy mortgages as it recognised that first-time buyers needed help, yet it still clobbers most of them with a fee of at least £1,250 at a time when they can ill afford it. The £125,000 starting point is farcical – particularly in London and major UK cities.”

Conservative MP Dominic Raab called for the stamp duty to be scrapped on properties sold for less than £500,000. The policy is backed by the Free Enterprise group of Tory MPs whose former members include several ministers.

Mr Raab said the levy had become a “punitive tax on aspirational home-buyers” because of soaring house prices.

“The current rates are crying out for reform – they distort the housing market, and punish hard-working families trying to get onto the housing ladder,” he told The Independent.

The TaxPayers’ Alliance, which is running a campaign for cuts in stamp duty, urged George Osborne to take a fresh look at its rates.

Its chief executive, Jonathan Isaby, said: “Stamp duty is proving an ugly barrier both to first-time buyers and to those wanting to move from an existing home to a bigger or smaller place, depending on their circumstances.

“The Chancellor should be looking to ease the burden by increasing the thresholds or reducing the rates – as well as ending the ‘slab rate’ nature of the tax, because the market currently gets completely skewed at the points where the higher thresholds kick in.”

Ms Spash believes there are easy things the Government can do to modernise the duty – starting with scrapping the 1 per cent rate, which is charged on homes worth £125,000 or more. “It is questionable how much tax revenue it will actually raise with higher average house prices and abolishing it would help those buying their first property.”

Ed Balls, the shadow Chancellor, called in 2012 for a two-year stamp duty holiday on purchases by first-time buyers of properties worth up to £250,000.

The move would “help aspirational men and women who want to get on the housing ladder and are finding it really hard at the moment,” he said.

Labour sources said they could not commit to including the promise of a stamp duty holiday in their general election manifesto next year. But Mr Balls’s comments indicate that he could be sympathetic to the move.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments