Scrap the triple-lock on pensions to tackle generational inequality, MPs say

Average household income is now higher among pensioners than working people

MPs have called for the scrapping of the triple-lock safeguard on pensions, calling it “inherently unsustainable.”

A report by the Work and Pensions Committee states that the triple-lock pension policy, which guarantees pensions increase annually by either average wages, inflation, or 2.5 per cent – whichever is highest, is heavily skewed towards the baby boomer generation and increases intergenerational unfairness.

The report states that the millennial generation, born between 1981 and 2000, are the first generation who will be materially worse off than their parents.

Rapid house price increases have concentrated wealth in the hands of home owners, forcing young people to pay costly private rents.

Final salary pension schemes, which are common for baby boomers are now ‘‘all but completely closed” for new entrants.

The report states that, after housing costs are removed, average pensioner household incomes now exceed those of working-age households.

Life expectancy has also risen in time for the baby boomer generation to reach retirement, placing a strain on the current working generation to support them.

The report states: “The triple-lock is inherently unsustainable. In the absence of reform the state pension would inevitably grow at a faster rate than the rewards of work and would account for an ever-greater share of national income. In particular, we find no objective justification for the 2.5 per cent minimum increase.”

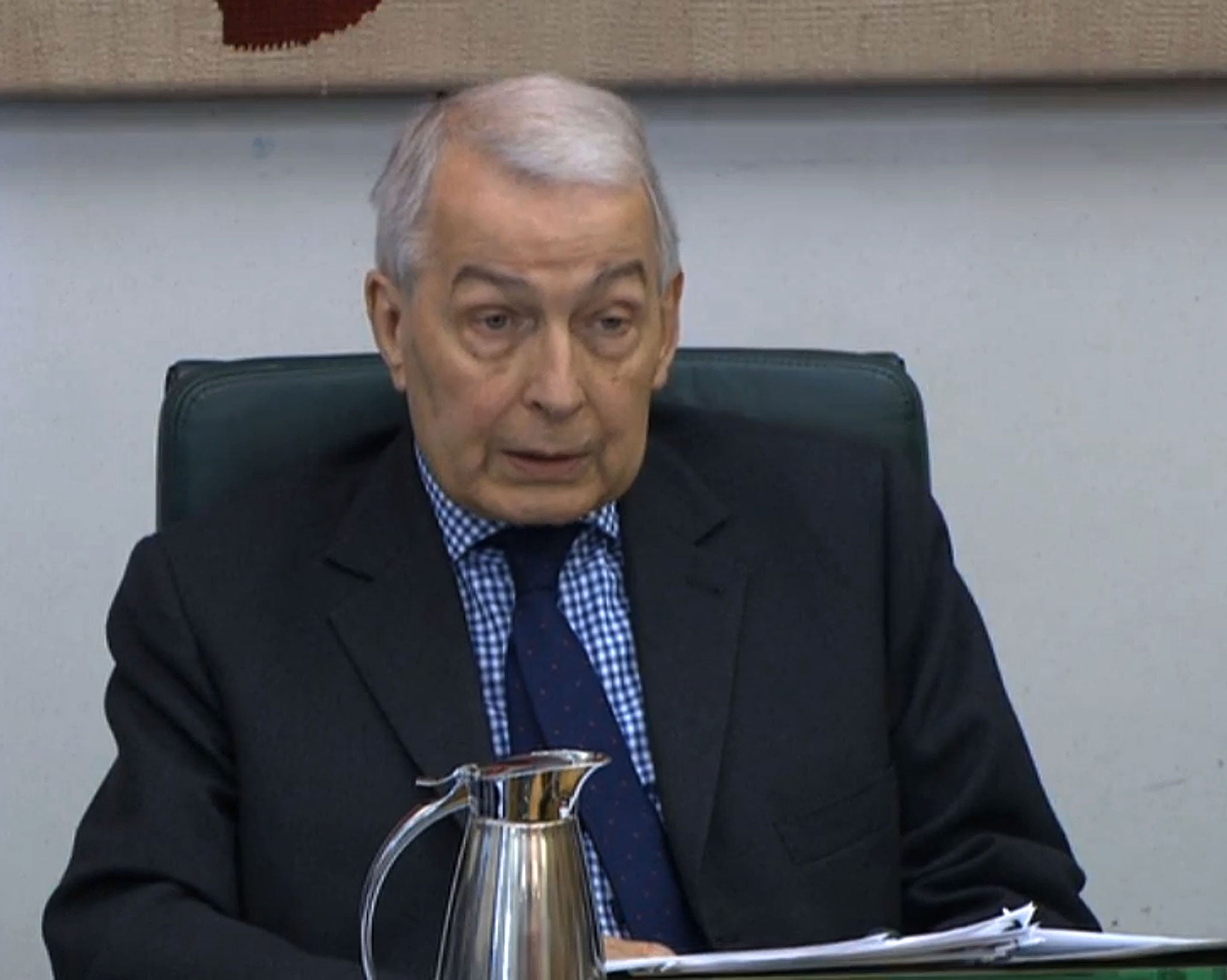

Frank Field, the chairman of the committee, said: “Home ownership, taken as a given by many in my generation, is out of reach for too many aspiring young people today.

“At the same time as tightening their belts, they are being asked to support a group that has fared relatively well in recent years.

“Millennials face being the first generation to be poorer than their forebears. No party has been immune from chasing the pensioner vote – but at what cost to future generations? Politicians of all stripes must accept some responsibility for these trends, and we must act together now to address them.”

The report comes amid mounting pressure for politicians to look again at the triple-lock.

Former work and pensions secretary Iain Duncan Smith also recently told the BBC's Sunday Politics show that the triple-lock should be ditched, saying there was a real danger of an imbalance between the generations.

Dot Gibson, general secretary of the National Pensioners Convention, said: “Whilst the report makes it clear that no single generation has stolen the future of their successors, there is little doubt that today’s pensioners are still being blamed for the problems faced by today’s younger generation.

“This phoney conflict is being used as a smokescreen in order to cut back on the welfare state. The housing crisis hasn’t been caused by pensioners, but because in Britain we sold off council houses, we haven’t been building enough affordable homes. Wages and employment are low and insecure and an economy built on house-price inflation simply cannot be sustained. This is what needs to be addressed.”

A spokesperson for the Department for Work and Pensions said: “We want to ensure economic security for people at every stage of their life, including retirement. We are committed to the triple lock, which is protecting the incomes of millions of pensioners.”

It will respond to the committee’s report in “due course”.

Steve Webb, a former pensions minister who is now director of policy at Royal London, said the triple lock was created to reverse “30 years of decline in the value of the state pension”.

He continued: “That job is not yet done. The UK still has one of the lowest state pensions in Europe.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks