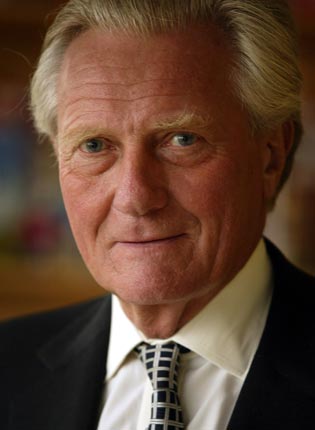

Tories are heading for hung parliament, warns Heseltine

David Cameron is facing the nightmare of a minority government in a hung parliament, Lord Heseltine has warned. The former Deputy Prime Minister's remarks coincide with a sequence of opinion polls showing that the gap between the two main parties has been closing since the new year, when greater attention focused on the Conservatives.

The latest YouGov survey, in The Sunday Times, put Labour at 33 per cent, six points behind the Conservatives, at 39 per cent, and suggests that Gordon Brown's personal standing has improved since his soul-baring interview with Piers Morgan on ITV. That lead would make the Conservatives the largest party in the Commons, but well short of an outright majority.

Last week, at a meeting of party activists, Lord Heseltine said he would "put money" on a hung parliament. According to The Sunday Telegraph, his audience, which included the shadow Cabinet Office Minister Francis Maude, was "stunned" by his pessimism.

Yesterday, the shadow Chancellor, George Osborne, promised that a Tory government would offer small investors cheap shares when the government sells off its £70bn stake in the Royal Bank of Scotland and Lloyds Banking Group. And the shadow Foreign Secretary, William Hague, accused the Government of deliberately running up debt to cause problems for an incoming Tory administration.

Mr Osborne's promise has an echo of the privatisation of gas, electricity and other utilities in the 1980s, which Margaret Thatcher's government used to spread share ownership to people who had no previous contact with the stock market. It is thought Mr Osborne is considering offering shares worth a few hundred pounds at a discounted price. But such an offer is unlikely to be less than five years away, because the banks would have to be in a good enough shape for the government to sell them at a profit.

But Labour and the Liberal Democrats rubbished the scheme. Liam Byrne, the Chief Secretary to the Treasury said: "The Tories' deficit reduction plan is now a certified farce. When it comes to the shares in the banks, the public expect us to focus on getting their money back. That means selling [shares] at a time and in a way that maximises their value, not an irresponsible and expensive political gimmick."

Vince Cable, the Liberal Democrat economics spokesman, said: "Dangling this prospect, when it will take at least five years before the likes of RBS are back in private hands, is Tory electioneering at its most cynical."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments