UK languishing in midst of two decades of lost wage growth and falling living standards, warn economic experts

Earnings for average Britons are set to plummet following downgraded growth forecasts in the Budget

Britain’s leading economic experts have warned that the UK is languishing in the midst of two decades of lost wage growth and a long-term fall in living standards.

Two of the country’s most prominent think tanks came to the ominous judgement as they began to set out the consequences of heavily downgraded UK growth forecasts released with Wednesday’s Budget.

The respected Institute for Fiscal Studies said that by 2021 average earnings are set to be £1,400 lower than the Government thought they were going to be.

The Resolution Foundation said British people are now set to suffer their longest sustained period of falling living standards since records began in the 1950s.

Politicians were only just getting a grip on what the grim figures set out in Philip Hammond’s budget statement meant on Thursday, when the IFS declared the UK is now unlikely to lower national debt to pre-2008 crisis levels until the 2060s, and a third think tank warned that the country’s books would not be balanced for more than a decade.

In his Commons statement, Mr Hammond announced a £25bn cash injection into the economy in a bid to prop up dwindling growth rates of on average 1.4 per cent over the next five years, and falling as low as 1.3 per cent in the year of Brexit.

But with the country yet to recover from the financial crisis, struggling under the pressure of deep austerity cuts, hamstrung by shockingly low productivity and mired in the uncertainty of EU withdrawal, the IFS laid bare what the low growth will actually mean.

Director Paul Johnson said: “The forecasts for productivity, earnings and economic growth make pretty grim reading.

“One should never forget of course that these are just forecasts. But they now suggest that GDP per capita will be 3.5 per cent smaller in 2021 than forecast less than two years ago in March 2016.

“That’s a loss of £65bn to the economy. Average earnings look like they will be nearly £1,400 a year lower than forecast back then, still below their 2008 level. We are in danger of losing not just one but getting on for two decades of earnings growth.”

Mr Johnson went on to explain that the immediate effects on households is already being felt, with real earnings already falling this year as inflation has risen to 3 per cent.

He accepted there had been something of a recovery in earnings through 2014 and into the first half of 2016, but said that had now been “choked off”.

The director called it “truly astonishing” that the Office for Budget Responsibility, the Government’s official auditor who formulated the forecasts in Mr Hammond’s Budget, is predicting wages might still be below their 2008 level in 2022.

He also said the Chancellor’s £25bn cash injection to offset some of the damage would peak at £9bn in 2019-20 but “dissipate very quickly thereafter, magically becoming a takeaway by 2022-23”.

The giveaway included a £300m measure to ease the pressure on claimants of the new universal credit benefit, but Mr Johnson said that was “modest” in the wider context of £12bn worth of cuts to working-age benefits during the period.

The award-winning Resolution Foundation said the OBR data showed British families are suffering the biggest squeeze in their finances since the 1950s.

It explained in a report published on Thursday that the UK economy will be £42bn smaller in 2022 than we thought it would be in March this year.

Director of the Resolution Foundation Torsten Bell, said: “Following years of incremental changes, yesterday the OBR handed down the mother of all economic downgrades pushing up borrowing for the Treasury.

“While Philip Hammond chose to take a relaxed approach to additional borrowing, families are unlikely to do so when it comes to the deeply troubling outlook for their living standards that the Budget numbers set out.

“Families are now projected to be in the early stages of the longest period of continuous falls in disposable incomes in over 60 years – longer even than that following the financial crisis.”

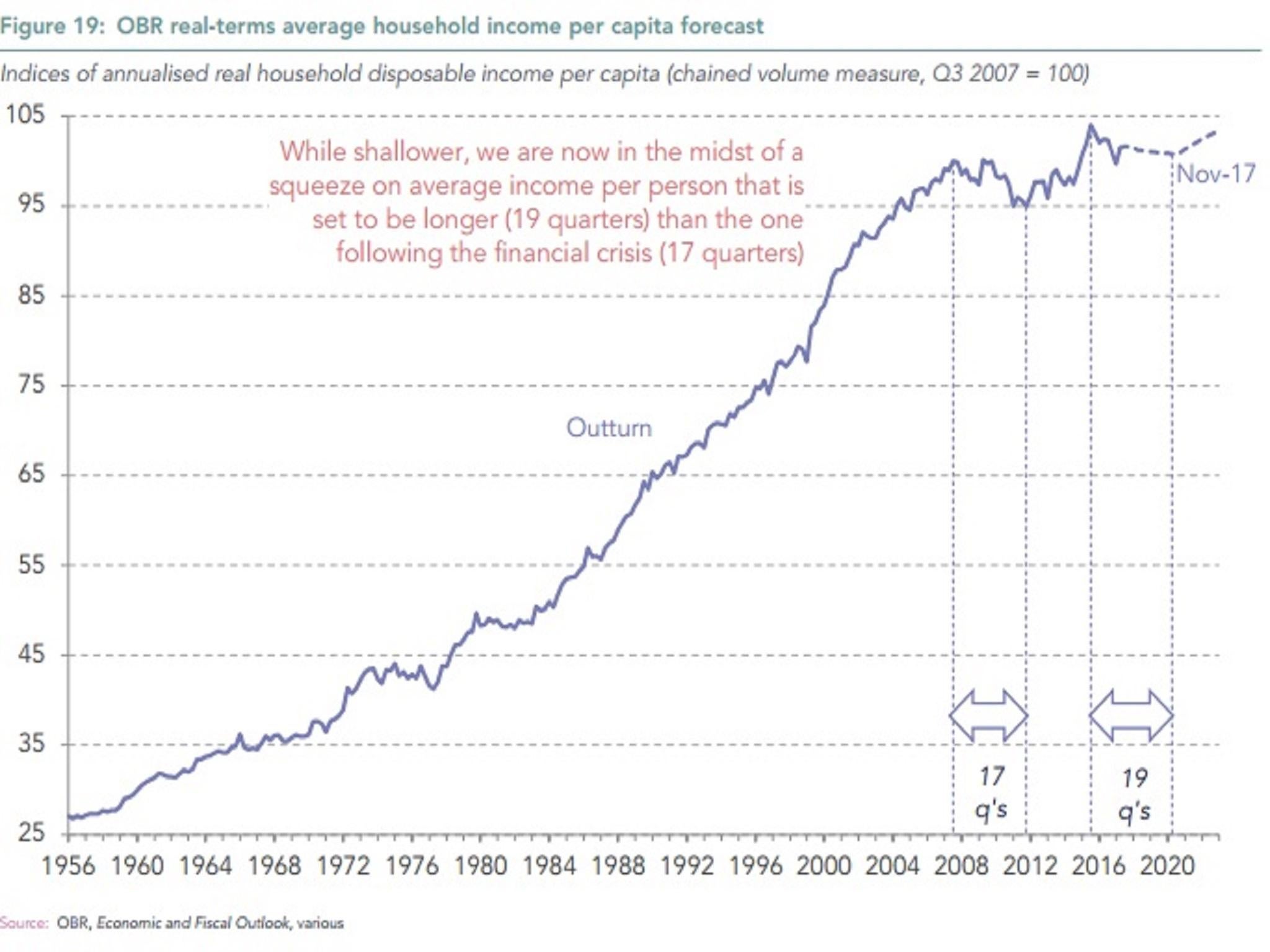

The foundation said that the current income squeeze is set to be longer, albeit shallower, than the post-crash squeeze, with real household disposable incomes set to fall for an unprecedented 19 successive quarters between 2015 and 2020.

Longer income squeeze than financial crisis

Mr Bell added: “Hopefully the OBR’s forecasts will prove to be wrong because, while the first sentence of the budget document reads ‘the United Kingdom has a bright future’, the brutal truth is: not on these forecasts it doesn’t.”

The IFS also poured cold water on the Chancellor’s insistence that he will hit his debt and deficit reduction targets, given the new GDP growth forecasts.

It said the modest growth rates currently expected implied that if a deficit at just over 1 per cent of national income projected for the early 2020s was maintained, it would take us well past the 2060s for debt to fall to its pre-crisis levels of 40 per cent of national income.

Director Mr Johnson added: “That assumes no recessions for the next half century.”

Meanwhile, the OBR said yesterday that it was possible the UK’s deficit, the difference between how much it spends and earns, will not be wiped out until 2031 – a staggering 16 years later than George Osborne originally pledged.

Despite Mr Hammond’s officials insisting on Wednesday that it would still be cleared by 2025, another think tank, the Institute of Economic Affairs, tweeted: “The Government is unlikely to balance the books until 2031 – six years behind schedule.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments