Tick tock. With a week to go until Uncle Sam runs out of cash, the International Monetary Fund (IMF) said that enough was enough yesterday, calling on politicians to stop bickering and act urgently to stave off global financial meltdown by raising their country's debt ceiling.

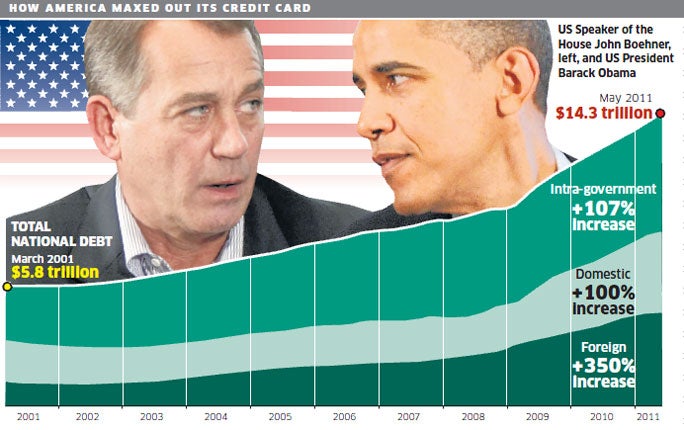

How America maxed out its credit card: Click here to download full graphic (150Kb)

The government of the United States will move more than $14.3 trillion (£8.7trn) into the red next Tuesday, surpassing an upper limit on the national debt and therefore preventing the Treasury from being able to pay its bills. That would leave the US unable to service its debt, leading to economic chaos.

For weeks, leaders of both major parties have been meeting with Barack Obama to negotiate an extension to the debt ceiling. But talks have so far produced nothing but hot air, and markets are growing increasingly uneasy as the deadline for action approaches.

The IMF published a harshly worded review of the US economy yesterday, calling for an immediate increase in borrowing limits followed by a "comprehensive solution" which will allow the US to reduce its public borrowing in the medium term by cutting spending and increasing the government's revenues.

But first, they must avoid what would be an unnecessary default. "Directors [of the IMF] highlighted the urgency of raising the federal debt ceiling and agreeing on the specifics of a comprehensive medium-term consolidation programme," said the review.

The US Congress has voted to raise the debt limit more than 60 times since the Second World War, without any serious debate. But with an election approaching and the political landscape more fractured than ever, both sides are attempting to use the growing crisis to their own ends. Republicans are opposed to any new taxes, insisting the country's books must only be balanced by slashing spending. Democrats argue that federal taxes are currently at their lowest, as a proportion of GDP, in history, and would like any cuts to be accompanied by revenue increases.

The Obama White House is willing to agree to $2.7trn in public spending cuts, without any tax increases, provided the debt ceiling is increased by the same amount. That would provide them with cashflow until after next November's election. But Republicans want to allow a mere $1trn increase to the ceiling. Neither side's ideas will pass muster with ratings agencies, who would like to see $4trn in spending cuts or tax increases in the near future, if the US is to hold onto its triple-A creditworthiness.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments