House Republicans narrowly pass $4 trillion budget, opening door for Trump's massive tax cuts

The budget blueprint will allow Republicans to pass a measure that could cut taxes by $1.5 trillion over the next 10 years

Republicans in the House of Representatives have narrowly passed a $4 trillion (£3 trillion) budget, paving the way for President Donald Trump’s tax overhaul plan.

The budget blueprint will allow Republicans, without any support from Democrats, to pass a measure that could cut taxes by as much as $1.5 trillion over the next 10 years.

But the close 216-212 vote suggests that any tax reform bill will face an uphill battle to make it to the President’s desk to be signed into law. Twenty Republicans voted against the budget resolution, which received no “yea” votes from Democrats.

While the budget measure, for the 2018 fiscal year, ostensibly maps out spending and revenue levels for the federal government, its passage is largely meaningful because it triggered a special legislative process.

The process, known as reconciliation, allows the Senate to pass a tax reform bill with a majority of only 51 votes. Most other bills require the support of at least 60 senators in the 100-member Senate. With a 52-seat majority, the Senate’s Republican leadership can only afford two defections to pass tax legislation.

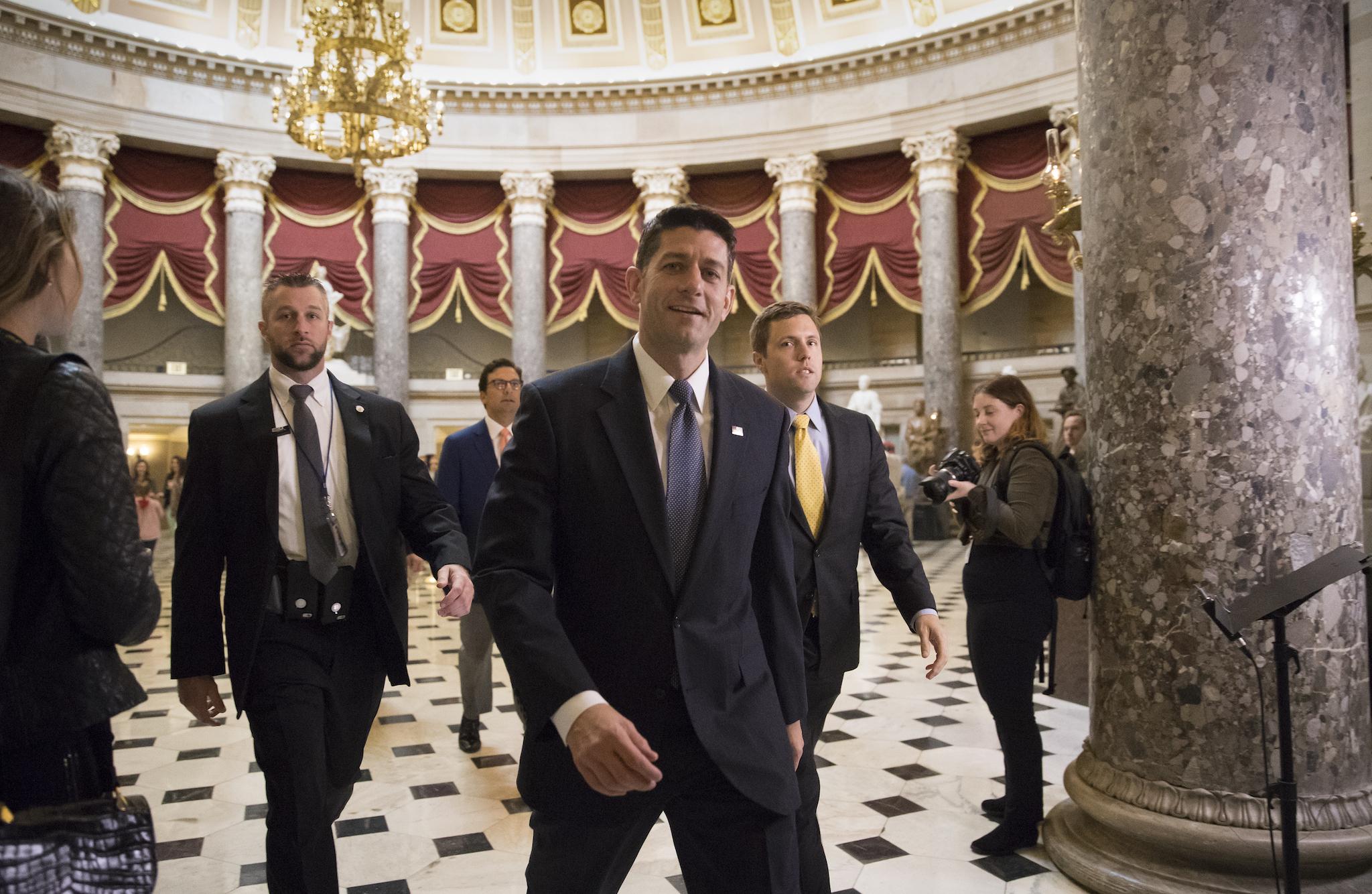

House Speaker Paul Ryan applauded his conference for approving the Senate-passed budget, asserting that it “brings us one step closer to historic tax reform”.

The budget measure would allow for a tax bill that adds as much as $1.5 trillion to the federal deficit over 10 years. Meanwhile, the federal government continues to accumulate more debt, which has now surpassed $20 trillion. The deficit for the 2017 fiscal year, which ended Sept. 30, totalled $66bn, an increase of $80bn from the previous year.

Some Republicans have indicated that they would not vote for a tax bill that increases the federal deficit.

A point of contention on the budget resolution was the possibility that it could doom the current deductions for state and local taxes, known as the Salt deductions – particularly important for taxpayers in high-tax states such as New York, New Jersey and California. More than half of the Republicans who opposed the measure came from New York and New Jersey.

The current tax reform framework calls for cutting Salt deductions, which are used by nearly one-third of those who file taxes. Nixing the deduction would help Republicans raise more than $1 trillion to help pay for tax cuts over the next decade, making it a huge possible source of revenue for their overall plan to reform the tax code.

Mr Ryan said that he agrees that there should be “comprehensive tax reform” and that the tax-writing House Ways and Means Committee should be given “latitude” to write the tax code overhaul. The plan is now scheduled to be released next Wednesday, with a formal bill drafting expected by mid-November.

Along with the debate over deductions for state and local taxes, Mr Trump and the Republican head of the House’s tax-writing committee, Representative Kevin Brady, have also disagreed on the delicate issue of retirement savings. The President and Mr Brady have collided over whether the tax plan would include sharp reductions in how much Americans might save, before taxes, in 401(k) accounts.

Mr Trump declared on Monday that “there will be NO change to your 401(k)”, even though House Republicans have been considering sharply lowering the amount that Americans are allowed to save, before taxes, in 401(k) retirement plans.

These sharp disagreements this early on in the bill-writing process indicate the rough road ahead, even though Mr Trump has promised Republican “unity” on tax reform.

There is also uncertainty over whether the President’s recent public feuds with members of his own party could completely derail his legislative agenda. After nine months in office, Mr Trump has still not secured a major legislative victory.

Earlier this week at a news conference, Senate Majority Leader Mitch McConnell refused to weigh in on a spat between Mr Trump and Republican Senator Bob Corker.

“If there’s any thing all Republicans think are important to the country and to our party is comprehensive tax reform,” Mr McConnell said. “The issue beings about great unity among our members. The President shares that agenda and is going to do a good job promoting that agenda, and we intend to achieve what we set out to achieve by the end of the year.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments