Now Cyprus asks for bailout – but Angela Merkel stands firm

Chancellor refuses to give ground despite leaked report detailing impact of eurozone collapse on Germany

Angela Merkel quashed hopes yesterday that Germany's resistance to eurobonds is weakening, even as a leaked analysis from her Finance Ministry suggested a break-up of the single currency would have a devastating effect on Germany's own economy.

The German Chancellor has come under intense pressure ahead of a European Summit this week to give the go-ahead to the mutual issuance of sovereign debt by the countries of the eurozone to calm financial markets and ease the unsustainable borrowing costs faced by Spain and Italy.

In a fresh reminder of the fragility of the currency bloc, Cyprus yesterday announced that it would become the fifth eurozone nation to seek outside assistance. Cyprus said it needed help because of "negative spill-over effects" on its banks from the Greek financial sector.

But despite the mounting woes in the troubled union, Ms Merkel played down expectations of a major shift in policy from Germany at the summit, which begins in Brussels on Thursday, and reiterated her longstanding view that common eurozone bonds would be "economically wrong and counterproductive". She said: "When I think of the summit I feel concerned that yet again we will have too much focus on all kinds of ways of sharing debt."

Financial markets were depressed by the news, which sent Italian and Spanish borrowing costs up. "There's now a growing suspicion that Germany is simply not ready to accept the level of debt mutualisation necessary to restore confidence and keep the single currency project alive," said Nicholas Spiro of Spiro Sovereign Strategy.

Hopes that Berlin might be willing to make greater financial commitments to ensure the survival of the euro had been raised after an analysis by the German Finance Ministry was leaked to Der Spiegel. It showed that the economic impact of a break-up of the single currency would knock 10 per cent off the size of the German economy and push unemployment above five million. The magazine quoted a Finance Ministry official saying: "When measured against such scenarios, even an extremely costly rescue seems to be the lesser evil."

The Swiss bank UBS said that Germany's losses could be €500bn, more than 40 per cent of its GDP.

Last week, the International Monetary Fund joined the European Commission, France and Italy in urging the eurozone to move towards mutual debt issuance. The European Union's Competition Commissioner, Joaquí* Almunia, yesterday backed this up by describing eurobonds as "indispensable". He said: "If we don't move forward with a gradual mutualisation of debt, there is no possibility of stopping the contagion."

Other items on the agenda in Brussels will be a European Union banking union, designed to reassure depositors and prevent a disastrous run on banks in weaker eurozone nations. This is expected to include proposals for a common supervisor of European banks, likely to be identified as the European Central Bank, and pan-European guarantees for ordinary depositors. Private banks in Greece and Spain have witnessed large withdrawals by ordinary savers concerned that their money could be at risk of being devalued if their countries were to crash out of the single currency.

Spain, meanwhile, submitted a formal application for a bailout of its own banking sector from the European Union yesterday. The Economy Minister, Luis de Guindos, did not specify how much Madrid would request but Spain is expected to apply for €100bn in assistance, which will be added to Madrid's sovereign debt pile. It remains to be decided which bailout pot, whether the temporary European Financial Stability Facility (EFSF) or the incoming permanent European Stability (ESM), the funds will come from. Bond buyers are nervous about the ESM providing the money since that would push them down the queue of creditors in the event of a sovereign insolvency.

Ms Merkel and the French President, François Hollande, clashed over eurobonds last week at a meeting in Rome. Mr Hollande said that Europe could not wait 10 years for commonly issued debt, a pointed reference to the German Chancellor's long-standing argument that eurobonds can only be countenanced when Europe's economies have become much more integrated. The two leaders are due to meet again on Wednesday in advance of Thursday's summit.

European summit: What's on the table?

What's the issue?

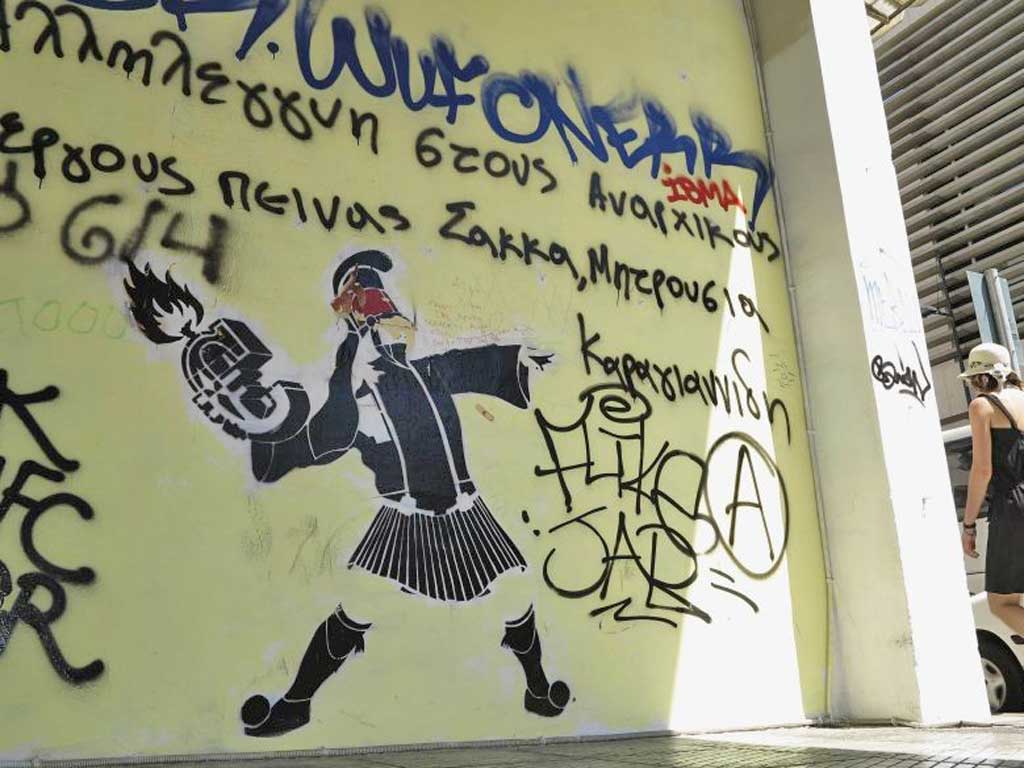

Greece: Greece's new Prime Minister Antonis Samaras is pushing for a relaxation of Greece's deficit reduction schedule imposed in return for its EU/IMF bailout. Samaras is pushing for Greece to be given an additional two years to hit its targets, pointing out that the present rate of cuts will push the country still deeper into recession.

Where they stand: There is some sympathy for Samaras, born of relief that he prevented Syriza forming a government. Some German ministers have hinted there could be a relaxation of the deficit reduction timetable. But Austria and the Netherlands have rejected this.

Likely outcome: The German government said no decision will be taken in Brussels. And Mr Samaras and his Finance Minister will even miss the meeting. European leaders are likely to wait for the latest report on Greece from the Troika of inspectors – the ECB, the IMF and the EC.

What's the issue?

Bond purchases: The Italian Prime Minister, Mario Monti, has proposed the European bailout funds should be used to buy up the sovereign bonds of the secondary debt markets of distressed states to reduce borrowing costs. The Spanish government also suggests bailout funds should inject loans into its banking system directly, rather than adding to the sovereign's debt.

Where they stand: Since last year the bailout fund, the European Financial Stability Facility, has had the power to do this. But the purchases must follow a formal request and would come with conditions. It is unclear whether Mr Monti would risk it.

Likely outcome: Mario Monti will push his proposal in Brussels, but agreement is likely to prove elusive. The German parliament will vote on whether to ratify the permanent successor of the EFSF on Friday after a compromise. Ms Merkel will not want to announce a major decision on those funds that could jeopardise that vote.

What's the issue?

Banking union: There is a clamour in Europe to establish a banking union to reassure nervous depositors in Spain and Greece who are pulling out their money. Leaders are set to discuss proposals for a single banking superviser, a common EU deposit guarantee and a single bank resolution fund.

Where they stand: The European Central Bank president, Mario Draghi, has called for it. Southern European nations are keener on the cross-border guarantees. Northern European leaders are more interested in the central supervision aspect. But the German Bundesbank has warned that a banking union could become a covert way of transferring resources between member states.

Likely outcome: Meeting expected to provide a blueprint for a banking union since most leaders accept that financial contagion could tear the single currency apart unless action taken. But details of liability sharing aspect of banking union likely to be kept vague for fear of revealing which countries are bearing the greatest risk.

What's the issue?

Eurobonds: An increasing number of observers say that the single currency simply cannot survive without some joint issuance and guarantees of sovereign debt, which would allow the weaker nations of the eurozone to borrow on the same decent terms as the stronger ones.

Where they stand: The Commission, under president Jose Manuel Barroso, has pushed for eurobonds, and France is also in favour. Angela Merkel's advisers have suggested a debt redemption fund, which would be halfway house. But the official German position is that eurobonds can only follow a much closer economic union.

Likely outcome: Will probably be kicked off the table by Germany. Ms Merkel said yesterday that proponents of eurobonds were looking for "easy answers" where none existed. Plus any joint issuance would require extensive negotiations about division of liabilities. No sign that this is underway.

What's the issue?

European Central Bank: Many are pressing for the European Central Bank to recommence its sovereign bond purchase programme as the most direct means of all to ease the stress on large borrowers like Spain and Italy. The ECB has amassed a portfolio of more than €200bn since mid-2010. But it brought the policy to an end last year and has shown no signs of restarting it.

Where they stand: Two German members of the ECB board resigned because they believed the bond-buying programme was a breach of the bank's constitution, which forbids the financing of borrowing. Germany, the Netherlands and Finland are opposed. France, Italy and Spain are in favour. So is Britain.

Likely outcome: Will not be mentioned. If European leaders look as if they are finally taking the tough decisions needed to resolve the emergency, it is possible the ECB will feel that it has enough political space to restart its bond purchase programme. But otherwise, the ECB us unlikely to move on this front again unless there are clear signs that the whole eurozone could be at imminent risk of collapse.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments