In through the Shankly Gates, out through the High Court?

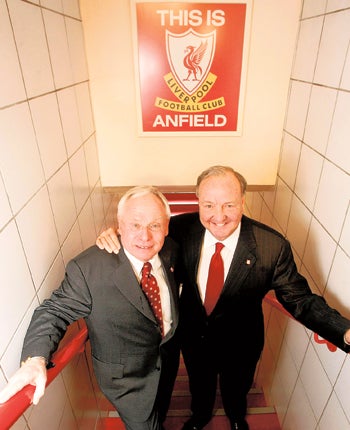

Ian Herbert and Nick Harris report on an extraordinary day for Liverpool's US owners

The most famous of all custodians of the Liverpool manager's chair, Bill Shankly, never trusted the boardroom men. "At a football club, there's a holy trinity – the players, the manager and the supporters," he once said. "Directors don't come into it. They are only there to sign the cheques." The problem for the club he helped create is that there are no cheques left to write – and it was against that backdrop that perhaps the most extraordinary board meeting in British football history took place on Tuesday afternoon.

More precisely, it was the events directly preceding the meeting which will take their place in the annals of corporate lore. A conference call from the club's owners – Tom Hicks and George Gillett – told their English counterparts, assembled in London, that the club's managing director and commercial director were being suspended from the board. The news was as perfunctory as it was unexpected: Hicks and Gillett did not wait on the line for a lengthy discussion. But it represented the last throw of the dice for two business high rollers who were about to be outvoted on a takeover deal which would see them walk away with nothing from the club in which they have invested £144m. Even worse for them, it was another group of Americans – the New England Sports Ventures (NESV) group, owners of the Boston Red Sox baseball team – who want to move in.

This story's roots reach back to February 2007, with Hicks' and Gillett's big talk of a new stadium to rebuild Liverpool's legendary Anfield Road ground, symbolically extending its capacity above that of Manchester United and laying to rest rival manager Sir Alex Ferguson's claims that he would knock Liverpool "off their fucking perch". But the pair borrowed heavily to fund their acquisition of Liverpool FC. They prevaricated, fatally so, on the new stadium. The club's players started stuttering, the banks started crashing, the Americans ran out of disposable income and no one wanted to lend any more.

Royal Bank of Scotland (RBS), the lender which financed most of the Hicks-Gillett takeover and which is currently owed £237m, set a deadline of a week tomorrow to find a buyer. Having agreed to three re-schedulings of the debt already, the bank does not appear willing to extend that limit any further.

The incumbents have "tried everything to prevent a sale", in the words of Martin Broughton, the British Airways chairman and Barclays Capital corporate financier whose appointment to the Liverpool board was a precondition of RBS extending the loan facility to 15 October. Tuesday's telephone call was just one more device by Hicks and Gillett. Remove managing director Christian Purslow and commercial director Ian Ayre and any subsequent approval of a NESV bid might be deemed illegal. They call it "turning another card" in the US finance world: delay things a few days more and something will turn up.

The odds seem against that now, despite yesterday's deep scepticism among long-suffering Koppites. If this deal fails, Hicks and Gillett will have to find an alternative buyer to prevent RBS foreclosing on them, the club entering administration and being forced to sell anyway. But Tuesday's ploy has forced Broughton into a High Court hearing sometime in the next week, to defend his board's approval of the NESV bid against the owners' claims that two suspended directors voting it through rendered it illegal.

If the Americans thought they were dealing with mild-mannered Brits, then they now know their mistake. On Tuesday evening, in the immediate aftermath of the Hicks/Gillett stunt, Broughton was privy to language of a kind he does not hear at his British Airways board meetings. It is hard to underestimate the indignation with which he, Purslow and their lieutenants have hit back in past 24 hours. "Let's get stuck in," as they say in the dressing room.

Hence the eye-boggling statement published on the website of a football club 100 per cent owned by Hicks and Gillett, late on Tuesday evening, in which the NESV bid was praised as "excellent" and those two "suspensions" given short shrift. Gillett is the silent partner: the source of credit he sought to buy his 50 per cent share has seemingly called in the loan. But Hicks has been neutered too – now apparently powerless to communicate through the club's website, a vehicle he has used to respond to many controversies of his own making in three tempestuous years on Merseyside. A brief statement issued through his London PR agency in the early hours of yesterday had to suffice. The NESV price is too low, it said.

Hicks, as Broughton put it yesterday, is in "£600m territory". The club is worth half that much, even though Liverpool have made themselves more attractive to buyers by removing the recalcitrant manager Rafael Benitez for a £6m payoff, when the terms of his contract meant severance could have cost a new owner £15m. There was an uplift in interest from prospective buyers when Benitez left; star players Fernando Torres and Steven Gerrard decided to stay and Joe Cole signed in July.

So now the soap opera moves to the High Court. Broughton's lawyers, Slaughter and May, will argue that Hicks and Gillett signed a legal undertaking not to block a sale when Broughton was hired. Hicks and Gillett – who sadly don't seem booked on London-bound flights soon – will say they deserve some return on investment.

True to the city's capacity to create something out of adversity, a wonderfully inventive viral film, Dear Mr Hicks, has been published online to make it clear where he ought to go. The fans' view can be summarised thus: away, and soon. However, as far as the leaving of Liverpool is concerned, Hicks hasn't got the message and he isn't making dramatic phone calls any more. "I have been speaking to Tom rather a lot lately but I haven't spoken to him since the board meeting," Broughton reflected yesterday.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies