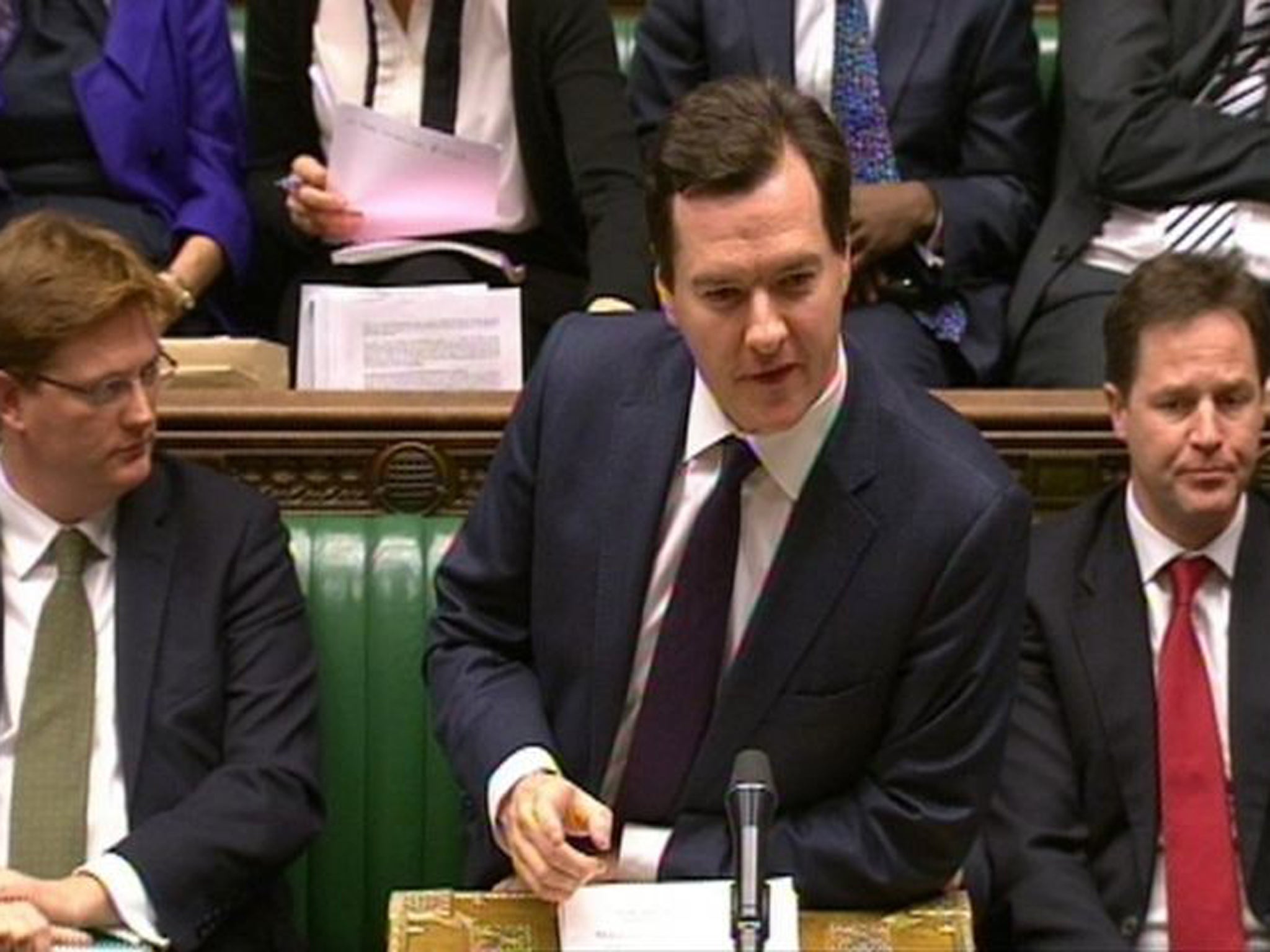

George Osborne had a surprise for us all in his Autumn Statement today:

"Today's figures show that, with or without the APF coupons [the temporary windfall from taking the Bank of England's QE coupons onto the Treasury's books], the deficit is forecast to fall this year."

That's odd, because the public finance figures have shown the deficit so far in 2012-13 running about £5bn higher than in the 2013-14 financial year.

Osborne went on to taunt those who have predicted that the borrowing bill would rise:

“There are those who have been saying that the deficit was going up this year. But any way you present them that is not what the OBR forecasts show today. They say the deficit is coming down. Coming down this year - and every year of this Parliament."

This is quite disgracefully misleading.

Read the (very) small print of the Office for Budget Responsibility document and it shows that Osborne's figures do exclude the APF. But they do not strip out the one-off effect of his move to take the assets of Bradford and Bingley (B&B) and Northern Rock (NRAM) on to the public balance sheet.

Here's the OBR 2012/13 deficit forecast between the March Budget and today's Autumn Statement without stripping out that accounting wheeze:

Yes, it looks like the OBR borrowing forecast has been revised down.

But here's what happens to the OBR forecast when you exclude the banking assets move:

Yes, the deficit is rising in cash terms.

And as for the deficit “coming down every year", as Osborne put it, yes, as a percentage of GDP.

But the forecast for cash borrowing is now higher every year, to the total tune of £101bn, stripping out all the accounting tricks, as this shows:

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies