The Bank of England should beware: forward guidance without policy action is useless

Full employment in the UK is a long way off and the labour market is weakening again

Why exactly is the Federal Reserve putting lots of stimulus into the US economy while the Monetary Policy Committee (MPC) does nothing when on every measure the UK economy is performing a lot worse?

Ben Bernanke, the Fed chairman, continued to push home the message last week that the US central bank was watching the data as it pumps more stimulus into the American economy. In testimony to Congress, Mr Bernanke repeated the message of his recent lecture at the National Bureau of Economic Research in Cambridge. “We are not talking about tightening monetary policy,” he said. “I want to emphasise that none of that implies that monetary policy will be tighter at any time within the foreseeable future.”

The Fed’s position is that if, and only if, the incoming data are in line with the Fed’s projections, they would expect to begin reducing the pace of asset purchases, currently at the rate of $40bn a month of mortgage backed securities (MBS) and $45bn a month of longer-term Treasuries, in “measured steps” later this year. If the subsequent data continue to conform to that pattern of ongoing economic improvement and normalising inflation, they would expect to continue to taper the pace of purchases through the first half of next year, ending around mid-year.

But if the data were less favourable the current pace of purchases could be maintained for longer. Mr Bernanke made it clear, though, that if needed the committee would be prepared to employ all of its tools, “including an increase in the pace of purchases for a time, to promote a return to maximum employment in a context of price stability”.

Mr Bernanke suggested that the Federal Reserve would be unlikely to view a decline in unemployment to 6.5 per cent as a sufficient reason to raise its target for the federal funds rate. Likewise, the Fed would be unlikely to raise the funds rate if inflation remained persistently below their longer-run objective. To put this in context, the US unemployment rate is 7.6 per cent with inflation well below target. The central tendency of member’s projections is that unemployment will not reach 6.5 per cent until 2015, and even by then inflation is expected to remain well below target.

The International Monetary Fund is forecasting that the US will grow 1.2 per cent in 2013 and 2.1 per cent in 2014, compared with even slower growth in both years of 0.9 per cent and 1.5 per cent for the UK. The MPC is asleep at the wheel. Why it isn’t buying assets remains unclear given the parlous state of the economy. And at its latest meeting the two doves, David Miles and Paul Fisher, unexpectedly voted along with the new Governor to do nothing whatsoever this month.

The vain hope is that there will be something coming in August, when the committee provides an assessment, alongside its Inflation Report, of the case for adopting some form of forward guidance, including the possible use of intermediate thresholds. The doves’ action was panned by my good friend and distinguished ex-MPC member Adam Posen, who noted that the global outlook is weakening and the UK is far from full employment. The doves’ change in votes, Adam argues, is “at best a misplaced belief in the utility of forward guidance”.

Forward guidance without policy action tied to it is completely and utterly worthless in my view. It has to be data contingent: if this, then this; if that, then something else. Otherwise their exit plan simply won’t be credible. The IMF in its recent assessment even called for credit conditions to be eased right away, so they need to get to it.

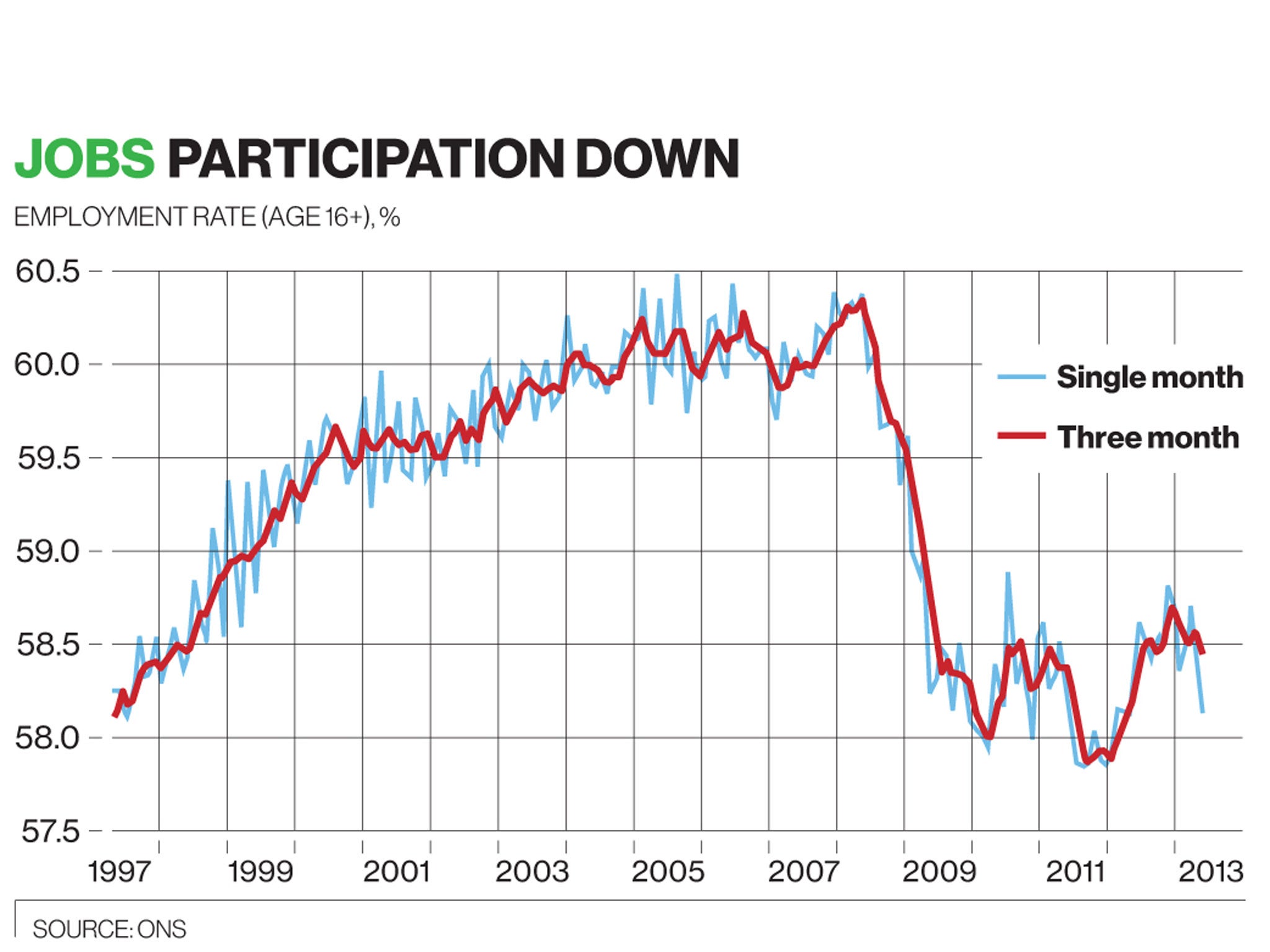

Full employment in the UK is a long way off and the labour market is weakening again. As the chart above shows, the age 16+ UK employment to population rate is now falling sharply. In May it was 58.1 per cent, down from 58.5 per cent in April and 58.7 per cent in March and down from 60.4 per cent in May 2008.

If we look at the unemployment data in the same way it is presented in the United States and every other advanced country in the world, by single month, we see no evidence the unemployment rate is falling as claimed. The last six monthly readings are 7.8 per cent, 8.1 per cent, 8.0 per cent, 7.4 per cent, 8.0 per cent and 8.0 per cent.

The smoothed average of the last six-monthly observations is 7.9 per cent (December 2012-May 2013), up 0.1 per cent from the six-month rolling average of 7.8 per cent (November 2012 to April 2013). Over the last three months the inactivity rate, the proportion of the population neither employed nor unemployed, rose sharply. Indeed, this month the numbers rose by 213,000, to 18,736,000, the highest number ever recorded since the data started in June 1992. Long-term unemployment continues to rise, up 15,000 on the quarter to 915,000, and real earnings continue to fall, with prices rising at 2.9 per cent per annum and weekly nominal wages growing at only 1.5 per cent and falling also. So where is the healing exactly?

One sensible policy the MPC could adopt right now, as Adam Posen, Vince Cable and I have long advocated, would be to start buying £10bn a month of bonds targeted specifically on getting lending flowing to small firms, given that net lending to SMEs has been negative since the second quarter of 2011. Banks could take in applications and then apply to the Bank of England or some other agency for funding, as has occurred in the US via the Small Business Administration.

It should keep going until the rolling six-month average of the unemployment rate hits 7 per cent, as long as forecast inflation two years ahead is close to the 2 per cent CPI target. It would also make sense for the MPC to say it will keep rates at 0.5 per cent until the outlook for the labour market has improved substantially in a context of price stability. It might well signal it would start to raise rates when the six-month rolling average of the unemployment rate hits 6.5 per cent, as long as it also looks at broader measures including labour force participation and wage growth.

But this is going to take a while. The MPC needs to wake up and work out once again that they are behind the curve. August is their chance, so they had better get busy!

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks