Singing from the same balance sheet

As one pop star is bankrupted by his investments, Gillian Orr tallies the acts who've made a non-musical mint and the projects that were top of the flops

This week Westlife's Shane Filan joined the likes of Willie Nelson, Tom Petty, Marvin Gaye, Toni Braxton and Meat Loaf in becoming a successful musician who has been forced to file for bankruptcy. But while the other artists' financial woes were brought about by unpaid taxes, record label issues, divorce or lavish overspending, Filan's troubles are the result of some bad business decisions. Having sunk money into a housing development company he established in 2004, Filan has since suffered enormous losses in Ireland's property crash.

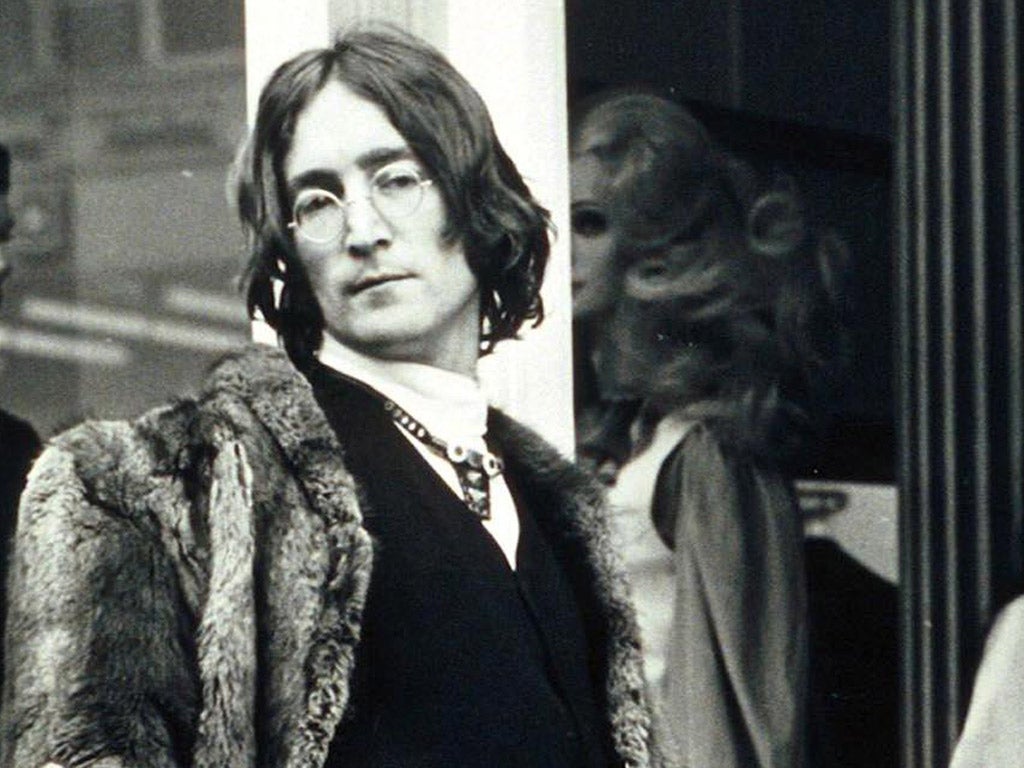

Musicians often look to pump their cash into something that will make them even wealthier. But pop stars have been making bad business decisions since the Beatles invested in the Apple Boutique in 1967, which closed six months later having lost around £200,000.

Like Filan, Mick Fleetwood's downfall was real estate. His property investment binge contributed towards him declaring bankruptcy in the mid-1980s (perhaps his staggering cocaine habit also had a lot to answer for). MC Hammer's investment in thoroughbred racehorses played a big part in the parachute pant-wearing rapper going broke in 1996. He should have learnt from rocker Ted Nugent, who also thought investing in racehorses was a good idea. Nugent had filed for bankruptcy in 1980.

Jay-Z lost millions in a failed luxury hotel endeavour, J Hotels. At least wife Beyoncé can help him out if he ever finds himself short. And although Bono recently made headlines after the flotation of Facebook meant that Elevation, the equity investment group of which the U2 frontman is co-founder and managing director, pocketed $1.5bn (£965m), it was only a few years ago that the firm had lost over $400m after a disastrous investment in Apple rivals and PDA maker Palm. So who is getting a return on their investment? Apparently, Britney Spears is making a killing in the unlikely field of timber, having invested over $3m in buying up forest land in Louisiana. Presumably Britney learned her lesson from her failed NYC restaurant NyLa. 50 Cent added to his accounts after he negotiated a stake in Glaceau, the makers of Vitaminwater. When The Coca- Cola Company acquired the soft drink for $4.2 bn, the rapper made $100m, which presumably even eclipsed the pay cheque he got for starring in Get Rich Or Die Tryin'.

Of course, everyone knows it's all about tech start-ups, and many musicians are injecting cash into Silicon Valley. Selena Gomez, Shakira and Jay-Z (who else?) have all invested in various apps and platforms. But the savviest is none other than Justin Bieber, who has just appeared on the cover of Forbes for his business acumen. The singer reportedly holds stakes in a dozen tech firms, the most notable of which is music service Spotify. It certainly sounds a lot more sensible than Justin Timberlake's recent investment: a major stake in the $35m buyout of ghost town MySpace.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments