Shanghai remains magnet for foreign investment

THE ARTICLES ON THESE PAGES ARE PRODUCED BY CHINA DAILY, WHICH TAKES SOLE RESPONSIBILITY FOR THE CONTENTS

French banking group BNP Paribas’ confidence in the Chinese market has remained undeterred by global market volatility and the COVID-19 pandemic.

The group’s continued investment is proof of this. It has placed 5.3 billion yuan (£607.09 million) of additional equity in its China joint ventures over the past 18 months. It expects to make a further investment of 1.5 billion to 2 billion yuan (£172 million - £229 million) in the next 12 months.

Bruno Weill, the bank’s vice-chairman in China, said that in the next two months, BNP Paribas will unveil a wealth management joint venture with Agriculture Bank of China.

The company has founded 11 joint ventures with Chinese partners, including State-owned enterprises, privately owned companies and financial institutions.

The presence of foreign asset management companies, or financial institutions in a broad sense, is nothing new to Shanghai.

At least 122 foreign asset management companies from 13 countries have set up operations in the Lujiazui financial hub in eastern Shanghai. Of the 1,736 licensed financial institutions registered in the city, 539 are foreign financial service providers. Nearly half of the foreign banks, jointly-held asset management companies and foreign insurance companies operating in China have set up regional headquarters in Shanghai.

Many initial attempts to facilitate the two-way opening-up of the Chinese financial market have been made in Shanghai.

Crude oil futures, China’s first yuan-denominated futures product open to foreign investors, was launched at the Shanghai Futures Exchange in 2018. The Stock Connect programme linking the Shanghai and London bourses began in June the following year.

JP Morgan, whose China headquarters are located in Shanghai, was given approval in August 2021 to set up the first wholly foreign-owned securities company in China, and in late March, China’s national oil company CNOOC and France’s TotalEnergies settled the first yuan-denominated trade for liquefied natural gas via the Shanghai Petroleum and Natural Gas Exchange.

Shanghai’s role as an international financial centre has thus been consolidated. Data from the Shanghai Municipal Development and Reform Commission show the total trading value in the city reached 2,933 trillion yuan (£336 trillion) last year, up from 528 trillion yuan (£60.49 trillion) in 2012.

The progress made in the financial sector is just one example of the numerous efforts made by Shanghai to advance its two-way opening-up. The China International Import Expo, or CIIE, which has been held annually in the city since 2018, has served as an important platform for advancing China’s all-around opening-up.

In addition to the $345.8 billion (£278.52 billion) of intended deals reached at the past five expos, up to 2,000 new products, technologies and services have made their China or global debuts at CIIE.

Swiss industrial conglomerate ABB has attended all five expos, globally showcasing its latest breakthroughs such as the gas leak detection technology ABB HoverGuard. ABB’s China chairman Gu Chunyuan said the expo helps the company better understand market demand and the latest industry trends.

“We receive a great many government delegates and visitors from large corporations every year at CIIE, which has provided us with good opportunities to come up with innovative technologies to better address the demands of local clients,” he said.

Meanwhile, the China (Shanghai) Pilot Free Trade Zone, which was officially launched in 2013, serves as one of the best examples of systematic innovation.

The negative list for foreign investment, first adopted by the Shanghai FTZ when it was launched, was promoted nationwide in July 2017.

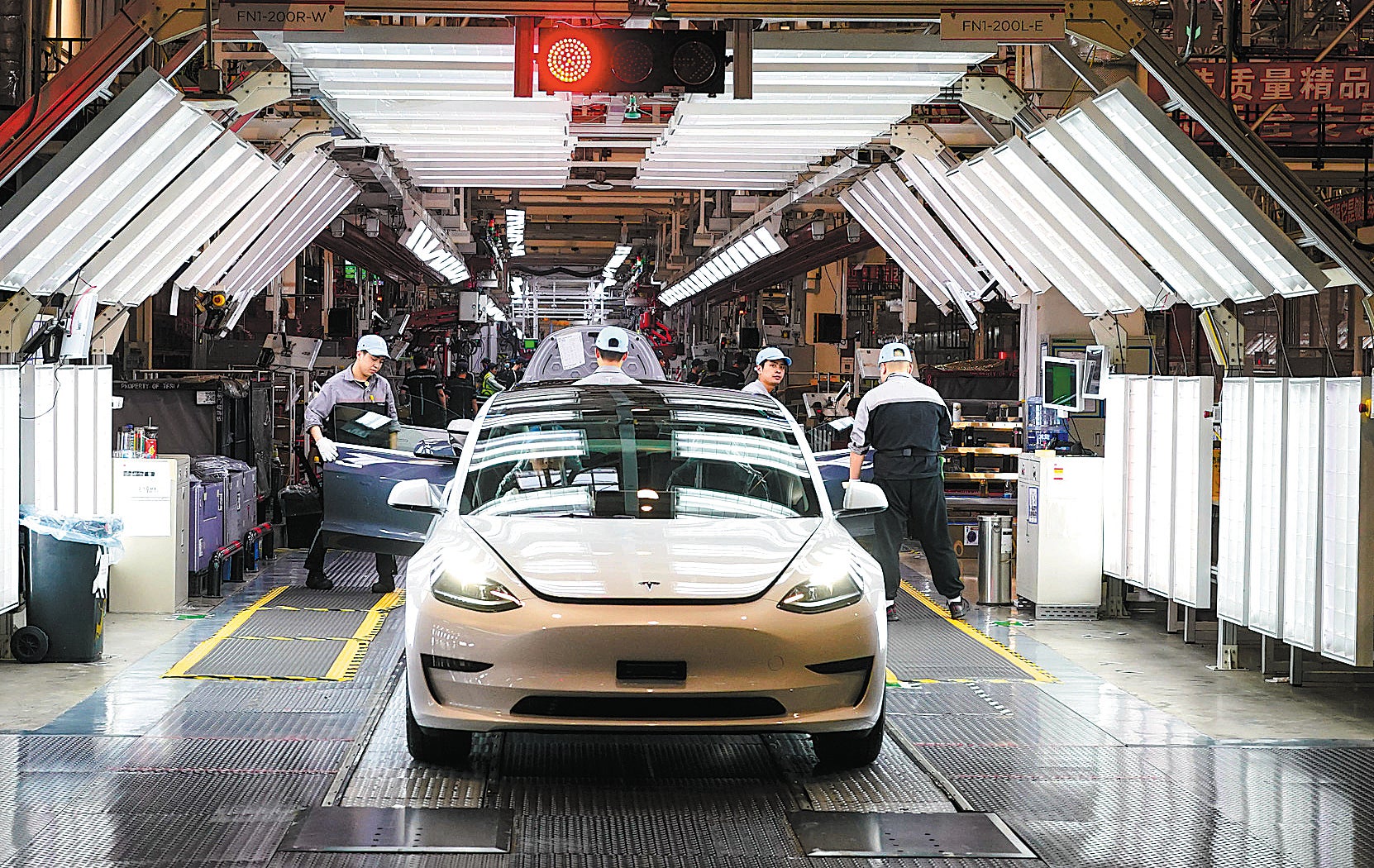

New energy vehicle maker Tesla has benefited from the systematic advantages in Lingang Special Area, part of the Shanghai FTZ that was officially launched in August 2019. It held the groundbreaking ceremony for its Lingang gigafactory in early January 2019, and the first car was completed at this facility 11 months later.

Tesla’s vice-president Tao Lin said, “Shanghai has provided Tesla with development opportunities in China.”

Chen Kele, deputy director of the intelligent manufacturing promotion division at the Shanghai Municipal Commission of Economy and Informatisation, said systematic innovation in Lingang has created a win-win situation. Not only has Tesla’s production capacity increased, Shanghai’s industrial growth has been boosted and the city’s new energy vehicle, or NEV, ecosystem has been optimised, he said.

More than 1.1 million NEVs were in use in Shanghai as of April, more than in any other city worldwide, data from the commission shows.

Shanghai’s accumulative actual use of foreign capital exceeds $330 billion. A total of 907 multinational companies have set up regional headquarters in the city, which is also home to 538 multinationals’ regional research and development centres.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.