The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

How to find medical cover that won't give you a heart attack

Health insurance can be affordable – in fact, it can be as little as £1 a week, says James Daley

As the National Health Service celebrates its 60th anniversary this summer, it has much to be proud of. Having cared for and cured millions of patients since it was first launched back in 1948, it is still considered by some to be one of the world's leading examples of a universal healthcare system – one that many countries in the world would be proud to call their own.

Nevertheless, for a 60-year-old, it certainly has more than its fair share of aches and pains. Since Labour came to power 11 years ago, the Government has increased spending on the NHS from less than 7 to more than 9 per cent of GDP – yet local health authority deficits have continued to soar, while improvements in service and standards have not been nearly as great as they might have been given such a sharp rise in expenditure.

Although the service is still usually good when it comes to getting a GP appointment, or receiving urgent hospital attention, patients are still forced to wait months for referrals to specialists and many more for certain operations.

More recently, the NHS has also started to refuse to pay for certain expensive treatments – even if they are known to have a much higher rate of success than the alternatives. Worse still, when patients have offered to pay the difference in price between the two treatments, the NHS has refused – claiming that they must pay the full cost of the more expensive treatment.

These factors have all helped to drive up demand for private medical insurance, as consumers have sought to eliminate the uncertainties that come with relying on the NHS. Unfortunately, however, demand isn't the only thing that's been on the rise – the cost of private medical insurance has been soaring as well.

According to consultants Mercer, medical inflation (the cost of medical treatments) came in at a shade under 10 per cent last year – well above the regular rate of inflation, which was closer to 4 per cent.

Julian Stainton of WPA, the not-for-profit medical insurer, says that the cost of spending a night in a private hospital is now around £1,600 across most of Britain, and as high as £1,900 in the capital. A night in the intensive care unit of a private hospital will set you back around £5,500.

This has left insurers in a difficult position. While the temptation has been to keep raising their customers' premiums, this tends to have the effect of scaring off the healthy customers first. In the long run, this will only serve to push up premiums even further, as insurers are left with a higher volume of elder and less healthy patients on their books, who claim more often.

As a result, the medical insurance industry has been forced to become a little more innovative in recent years, finding a way to keep premiums affordable, while ensuring that they can still make a profit.

FULLY COMPREHENSIVE

If you still want to buy fully comprehensive private medical insurance, which will pay out regardless of your condition, such policies still exist, but can cost an awful lot. Depending on your age, lifestyle and whether you have any pre-existing medical conditions, policies can cost anything between £2,000 and £5,000 a year.

Nevertheless, Jason Pettit at Bupa, says there remains a strong demand for such policies. "What consumers want is what they've always wanted – as comprehensive a policy as possible," he says. "And one of the interesting things we find is that when we speak to people, they're often surprised that the cost is less than they had anticipated."

Bupa, like most other health insurers, gives customers the chance to reduce the cost of their policy, by choosing from one of four main levels of cover. Furthermore, you can also cut costs by increasing the excess on your policy – the amount that you're willing to pay towards any claims each year.

Another recent innovation in the fully comprehensive market is Prudential's PruHealth policy, which allows you to cut the cost of cover by leading a more healthy lifestyle. Customers are given credits for going to the gym, having health checks or giving up smoking, which help to reduce their premiums in subsequent years.

CO-PAYMENT

Another type of product, which is growing in popularity, is the co-payment plan – where customers agree to pay a proportion of any claim, up to a pre-agreed annual limit. WPA is one of the biggest players in this market, and pays 75 per cent of any claims, leaving customers to pay the remaining 25 per cent. The cap on the amount that policy-holders can pay each year is set at £500, £1,000, £3,000 or £5,000 – and the bigger the cap, the less the premium. Exeter Friendly Society offers a similar set of plans, including one where the customer goes 50-50 with the insurer up to a limit of £10,000 a year, and another where the customer pays only 10 per cent, up to a limits of £2,000 a year.

Stainton says WPA also helps cut their premiums even further, by offering to omit certain major conditions from the policy. "We're offering people the option not to have cancer cover," he says. "Because by and large, cancer treatment on the NHS is pretty good. Similarly, they might opt to keep cancer covered in their policy, but agree to not be treated at the more expensive hospitals."

Co-payment premiums are typically 60 or 70 per cent less than fully comprehensive policies, and have the added benefit of incentivising customers to stay healthy, to keep their own costs down.

CASH PLANS

A third and even cheaper option is to take out a cash plan, which will make modest cash payouts every time you take a trip to the dentist, optician, physiotherapist or the like. These plans can cost you as little as £1 a week, and they will typically pay out between £50 and £500 a go – depending on the size of your premium and the nature of the treatment.

Bupa's Pettit says these plans are generally used by two types of people. The first group are those who have private medical cover with lots of exemptions, and want an extra cash plan to fill in some of the gaps. While the second group are those who can't afford any other cover. "They tend to cover a broad range of benefits and pay out relatively low sums," he says. "But they can help take the sting out of everyday health costs."

Most policies will have a waiting period of a few months, during which they won't pay out.

SELF-PAYMENT

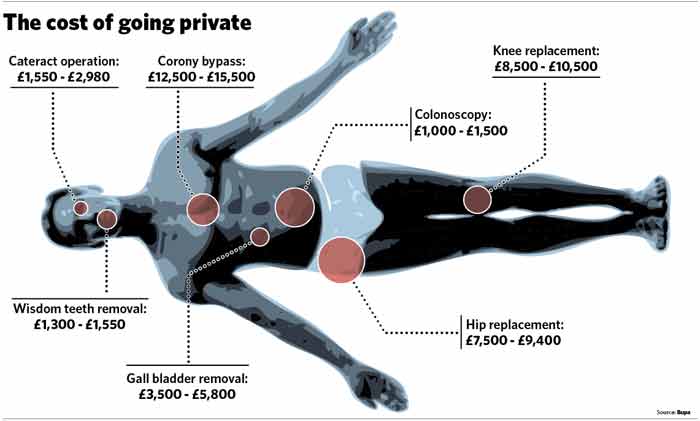

If you don't want, or can't afford, to pay for private medical insurance, you could consider paying for treatments as and when you need them. Pettit says this market is still very popular – especially when people are told that they will have a long wait for a procedure on the NHS. However, as our illustration shows, the one-off cost can be considerable.

If you decide to go down this route, it may be worth considering taking out critical illness insurance. Matt Morris from Lifesearch, the specialist adviser, says critical insurance cover can cost as little as £30 to £35 a month for a healthy young individual, and will pay out a lump sum in the event that you're diagnosed with a serious illness.

Virgin Money and Bupa also offer policies that just pay out for a small number of conditions, such as cancer and heart disease.

WHERE TO BUY

If you think you've got a good grasp of the medical insurance market, websites such as www.moneysupermarket.com can help you get a feel for how much you might pay for a policy. However, the quotes that you get are unlikely to be accurate, as medical insurance is a relatively complex product, and prices will be tailored to your individual circumstances (except for cash plans, which are not underwritten).

As a result, Colin Boxall, of the Association of Medical Insurance Intermediaries, says it makes sense to find a broker or independent financial adviser, who can pick out the best value product for your circumstances.

"PMI is great when it is appreciated and understood," he says. "But there needs to be greater education and understanding of a first-time purchase, or when changing from one insurer to another. Independent specialist advice is essential. The options available are bewildering with the wrong choice possibly leading to serious financial and emotional consequences.

Websites such as www.amii.co.uk, www.biba.org.uk and www.unbiased.co.uk will help you find a suitable adviser or broker in your area

'Health assessments may be costly, but they give you peace of mind'

Over the last few years, I've found myself developing more than my fair share of medical paranoias. While by most people's standards, I'm a fit and healthy 30-year old – cycling 23 miles on my commute most days, and eating relatively well – I still drink much more than the doctors tell me I should, which has left my concerned about some strange pains I've been getting on the right side of my torso over the past few months. I'm also still nursing a small bump on my head after slipping over and concussing myself last summer, and though I'm asthmatic, I only recently gave up smoking.

If I'm in a particularly fretful mood, I can usually convince myself that I've got cirrhosis of the liver, lung cancer and a malignant brain tumour – all of which the rational part of my brain understands to be highly unlikely.

To try and put a stop to such nonsense, I decided to sign up for a medical assessment with Bupa, which promised to test how well my heart, lungs, liver, kidneys and various other organs were working. It also offered me the chance to sit down with a non-NHS doctor for half an hour, and to ask all the stupid questions I've been desperate to get an answer to (my local GP usually tells me I'm crazy and sends me home).

Private health assessments are not cheap – but in my view, they're well worth considering if you're a paranoid hypochondriac like me. Bupa's premier health assessment – which I took – costs £580 for men and £630 for women, and can provide you with real peace of mind. There are slightly cheaper options too. Bupa is currently offering £100 off its classic health assessment – which works out at £330 for men and £360 for women, and only omits a few tests which are included in the Premier package. See bupa.co.uk for more details.

It turns out that my liver is (amazingly) still fully functioning, and my kidneys, heart and lungs are also in good shape. The bump on my head might stay for life, but it's nothing to worry about – and the pains in my side are probably muscular.

Since taking the health assessment, I've been sleeping better than I had for months – it's certainly taken a load off my mind.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies