Got a financial hangover? Budget your way out of New Year debt

Nearly half of us paid for the festivities on credit, so resolve now to get a financial grip. Julian Knight shows how to pay the bills

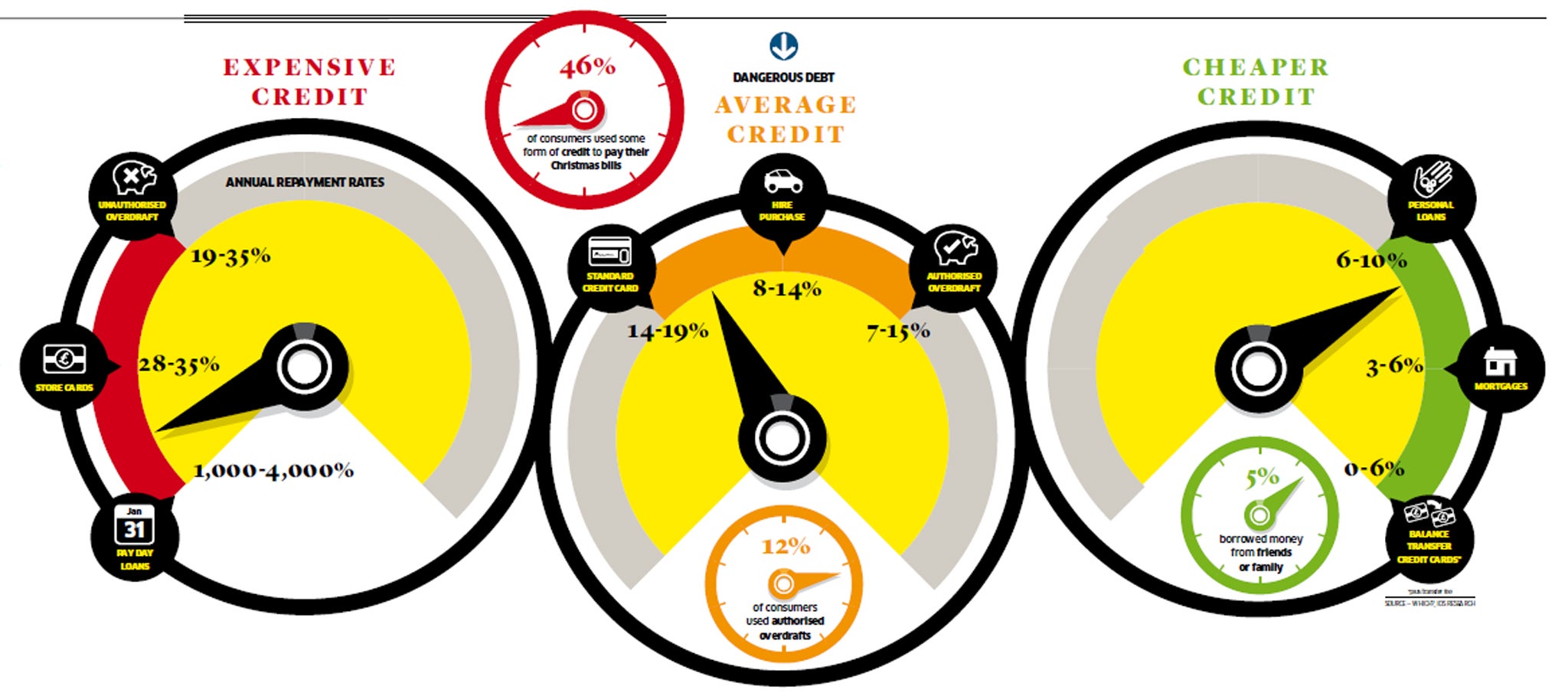

After the Christmas and New Year party comes the financial hangover. Consumer group Which? reckons that 46 per cent of the population paid for at least part of the festivities on credit. This is probably an exaggeration, but there is no doubting that millions of Brits enter 2013 with less hope but more debt.

Mortgages aside, Britain's adults on average owe more than £8,000. Factor in mortgages and the debt really takes off, with each adult owing an average of £57,000 or an eye-watering £1.45trn in total. So understandably many Brits feel the dead hand of debt on their personal finances and the new year is as good a time as any to sort out a plan on how to deal with it.

Sarah Pennells, the founder of financial advice site SavvyWoman.co.uk, says the first step is to take a few minutes and assess exactly where your finances are.

"Draw up a list of everything you owe, who you owe the money to, how much you're paying and how long until you've paid it off. Then it's time to work out a budget. By doing this you'll know what you need to spend and what you have left over to pay off your debts. There are free budget calculators on the Government's moneyadviceservice.org.uk website."

Free-to-use debt advice firm Payplan says many consumers fall at this first budgeting hurdle by failing to assess thoroughly where their finances stand, so when the numbers don't add up they can often fall back on the crutch of debt.

"The best advice is if your income is variable for budgeting purposes just show the minimum income you usually earn. And make sure you include everything such as your TV licence, car tax, MOT, car repairs and so on," says its director Jason Eaves.

If you find that you have a little surplus then target the priciest debt first, says Ms Pennells.

"Even a small amount will make a difference, especially if you're paying the minimum on your credit card," she explains. "On a £1,000 credit card debt, doubling your monthly payment from £25 to £50 will trim around 12 years off the repayment time – it will fall from 15 years to less than four."

The advice seems to be to take each debt in order and work down them from the most expensive. So usually an overdraft will be more expensive than a credit card, while a card is pricier than a personal loan which in turn will cost more than a mortgage.

But if you don't have a surplus each month, even after some cost-cutting, then there is still a chance to push down on your debt by shifting to lower cost credit. Andrew Hagger, a personal finance expert at Moneycomms, says that even shifting from relying on an overdraft to a credit card can reduce outgoings and speed up debt repayment – provided that no new debts on the card are accrued, of course.

"If you're £500 overdrawn for at least three weeks of every month, you could end up paying £20 per month in charges with some banks, and that's a hefty £240 hole in your budget you could do without. If you take out a rate for life card from MBNA, you can transfer some of your credit limit into your bank account and wipe out the expensive overdraft.

"With the interest rate just 5.9 per cent APR for as long as it takes you to clear the debt, by paying £20 per month to the card instead of to the bank in overdraft charges you'll have wiped out your debt in two years and three months. The total cost to you will be £42.50 which is a one-off money transfer fee of 1.5 per cent (£7.50) and interest costs of £35."

As long as you have kept up your repayments and are in employment, then there is a good chance that your credit record will be clean which in turn gives you options, particularly when it comes to remortgaging which can help push down out- goings and release cash to pay down other pricier debts.

Mark Harris, the chief executive of mortgage broker SPF Private Clients, says: "Your mortgage is likely to be your biggest outgoing so it makes sense to check if you could reduce your monthly payments. We are seeing some of the cheapest mortgage deals ever so it is well worth finding out if you qualify for one."

If the answer is no, then Mr Harris advises: "If you have a high loan-to-value so can't remortgage, think about overpaying this year. This will improve your equity stake, making it easier to remortgage onto a better rate." As for the choice of mortgage product, Mr Hagger recommends that borrowers look at fixed rate deals.

"You will know where you are with a fixed rate and won't be subject to nasty interest rate shocks for the term, and in addition rates are at a historic low at the moment," Mr Hagger said.

However, if your finances are still in a more parlous state and the Christmas expense has left them on the brink, then it's crucial not to ignore the situation. If you're struggling to pay the important bills, such as rent or mortgage, council tax or energy bills, you should get help from one of the debt advice charities such as Stepchange, Citizens Advice or National Debtline.

Some will help face-to-face, others advise over the phone or anonymously online. Don't put off seeking help or be embarrassed, as you can guarantee that they will have seen far worse than your situation.

"Whatever you do don't pay for debt advice as that means less of your money will be going to reduce your debts," Ms Pennells warns.

Debt tips for Payplan

Create a realistic budget using the minimum income you usually earn, and remembering to include paid annually or monthly. If you have a deficit:

Can you generate extra income? By working more hours, or claiming all the benefits you are entitled to?

Are you getting the cheapest deal? Check your utility tariffs.

Check your direct debits and standing orders Annual direct debit claims can be forgotten

Obtain a credit file report Check that the data is correct and get a sense of your credit rating score

Negotiate a reduced repayment programme If still in deficit speak to all your unsecured creditors

Sell assets you no longer need

What to pay first

It is important to distinguish between priority and non-priority debt

Priorities Mortgage or rent; food, heating and lighting; council tax; any HP agreements

Non-priorities Unsecured debt: overdrafts, credit and store cards, catalogues, standard and payday loans

If you move debt onto a 0 per cent credit card do not buy anything with it

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments