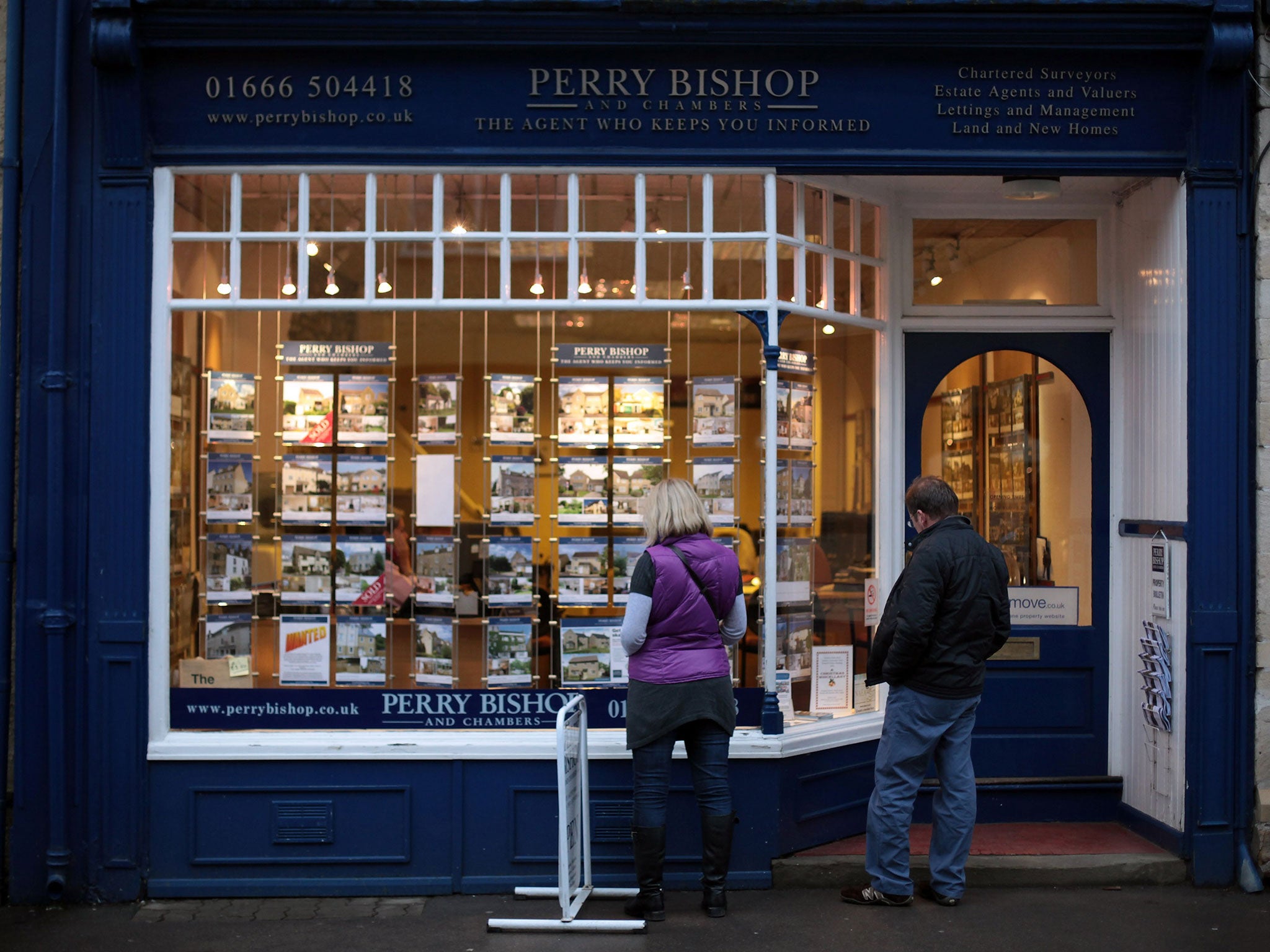

Capital flight: house prices cause exodus

London’s homeowners are cashing in on the huge rise in property prices to move out to somewhere much bigger in the country

“You used to be able to buy one rectory in the country for the price of a town house in Kensington; now you can buy two or three rectories,” such are the high prices still being fetched by prime central London property, according to Charlie Ellingworth of the top-end property buying agency Property Vision.

The prospect of their money going so far has led to large numbers living in central London selling up and moving out. So much so that the London estate agent Savills says that the London property boom was slowing as many families had decided by now to sell up – cash in their home.

“People are selling up in London – they’ve had a very strong rise over the last two to three years – especially families with kids who decide they can’t get the right schools and want more space,” Savills’ chief, Jeremy Helsby, said.

The lack of available schools, a sense that much of prime London property is now nothing more than a safe deposit box for the world’s super-rich and the idea that prices have now peaked has led many London families to head for the exit.

Mr Ellingworth recognises this phenomenon: “These folk are not moving to the Home Counties – that has got nearly as inflated as central London – but further afield; the country-country as I call it. They read the press and know that interest rates will rise sooner rather than later and there is real concern over a possible mansion tax should Labour or a Lib Dem-Labour coalition come to power.”

Savills forecast that central London prices would rise by 3 per cent in 2014. This looked distinctly under par back in January with many transactions going to sealed bids, but now eight months later and prices up by just 2.5 per cent it looks as if Savills called it right. As for the rest of the UK, for the first time in a decade it’s set to outperform the capital with prices on course for a 4.5 per cent increase. About time too, as in many parts of the UK the average price of a home is still only at 2006 levels. As a result, Londoners’ cash goes much further.

Sentiment is key to the housing market. Prices can move on a headline in either direction, and of late many have suggested that the top of the market has been reached.

The theory goes that mortgages are now harder to come by since stricter affordability rules introduced in April, and, of greater importance to the central-London property market, there is huge international unrest. But, oddly enough, Mr Ellingworth suggests this could be buttressing the central-London market: “The Ukraine crisis and the imposition of sanctions is actually a possible driver of the market in recent weeks because many Russians look at London as a safe haven. A property in London is a tremendous hedge against problems with the Russian economy and currency. If they pay over the odds that’s still better than seeing huge losses due to ... the sanctions.

“As for the Chinese, we are only just seeing them get started as far as London property is concerned. That could be the next big overseas market.”

Nevertheless, the rush for the London property market exit may well intensify over the coming months. Already in the past week, Lloyds – the UK’s biggest mortgage lender – has announced a shock £150,000 cap on help-to-buy home loans, effectively removing itself from the first-time buyer London property market.

“I think they felt overexposed to this part of the market, which meant if there was any future correction in London property prices they would be the losers,” Ray Boulger, of the mortgage broker John Charcol, said.

Lloyds’ move could be seen a little like the first fluttering of a pit canary smelling gas, but are there are other reasons to think that the London market is heading for rockier times?

Well, not only are interest rates likely to rise before the year is out, but also new requirements on lenders to hold more cash could choke off supply of home loans, with the likes of Nationwide, Co-op and Barclays rumoured to be most affected. “This could choke off new mortgages but also it may lead to the price of home loans increasing at exactly the same time as interest rates start to go up. There is real danger of killing off not just central London but the nascent recovery going on in other parts of the UK ,” Mr Boulger says.

Andrew Montlake, a longstanding City mortgage broker who has seen market busts, warns that the Bank of England and the Financial Conduct Authority seem to be making good on their pledge that they would ‘take the punch bowl away’ when they thought the market was getting out of control. “With strong talk of rate rises getting ever closer and a reluctance of buyers to pay higher prices, on top of the relatively recent mortgage market restrictions, we are already seeing the froth come off the London market and time should be taken to allow this change in sentiment to take hold,” Mr Montlake said.

And with more and more Londoners looking to cash in at what is widely seen as the “top” of the market – at least for now – there is for the first time no shortage of supply. More sellers and fewer buyers means lower prices, and yes, that old economic truism even applies to the strange other world of London property.

Pull of the metropolis likely to remain strong

Comment

Ben Chu

Have Londoners finally had enough? Are they cashing in on stratospheric house prices and fleeing the capital for a better quality of life, as Savills suggests?

Some families might, but probably the majority are likely to find it impossible. London house prices are double those in the rest of the country, but average wages outside London are also much lower, with an average premium for workers in the capital of 20 per cent.

Some might be able to wangle a deal from their employers to work remotely for the same money, but for many a new job and a hefty pay cut would be in prospect if they left.

Meanwhile, London’s status as the country’s dominant commercial and financial hub shows no signs of slipping: another barrier to exodus. Official projections suggest London’s population will rise by 13 per cent in the decade to 2022, twice the rate of the rest of the country. The forecasters, rather than the estate agents, will probably be proved right.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks