Hamish McRae: A bad winter, but recovery looks secure

Ecnomic View

It's time to stand back. It has been a difficult, tetchy winter for people in Britain, and not just because of the weather. At a macroeconomic level there is all this talk of a triple-dip in the economy, while the underlying fiscal deficit is staying about the same, and will be for three years. This was not what was supposed to happen.

At a personal level we are poorer than we were five years ago, in the sense that our real incomes are lower. People are saving again, for the savings rate is the highest since 1997, which is certainly welcome in the long term, but which is also a sign of lack of confidence in the future.

So not a great start to the year. Part of this caution may be a reflection of what is happening in Europe. Not many Britons own homes in Cyprus but there are some, and an awful lot of people own homes in the south of Spain. The travails of the eurozone therefore do impinge on most of us at one remove. You can read a story about exports to the continent being weak, and that is one thing; having friends caught up in the Spanish property crash is something else.

And yet on Thursday, the S&P 500 index of US shares closed at a record high, just a whisker ahead of its previous best, reached in October 2007. Our own FTSE 100 index is still some 7 per cent off its best, reached in the previous cycle in December 1999, but it managed to come through this difficult first quarter up nearly 9 per cent.

On the continent, German and French shares are both up some 2.5 per cent so far this year. Whatever you think about the future of the eurozone, the shares of large companies in the two largest continental economies are doing just fine.

The trouble is that markets reflect the mood of the moment and nothing more. Those share peaks at the beginning of 2000 and the end of 2007 gave no hint of the dot.com crash or the banking collapses to come. So anyone taking comfort from their reasonably upbeat mood must acknowledge that stock market cheer has been a false friend in the not-so-distant past.

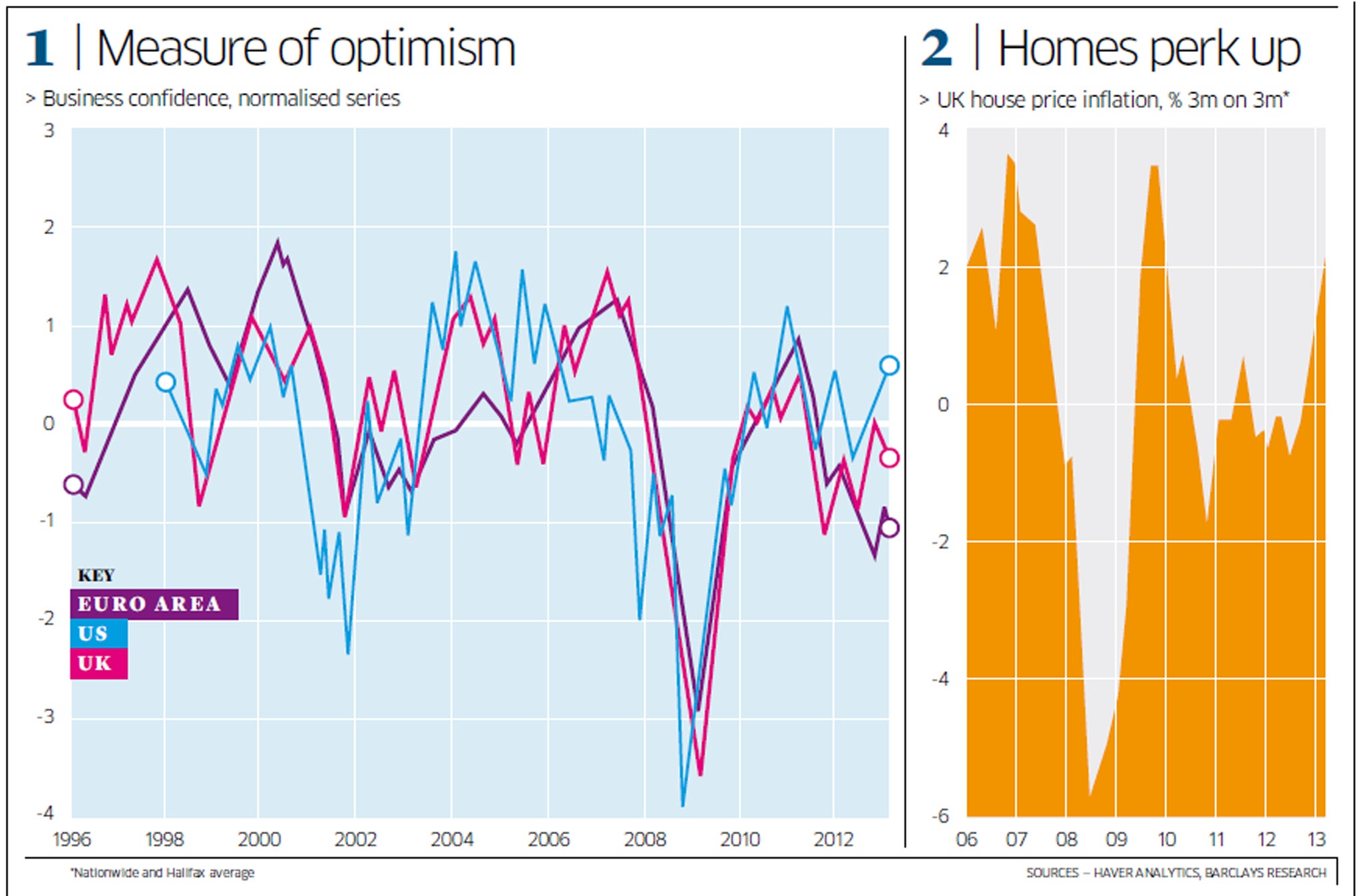

There is a clear distinction to be made between the situation in the US, UK and Europe. You can catch a feeling for this in the main graph. It shows business confidence in the three regions over the past decade. As you can see, businesses in the US lost confidence ahead of those in the UK and Europe in the run-up to the banking crash, maybe because they knew more about what was happening in the subprime market there than we did. Once the scale of the disaster became clear we all headed down pretty much together, and turned up together too. But now US firms are markedly more optimistic that European ones, with the UK somewhere in the middle.

That would square with the data. The US recovery does look reasonably secure, notwithstanding the scare stories about the so-called "fiscal cliff". That is interesting in itself. The experts who worried about the sudden tightening of US fiscal policy hitting growth seem to have been proved wrong. Consumption in the first quarter is running more than 3 per cent up, and since that accounts for about 70 per cent of final demand, this suggests decent growth overall.

Maybe this will prove all those economic models wrong yet again, but what I think may have happened is that the wealth effect from the strong stock market and the housing recovery has more than offset the drag from a tighter fiscal policy. We'll see. The point is that so far the US economy has not fallen off a cliff, in fact rather the reverse.

On the continent, the pattern is so different north and south that it is impossible to generalise. They are essentially two regions. Most of the Britons who have shot off south over this Easter weekend will be getting a taste of southern austerity, and it is always interesting to see how the figures and the reality marry up. Are the restaurants and hotels full? What do the staff say about business? How are the shops doing? Can you find a taxi? All these little indicators give a more nuanced feeling for what is happening than the stark numbers. You read of an unemployment rate of more than a quarter of the workforce in Spain and Greece, with even higher rates for the young, but you don't see the outward signs of a social disaster unless you look for them.

And then, for the much smaller contingent heading to northern Europe, there is an economy much closer to that of the UK – or rather the prosperous south, for we too have a north/south divide, with many northern towns suffering from lack of demand. Our housing market reflects that, for while in London the average home is now at or above its previous peak price, in most other parts of the country prices are still down on 2007/8. Still, averaged out, the past couple of months have shown a more buoyant market, as the small graph suggests.

Barclays highlighted this shift in a recent paper and suggested that the new government schemes to boost home purchase are building on some momentum. Whether the Government is wise to be doing this is another matter. Clearly the taxpayer will be taking on some risk, and whether that is a good idea depends very much on whether prices take a downward slide once interest rates begin to return to normal.

And that will, I think, be the thing that everyone will be looking for through the rest of this year. The US will move first, perhaps some time in the autumn. When that happens it will suggest to the rest of us that while this recovery has been most disappointing, it is looking reasonably secure.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies