Hamish McRae: And now it's time to get out my crystal ball

Economic View

Here are two predictions for the British economy. One is that the big number for growth this year will be two: it will be around 2 per cent. The other is that un- employment will fall below 7 per cent by autumn next year.Absurdly optimistic? Well, these are both at the edges of the possible. The current spread of forecasts for growth this year as collected by Consensus Economics range from 1.5 per cent to 0.8 per cent; and the Bank of England's implicit projection seems to be that unemployment will not go below 7 per cent for another two years, maybe three. But while there are some qualifications that I will come to in a moment this sort of outcome is consistent with the current data.

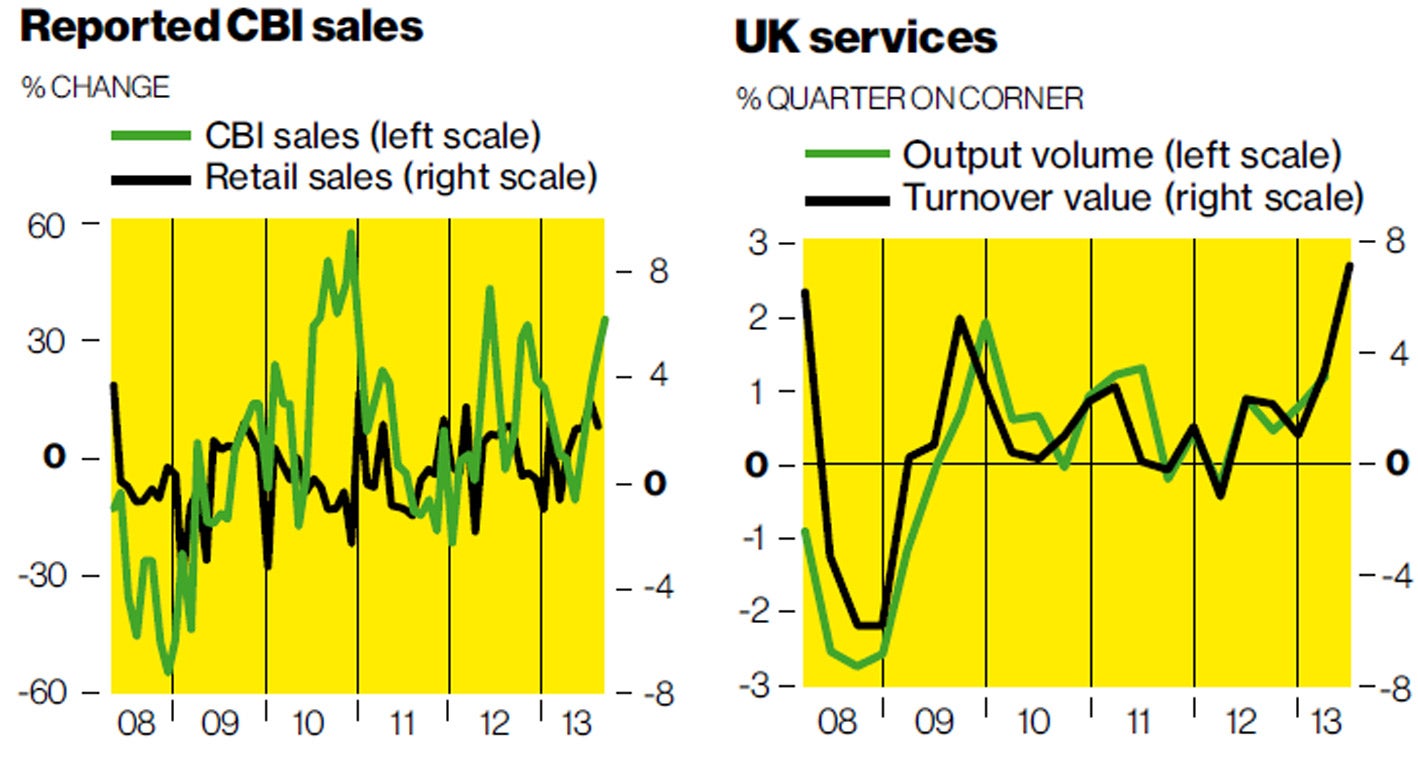

This year first. Yesterday we had another set of strong figures from the Confederation of British Industry's distributive trades' survey, with the strongest positive balance for more than a year. You can see the relationship between this and retail sales volume in the top graph, plotted by Capital Economics. It is not a close fit, but if retailers are that positive about their future prospects it would be pretty odd if the present pace of growth of retail sales were to ease off much.

The other recent positive signal comes from turnover in the services industries, a little-noted indicator followed by Simon Ward at Henderson. The basic point here is that services account for some 70 per cent of the economy, so what happens there is hugely important. These turnover figures do not include government, retail or financial services output so account for about 55 per cent of services, and we only have July figures at the moment and only in value, not volume. Still, it is plausible that services output will expand by 1 per cent in the third quarter, leading to an overall expansion of a similar order. We have had reported growth of 0.3 per cent and 0.7 per cent in the first two quarters, so a 2 per cent figure for this year as a whole begins to look quite reasonable.

Besides, there are always the revisions. Last month the "double dip" was duly revised away – it never existed, as some of us have believed all through – and the first part of this year may see further upward revisions as more data becomes available.

The main qualification I would make is that this is all about the onshore economy. If North Sea output continues to be weak, then growth for 2013 could turn out to be below 2 per cent. In addition, if the modest European recovery now taking place were to falter, then that too could chip a bit off growth.

So how quickly will faster growth cut unemployment? Gosh, this is really hard to predict because there are so many variables. For a start we don't how by how much the labour force will increase, because we don't know how many people at retirement age will continue to work or how many people will be pushed towards the UK by the dreadful unemployment in much of Europe. We also don't know what will happen to self-employment and to productivity. Will employers meet additional demand by taking on more labour or will they squeeze more output (and hence productivity) out of existing staff?

At any rate, for unemployment to fall to 7 per cent in a year or so (it is currently 7.7 per cent) and given the prospective growth in the labour force, we would need growth of at least 2.5 per cent and productivity rising by not much more than 1 per cent. The former looks attainable, for the current consensus is for growth above 2 per cent and forecasts are being revised up all the time. But only the slowest growth in productivity? Intuitively I think productivity will indeed take a long time to recover but there is not much evidence either way.

Let's assume, however, that these projections are more or less right. What then? Decent growth this year and next will, I suppose, be taken as an endorsement of the Coalition's economic policies, and at one level that is a fair judgement. It is quite likely that the fiscal deficit this year will turn out a bit lower than forecast, for the latest revenue figures to end-August are quite encouraging. The big taxes are running well up on last year: income tax is up 4.4 per cent, national insurance contributions up 2.8 per cent, and VAT up 2.5 per cent. But remember that the whole process of fiscal consolidation is going much more slowly than originally planned and that our deficit is still larger than that of any other big economy in the world bar Japan, so there should be no self-congratulation by the Coalition. We are only half-way, at best, towards eliminating the structural deficit.

If, however, these growth and unemployment judgements prove right, there will be a reasonable chance next year of a rise in interest rates. That is not what the Bank of England wants us to think. The new Governor, Mark Carney, unwisely decided to give "forward guidance" about monetary policy, which apparently has been misunderstood by the markets and which several members of the Monetary Policy Committee have subsequently sought to clarify. The reality is that the Bank has slightly earlier and much more detailed information than the rest of us, but its judgements in the past have been just as flawed. So here is a third prediction: the first increase in base rates will come in the final quarter of 2014.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies