Hamish McRae: As Janet Yellen takes over at the Fed, her greatest challenge will be to nudge its policy back to normal

Economic View:

It is, with the two-day meeting that ended tonight, the end of the Bernanke era as chairman of the US Federal Reserve, and the beginning of the Yellen one. But of course the terms of the chair of the Fed do not coincide with the economic cycle and the incomer has to cope with the problems as they stand. So Ben Bernanke was faced with a giant credit bubble when he took office on 1 February 2006. This was duly popped in 2007-08, and he had to tackle the consequences: the worst US recession since the 1930s. Now Janet Yellen, who formally takes office this Saturday, has to cope with the consequences of her predecessor’s efforts to tackle the recession: the massive flood of cash that the Fed has pumped into the economy.

It is still pumping. The monthly purchases by the Fed of US Treasury securities are being tapered down and the widespread assumption is that they will end later this year. The issues then will be what to do with all the stuff on the Fed’s balance sheet and how quickly to increase interest rates. Since there is huge money at stake in correctly interpreting what the Fed might do, people have been dissecting Ms Yellen’s background, speeches and academic work to try to assess her likely moves. Is she a hawk or a dove?

That preoccupation is totally understandable, but I am not sure that it is really very helpful, for two reasons. First, the Fed has to operate within the real world, and that world is unpredictable. Second, what it has to do is unprecedented in peacetime, for the measures it has used have been emergency ones, used in the past only to finance wars. So what can we say?

There are two useful intellectual anchors to policy. The most commonly cited one is called the Taylor Rule. This was devised by the economist John Taylor at Stanford University, to give a guide for central banks as to the appropriate short-term interest rate. There are three variables: actual versus targeted inflation rates; how far economic activity is above or below full employment; and what level of short-term rates would be consistent with full employment. Anyway, apply this to the US now and plug in the Fed’s own forecasts and what do you get?

The answer, calculated by Capital Economics, is that the Fed should have started increasing rates a few months ago. Its main short-term rate should rise to 2.5 per cent by the end of this year, to 3.6 per cent by the end of next year, and to 4.5 per cent by the end of 2016. Clearly it is not planning to do that. So policy will be looser than this guideline would suggest.

What might the consequences of an overly loose monetary policy be? Now look at a second useful intellectual anchor, house prices. This is less widely accepted but, put crudely, it does for asset prices what the Taylor Rule does for inflation and economic activity. If house prices are a long way above their historic average that tells you that asset prices have probably been driven too high by a loose monetary policy. If they are below, it may be that monetary policy should be loosened.

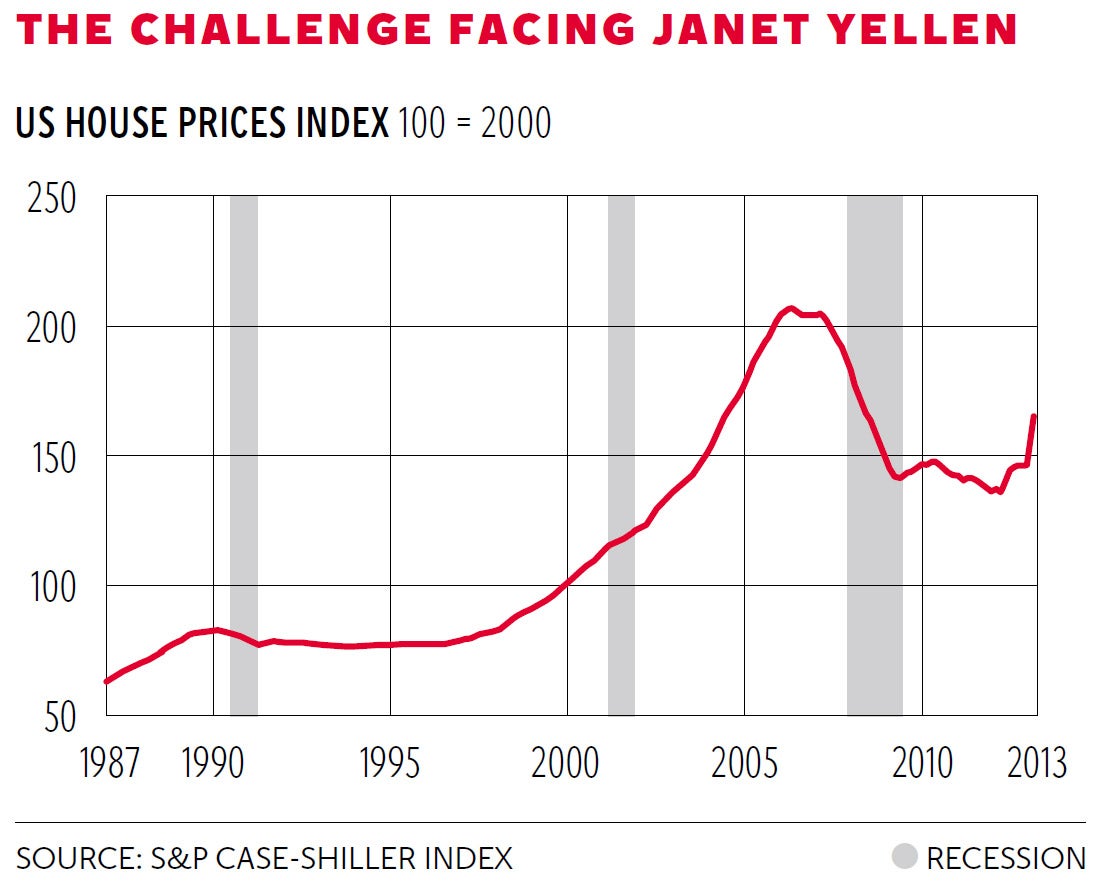

Have a look at the graph. It shows the Case-Shiller 30-city home price index, the most commonly cited measure of US house prices. If anything they were underpriced in the 1990s. They then shot up through to 2007-08 to a level that we now know (and should jolly well have known at the time) was an unsustainable bubble. That was the legacy of Alan Greenspan. This is now recognised as a catastrophe and for some of us the Fed has escaped with far too little damage to its reputation. (The same point applies to the Bank of England, whose Monetary Policy Committee focused on current inflation and ignored what was happening to asset inflation.)

So what are house prices saying? The common sense conclusion is that while US house prices have come back to more reasonable levels, they are still quite a bit above their long-term sustainable level. Actually I would modify that a little to say that an overshoot of 30 per cent, maybe a bit more, over the 2000 level is acceptable. The economy has grown, the population has grown, and there is some evidence that the long-term trend of real US house prices is creeping up.

The worry is what has happened in the past year. Prices are up around 8 per cent, the little kick up that you can see on the right-hand side of the graph. Hardly anyone thinks that the job of the Fed is to manage house prices but given its failures in the past, it cannot safely ignore them.

So there is a signal that policy should be tightened more quickly than the Fed seems likely to do from both the Taylor Rule and from the Case-Shiller index. That is the position Ms Yellen faces.

Central banking is as much an art as a science. You need discretion as much as science. Intuitively the Fed should move slowly and cautiously at this stage of the cycle but the more slowly it tightens policy, the less scope it will have to boost demand when the next downturn comes. A central bank can and should flood the markets with liquidity in a crisis; but it has to mop up that liquidity as things come back to normal or its credibility is shot when the next crisis comes along.

There is a parallel here with fiscal policy. You want to use the good years to build up a surplus that you can use in the bad years. Germany has done that; the US (and UK) have a long way to go.

So the challenge facing Janet Yellen is how quickly to nudge Fed policy back to normal – nudge because she is primus inter pares on the Fed board. One of the achievements of her predecessor was to end the dominance of the position of chair that had been built up under Mr Greenspan. So the thing we have to watch for is whether she nudges a little faster than the markets expect, or a little slower. In the short term slower seems better; in the longer term it is probably safer to get on with it.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies