Hamish McRae: Bernanke sprang a bonds surprise but it may be for the best in the end

Ecnomic View: Understandably there has been criticism of the timing and phraseology of the Bernanke speech

It may not yet be a great party but the booze supply is about to be cut back. William McChesney Martin, chairman of the US Federal Reserve Board from 1951 to 1970, said: "I'm the fellow who takes away the punchbowl just when the party is getting good."

The current holder of the post, Ben Bernanke, warned last week that the Fed would start to taper down its monthly purchases of treasury bonds, a remark that certainly put a damper on the markets.

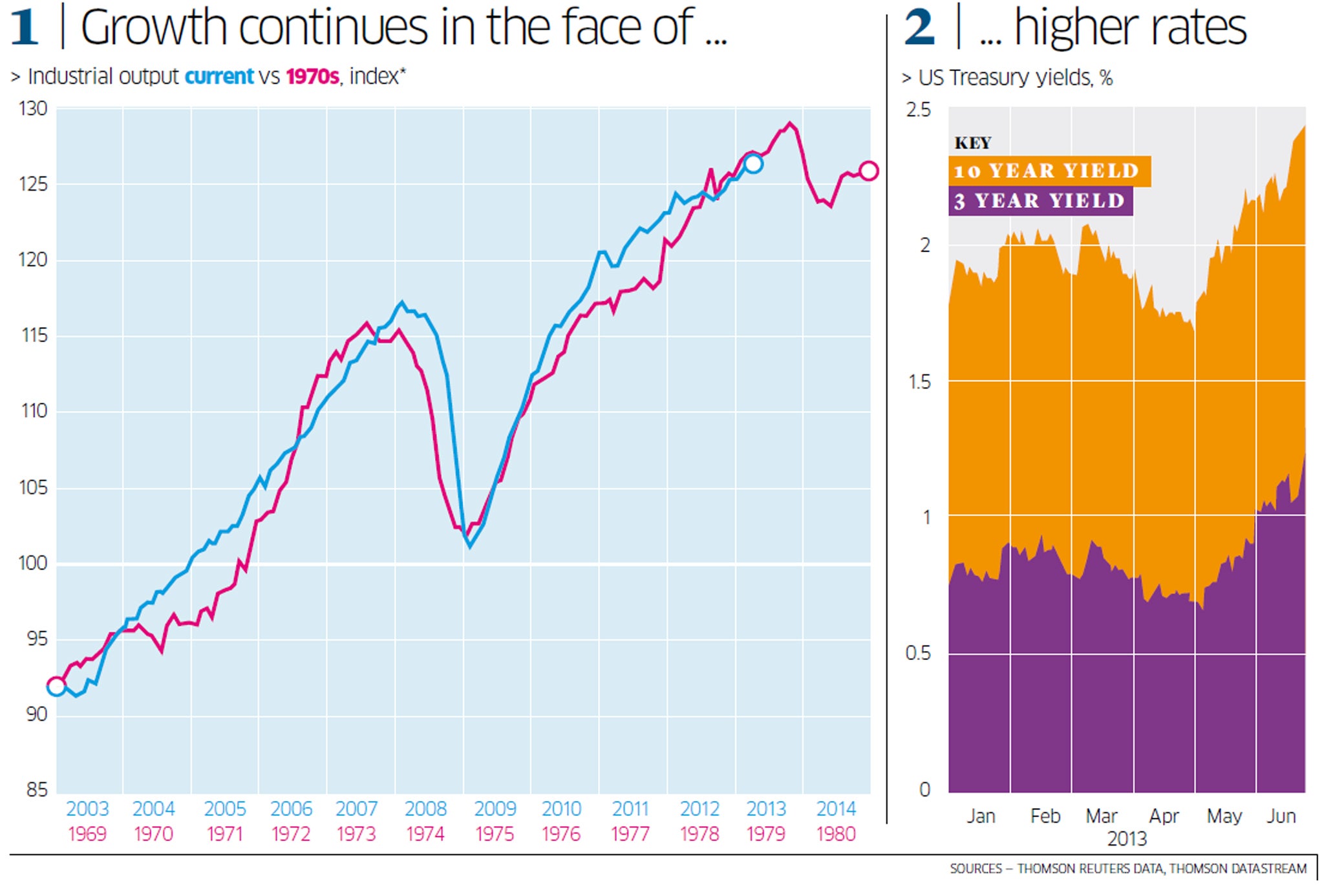

The fall in share prices took most of the attention but the drop in bond prices – or to put it the other way round, the rise in long-term interest rates – will have more economic significance. After all, notwithstanding its sudden slide, the Dow Jones index was on Friday still up 14 per cent on the year. US ten-year bond yields, however, were just under 2.5 per cent, against 1.9 per cent a month earlier.

So Mr Bernanke did, with a few words, what his European counterpart Mario Draghi had done a year earlier – except in reverse. The head of the Fed, by suggesting that it would start tapering off quantitative easing towards the end of this year and end it around the middle of next, pushed up sharply the cost at which the US government could borrow. Mr Draghi, the head of the European Central Bank, by saying that the ECB would do "whatever it takes" to save the euro, pulled down sharply the cost at which European countries could borrow.

In central banking, words matter a lot, and understandably there has been some criticism of the timing and phraseology of the Bernanke speech. But everyone knew that at some stage the Fed would have to end QE.

On a long view, it is probably better to get some dates into the market, rather than have any sudden surprises. You surprise the markets when you are trying to push rates down, as Mr Draghi did, not when you want to nudge them up.

But the Bernanke statement was to some extent a surprise. You can see the way in which the US bond markets moved in the right-hand graph. Yields were rising anyway but there was a sudden upward spike last week. Even if you know something has to happen sooner or later, it comes as a bit of shock to have to confront the fact that things may start in less than six months' time.

Actually, I think his remarks will come to be seen as rather wise. The party, as far as the US is concerned, is indeed picking up a bit.

The housing market, where the whole catastrophe began, is not back to reasonable valuations. If you relate house prices to incomes, homes are relatively affordable compared with the averages over the past 30 years. In most major cities, they are actually a little below their "normal" levels. Unemployment is still high but on present trends, it should be down around the Fed's target level of 6.5 per cent by the end of next year.

There is the separate question of why should structural unemployment be so high, in the US or indeed here, but you cannot tackle structural problems with monetary policy.

Further, if you think of the Fed as the dominant world central bank, which it really is, then the world economic party is indeed going well.

The left-hand graph, put together by Simon Ward at Henderson, shows industrial production in this cycle compared with that of the 1970s cycle, but with a twist.

The twist is that in the 1970s, what mattered was industrial production in the G7, the largest advanced economies, the red line. Nowadays to get a proper global picture, you have to include the main emerging economies, and these have accordingly been added in, the blue line.

Anyone looking at that graph might feel twitch of unease. If this expansion were to follow that of the 1970s, there might only be a couple of years left. If that were to prove right, not only will it have been a pretty third-rate party; it will be coming to a premature end. Simon Ward feels that next year may start to see difficulties.

Well, that may turn out to be the case, but my feeling is this is too gloomy an interpretation, for several reasons. One is that this looks at industrial production, which is a much smaller proportion of the output in the G7 than it was in the 1970s. Another is that there is more spare capacity in the world economy.

But the difference that matters most is that the world is not now facing the inflationary catastrophe it had to confront then. The rise in interest rates will be much more benign.

Indeed it will be more than benign; it will be a relief. By long-term standards, a yield of 2.5 per cent on US treasuries is still low – the equivalent yield on gilts is even lower at 2.4 per cent. I think the dip in yields last summer, which briefly saw both US and UK ten-year yields below 1.5 per cent, will be seen as a mad aberration. So what we are seeing is a return to normality, just one that is happening rather faster than the markets expected.

In any case, ultra-low interest rates have started to have adverse consequences. People and companies, faced with near-zero short-term rates, have started to take their money out of banks and put them into short-term securities. That may be fine for issuers of such securities; it is not so good if you are a customer wanting to borrow from a bank. Longer-term investors, hunting for a decent return on their money, have been pushed to take on more risky investments. And asset prices have been rising – the start of the next bubble, perhaps.

So anyone fretting about the winding down of this party should remember that no party goes on forever – and we are in the mess we are because the last one was allowed to go on too long.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies