Hamish McRae: Markets keep on climbing but there's still reason to be cautious about recovery

Economic View: Confidence is an odd thing. Share prices are as much a measure of confidence as a driver of it

It is a slightly artificial cal-culation because it is affected by the timing of month ends, but the fact remains that the UK equity market has now risen for 11 months on the trot, and is (on the FTse 100 index) some 16 per cent up on a year ago. On the law of averages, you would soon expect a monthly fall, and not just because of the "sell in May and go away" adage.

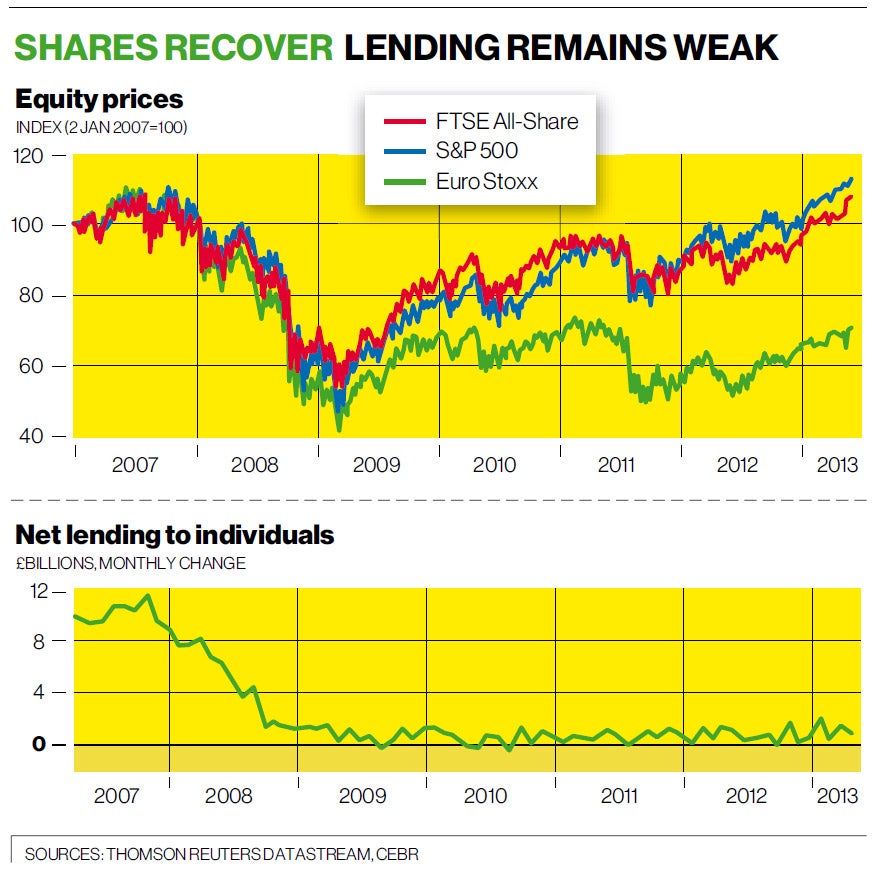

The recovery in process still leaves UK shares only around their previous peak of January 2008, although US shares have done slightly better (see graph). They may, however, have recovered enough to be starting to feed through into final demand, but not necessarily in the way the textbooks might suggest.

Take the big banking issue of the week, the move of Lloyds back into decent profit and the stories that the Government hopes to be able to sell part of its stake back to the public in this financial year. The Lloyds share price, at around 55p, is still some way off the 61p at which the Government bought in, and if you allow for the cost of funding the stake, the taxpayer needs a price of more than 70p to be square.

So we are not there yet. But Lloyd's shares have more doubled in price over the past 11 months, with the effect that a share sale is now no longer in the realms of wild fancy. Of course, the Government could always sell at a loss, but in practical politics that is pretty unattractive. Getting out without the taxpayer losing any money seems both a reasonable and attainable objective.

Once Lloyds is back fully in the private sector, this will be seen as a tipping point and the bank will find it has access to other sources of capital. Or put it this way, prospective investors will regard Lloyds as a "normal" investment rather than one dominated by the political risks associated with the huge government stake and, if it can make a good pitch, will respond sympathetically.

Royal Bank of Scotland's position is more difficult. Sir Mervyn King recently argued that there was a case for splitting it up into a good bank and a bad one. The argument in favour of that is that the bank has recovered more slowly than everyone expected, and you could say that the present model has not worked.

The argument against is that if the split were the right policy, the time to have done it was five years ago and not now when quite a lot of progress has been made in undoing the mistakes of the past. Whatever the merits of the case, it is certainly a bit odd to have the Governor of the Bank of England undermining the country's biggest lender to businesses – I could not imagine Eddie George or indeed any other previous governor saying anything like that.

We will get RBS results tomorrow, but whatever it reports, no one expects the bank will yet be in any shape where its shares might be sold off. It is partly a matter of price, for at 305p, they are still way off the price the Government paid, which works out at a little over 500p.

It is also scale, for the stake is more than 80 per cent, whereas at Lloyds it is just over 40 per cent. But these things take time, and one of the features of financial markets is that once it is perceived that a turning point has happened, they flip round fast. My guess is that the first modest tranche of RBS shares will be sold on in the life of this Parliament.

Meanwhile, the banks are very constrained in their lending, as the second graph shows. That is lending to individuals, which is actually slightly better than lending to businesses, but it is an extraordinary transition from feast to famine. Notwithstanding the Funding for Lending Scheme, which has now been running for six months, there is really very little sign of any uptrend.

The stock market recovery has not as yet had any impact on the supply of loans. But then you would not expect it to because the mechanism is through bank access to capital, and that access is shut for Lloyds and RBS, which on my quick tally account for half of all lending to UK small and medium-sized businesses. The FLS is a device to work around that particular blockage.

But if you look at demand side for loans, I think we may start to see a wealth effect developing. There is very little evidence yet, but for large companies the fact that markets are open means they can rely less on bank finance – the old point that banks will only lend to companies when they don't need to borrow.

For smaller firms, which obviously don't have access to equity markets, the mechanism will be different. For very small ones, the fact that owners' other assets have increased in value will give some comfort but I suspect that any wealth effect will probably work more through the property market than through share prices. Common sense says that if would-be borrowers' assets go up in value, they will be more prepared to borrow as well as more able to do so, but in the absence of evidence it is hard to show that this is the case.

Confidence is an odd thing. Share prices are as much a measure of confidence as a driver of it and in any case the present strength may be largely a response to the mass of liquidity swishing round the world rather than a true measure of confidence. So you have to be cautious in interpreting the recovery. It may be that companies as well as individuals have been so battered by the loss of wealth associated with the recession that they will be unduly cautious for a decade or more.

So let's wait for some further evidence that the rebound in equities is solid. But it would be odd if higher share prices do not result in some increase in demand, even if it is hard to trace the links whereby this happens.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies