Hamish McRae: My money's on the markets' optimism

Economic View

Should you listen to the economists or to the markets? It is a hot question because the two are heading in different directions: economists are going down – or at least suggesting that economic prospects are going down – while the markets are on the up.

This contrast is particularly evident in the UK (see below) but it is really a global phenomenon – which makes it much more interesting. If the economists are right, the world is in for a mid-cycle slowdown with quite serious consequences. If the markets are right, the return to health after the catastrophe of 2008/9 is assured. So who is right, or, at least, less wrong?

Start with the economists' case. Not all are gloomy, of course, for this is a fraternity not noted for its unanimity about anything. But the mainstream view was summed up last week in International Monetary Fund forecasts, which trimmed growth predictions for this year. The US is now expected to grow at 2 per cent, the UK by 1 per cent and the eurozone to shrink by 0.2 per cent. It is true the profile of growth is shaded upwards towards the end of the year, as the fund expects a better second half than first, but this is not very promising stuff. It is certainly not the "jam today" mood of the markets. You might say it is at best thinly-spread jam the day after tomorrow.

The markets? Well, is does depend on which one you take, but the S&P 500 (a more broadly-based index than the Dow Jones) has just had its longest winning streak for eight years and is closing in on previous peaks of 2000 and 2007. It is not past them yet and you might say the date of those two earlier peaks should sound an alarm – just ahead of recessions.

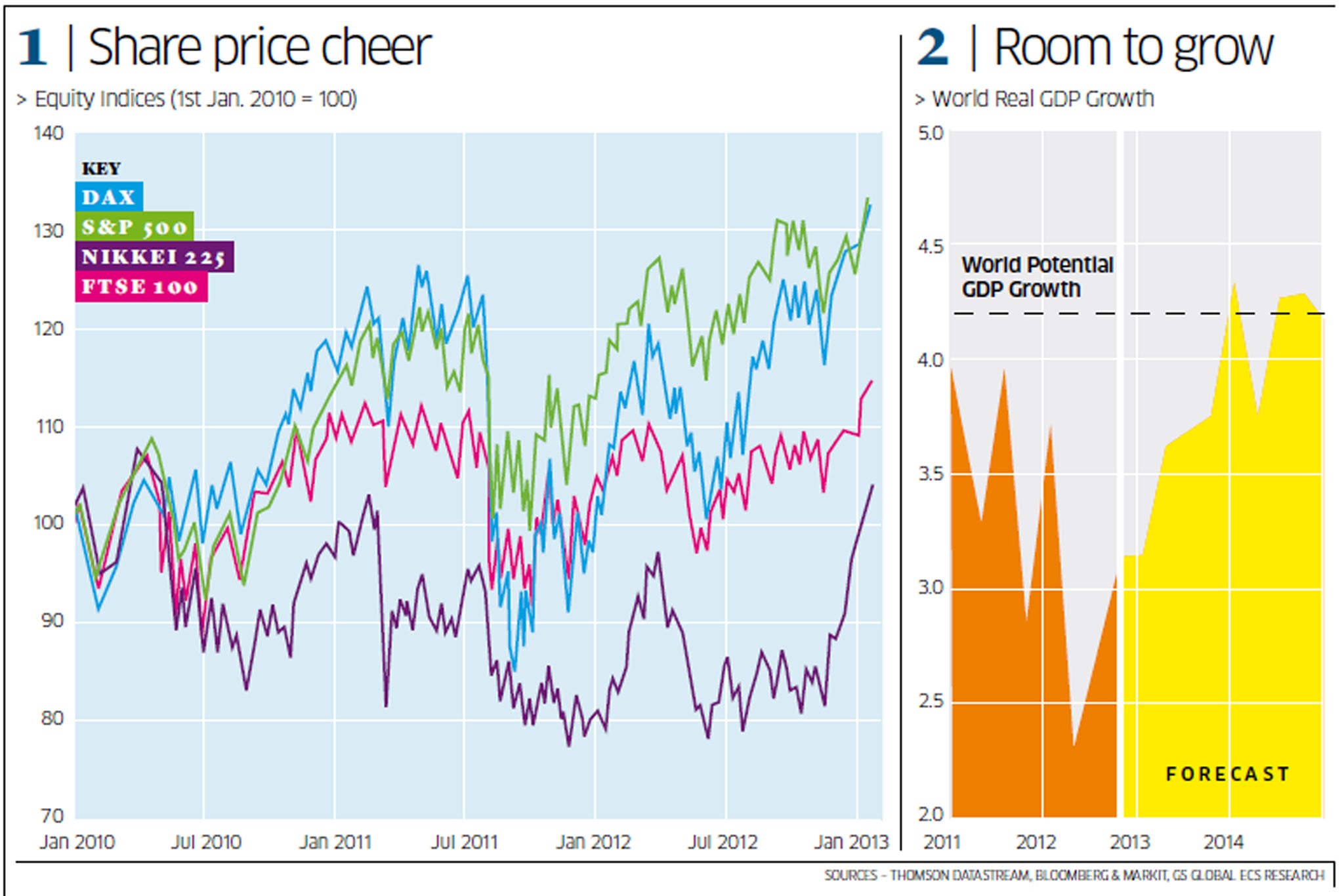

But the fact remains: US investors are becoming ever more cheerful about equities. So, too, are investors elsewhere. You can see the long-term perspective in the main graph. The US has run ahead but even the laggards are heading up. Indeed, if you timed it right, some of last year's best investments were in distressed countries' markets. Of the major equity markets, the best buy in the past three months has been Japan.

As argued in earlier pieces here, there are two broad drivers of this surge. One is the expectation that bond yields will rise, encouraging a switch from bonds to equities, the so-called "great rotation". The other is that profitability of the big companies represented in these indices has been generally good. This year, US companies are beating broker estimates by about two-to-one: double as many companies are coming in higher than forecast as are coming in lower.

You could characterise this as a negative reason for buying shares (at least they offer better value than bonds) and a positive one (companies are doing well). It is quite impossible to know which of these two forces is the stronger driver, but I have been struck by some longer-term estimates for global growth from Goldman Sachs. These are shown in simplified form in the right-hand graph.

Goldman estimates the world has the capacity to grow at around 4.2 per cent a year. Last year growth was woefully short of that, dipping below 2.5 per cent in the summer. Now it is picking up and, if these estimates are right, should be running at its long-term potential rate next year.

Goldman sets out five questions for the world economy this year and its answers would be consistent with the bullish mood of equity markets.

The first is about growth: its response as you can see from the graph is that growth will be below trend this year but with a better outlook for next. The second is whether monetary policy will be more of the same. The answer is no, as there will be innovations in central banking to buttress growth. The third concerns the eurozone, where it expects another year of "muddling through". Fourth, it expects faster growth in emerging markets. And finally, it expects inflation to remain well-behaved.

If this line of argument proves right, the recent recovery in share prices will be more soundly based than at either of the two previous peaks. It is backed by the prospect of decent world growth rather than the dot-com mania or the artificial stimulus associated with the banking boom. But there are concerns.

Take three, all implicit in those points above. One is that rethinking monetary policy conduct could make things worse, not better. The past 30 years, with increasingly independent central banks using money supply and then inflation targets to restore discipline, were a considerable success. Or at least they were until success against inflation lulled them, and politicians, into ignoring the build-up in the supply of credit and the resulting fragility of the banking system.

Now we have more active policies by the Bank of Japan, a US unemployment target, almost an implicit guarantee on eurozone sovereign debt by the European Central Bank, and who knows what changes here, when the Bank of England's new governor takes office. You can understand the policy-makers' frustration. They pull the levers and nothing happens. But past experience tells us that all financial innovation is to be treated with caution, perhaps especially when it comes from central banks.

That leads to a second concern. Will inflation remain benign? Current inflation may well do so, but asset inflation? We are already seeing pockets of asset inflation – you could say share markets show of bit of that – and people are starting to talk of the next "bubble" in some classes of assets.

The third concern is the familiar one of Europe. It may well be that another round of high-class muddling will be good enough. But the social and human costs being imposed on much of southern Europe are devastating and we cannot assume citizens will continue to accept them.

So the economists or the markets? I side with the markets because I do think the medium-term outlook for the world economy is quite positive. But expect big bumps as we move through 2013.

Pressure grows on Osborne to revise policy

The detail of the GDP figures does not explain the astounding divergence between the published stats showing a final quarter decline of 0.3 per cent, and the workforce numbers for the three months to end-November, showing unemployment falling to 7.7 per cent and a rise in 97,000 full time jobs. If you are one of those 97,000 your reaction might well be that if this is recession, let's have more of it.

But I think we can see bits of the explanation. You have to adjust that minus 0.3 per cent number for several factors. One was the unwinding of the boost to the previous quarter from Olympic ticket sales, all of which were counted on the day they were used. Another was a fall in North Sea output. Simon Ward at the fund managers Henderson calculates that these each accounted for 0.2 per cent of the shortfall, suggesting that without them growth would have been plus 0.1 per cent. He also suggests that construction output may well be revised upwards, given a slightly better positive figure.

But this is not great. There will, inevitably and rightly, be pressure on the Chancellor to revise policy in the Budget, now less than two months away.

Leaving aside political point-scoring on either side, the issue will be whether there are practical things, within the broad envelope of the deficit-cutting programme, that he can do to boost growth.

Here I expect a string of detailed measures, mostly of a road-block removal nature, that he will do. The good news is that they will probably be worth doing; the bad is that the lags before policy changes affect the real economy are very long.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies