Hamish McRae: Now that the economy is moving decently, it is important policymakers do not muck things up

Economic View: Better for the Bank to make an early start on the path to normality than move too late

It is, as far as the British economy is concerned, a time to take stock. There were two reports yesterday, both sensible and measured, which carry the same broad message. It is that we are on the move, but there is a long way to go.

The so-called Green Budget of the Institute for Fiscal Studies (IFS) gives the independent perspective on the economy and on the fiscal choices facing the Government in the Budget next month. The economic background, prepared jointly with Oxford Economics, confirms the stronger growth outlook and takes the view, which intuitively feels right, that the recovery is becoming better balanced.

It also knocks on the head the notion that we have inflated another housing bubble. Again, that seems sensible, at least for the time being. For all the concern about house prices, the fact remains that people have been net payers back of mortgage debt, the reverse of the situation between 1998 and 2007 when equity take-out was the prevailing pattern.

The fiscal picture, however, still looks most daunting. Most of the cuts in public spending still have to come through, and the IFS makes the correct point that cutting becomes progressively harder the further you go. We are still not halfway through this one.

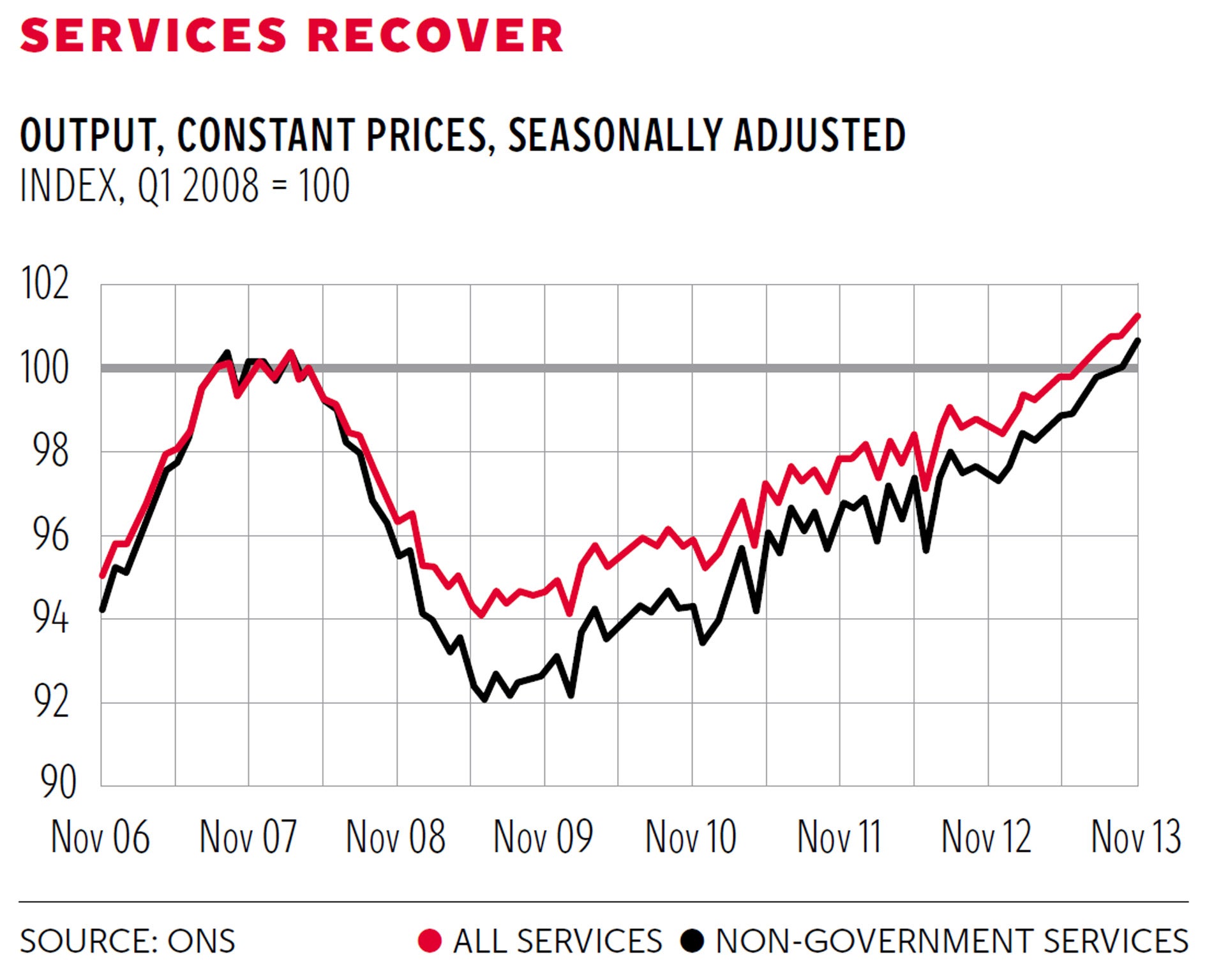

The other paper comes from the Office for National Statistics in their Quarterly Economic Review. This pulls together the work of the ONS into a coherent picture. The broad message is that growth has indeed been restored, and that the largest single section of the economy, services, is now past its previous peak. What most people do not appreciate amid all the stuff about the "cuts" is that the services sector has been supported strongly by growth in public-sector services, as you can see in the graph. During the downturn and in the early part of the recovery they were the main force supplying additional demand. The fall in private-sector services was much larger than the overall fall. Since then growth in the public sector has gradually been shaded back, so that the gap between the two lines on the graph – private and total – has progressively narrowed. However, even without the public sector, services have passed their previous peak.

That growth will continue. There was a slight shading down yesterday of the Purchasing Managers' Index for services, but this is still very positive, pointing to sustained growth this year. Thus RBC Capital Markets calculates that on this data the economy is running up 1 per cent quarter on quarter, equivalent, of course, to 4 per cent annual growth. If that turned out to be the case it would be way above its long-term trend and the next rise in interest rates would loom closer indeed.

We may catch some sort of feeling for what on earth the Bank of England proposes to do about its "forward guidance" today. It is the monthly meeting of the Monetary Policy Committee, and while I can find no one who thinks there will be any change in policy, that magic 7 per cent level for unemployment will be reached soon. The Bank has to say something when that happens, though probably the less it says the better.

My own view is that now that the economy is moving decently, the important thing for policymakers is not to muck things up. In an ideal world we would have a government and an opposition that together looked beyond the next general election, giving some element of stability to fiscal policy for the next five years. We don't have that. So the burden for holding economic policy steady through the election falls on monetary policy, and here there is a clear division of view as to the relative risks ahead.

The conventional view is that policy should stay very loose, and the task of the new Governor is to make a credible intellectual case for that. Forward guidance should therefore be reformulated to justify no increase in interest rates this year. He will be helped by the fact that current inflation is at last down to an acceptable level and that asset inflation in the form of the surge in house prices is, at least for the time being, acceptable.

The alternative view is that while there is no immediate need to do anything, it would be prudent for the Governor to signal that people should be prepared for a modest and gradual movement back to normal monetary conditions. We will get the Inflation Report from the Bank next week, and that would be the time to do so. The argument is that we all know rates are going to go up, and we all know that the last effort to persuade us that this would be far in the future has backfired. So we need to be told the truth. This is that the MPC will look at a range of indicators and make a rational judgement on what happens to these. They will include consumer inflation of course, for that remains their duty under statute. They will include unemployment of course, because that matters too. They will include what happens to sterling, because a rise of the pound is a tightening of monetary policy. (There used to be a rule of thumb that a 4 per cent increase in the exchange rate was equivalent to a 1 per cent rise in interest rates.)

The point here is that we – as individuals with mortgages, as people running companies, as investors and so on – should be treated as adults. Then we can make our plans. One thing is sure: if growth continues to run at 4 per cent the Bank will have to increase rates sooner rather than later. There is a real danger that it will lag behind the market, as it did during the boom years, and indeed when we hit the slump. It both increased rates too slowly, and then cut them later than it should. Much better to make an early start on the path back to normality than move too late, and then have to tighten more sharply further down the line.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies