Hamish McRae: The costs of the Bank of England's ultra-loose monetary policy have come to outweigh the benefits

Economic View: We all know rates have to go up. The issue is if it would be better to make an early start

The data at last is catching up with reality. That reality is that there has been solid growth in the UK economy for about a year, with the most significant indicator of that being growth in employment. The new labour market figures confirmed that yesterday, with 177,000 people getting jobs in the last quarter, and a fall in unemployment to 7.6 per cent. We also have the Bank of England's new Inflation Report, which is forecasting growth of between 2 and 3 per cent through to 2016 – and 2.8 per cent for next year. Third, we have had better than expected inflation figures, bringing the moment when pay starts to run ahead of inflation a little closer.

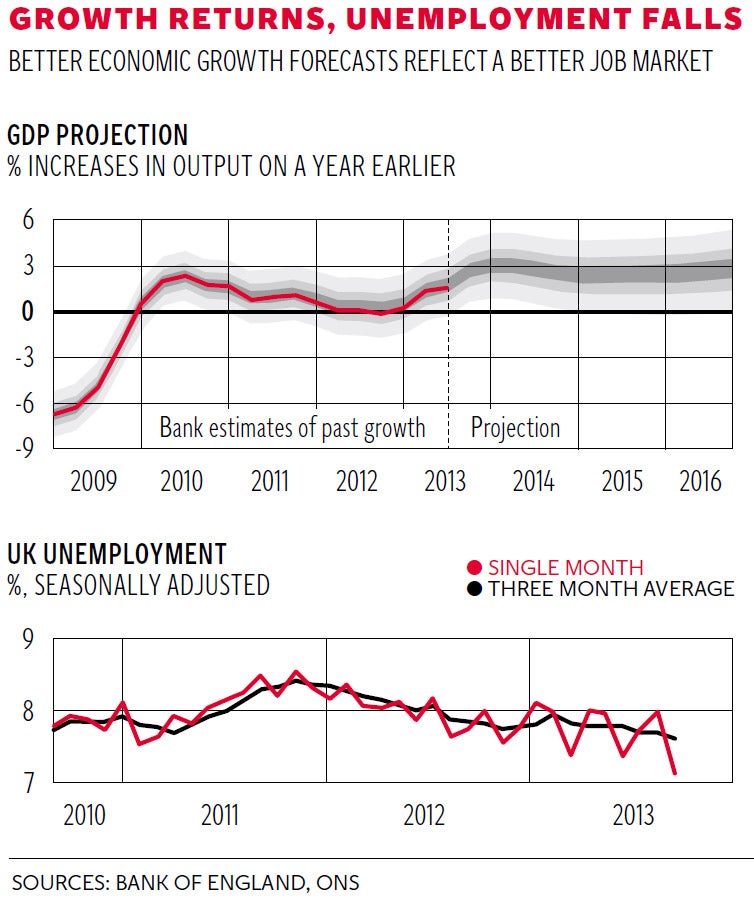

You can catch a feeling for all this in the two graphs. The first shows the Bank's growth forecasts, drawn up on the basis of market expectations for interest rates. It uses the familiar probability bands, and I don't think there is a lot of point in fussing about the last decimal point. But notwithstanding the uncertainties endemic in all economic forecasting, the idea of a 2-3 per cent band seems a pretty sensible one, for it would be the sort of long-term performance you would expect from the British economy, maybe a bit above it.

The second graph shows the unemployment rate, which is calculated as a three-month average, together with the monthly outcome. As you can see the very latest data, for October, has unemployment down to 7.1 per cent. The monthly numbers jump about a lot and again I don't think it is sensible to fret about the detail. But it is at least plausible that we could be down to 7 per cent unemployment by the middle of next year, the level at which we have been told that the Bank would start thinking about an increase in interest rates. (The Bank's own projection for unemployment reaching this level has come forward a year, to early 2015.) It was that prospect of an earlier-than-expected tightening of monetary policy that knocked share prices, which leads into what is going to be a really interesting debate in the months ahead. How do we get monetary policy back to normal, now that growth is back to normal?

The new Governor, Mark Carney, seeks to boost confidence by saying that the Bank is not even thinking of a rise in rates. There are two problems with that. One is the markets don't believe this, or rather they believe the Bank will have to increase rates long before its present "forward guidance" would have us think. The second is that delaying the inevitable increase too long might actually damage confidence. In other words, what he is saying may have exactly the opposite effect than the one he intends.

We all know rates have to go up sometime. The issue is whether it would be better to make an early start, say next summer, moving rates up by a token quarter point, rather than risk having to take much sharper and potentially more damaging action at a later date. There is a further wrinkle on this: maybe if the Bank is seen to be inappropriately delaying an increase in short-term rates, the markets will take it into their own hands by pushing up long-term interest rates. That would tend to push up sterling, another way of tightening monetary conditions, for there used to be a rule of thumb that a quarter of a percentage point rise in interest rates was equivalent to a 1 percentage point rise in the exchange rate, and vice versa.

The basic point here is that if the Bank is perceived as failing to tighten monetary policy when it ought to do so, the markets will take on the job instead. The thing to remember is that central banks can only control very short-term interest rates. They can influence longer-term rates, and other policies, such as prudential regulation, can also affect long-term rates. (It is supposedly "prudential" to make financial institutions hold government stock, notwithstanding the fact that government stock may objectively be a lousy investment.)

My instinct is that things may move very fast next year. That will partly be because unemployment will come down quite swiftly, but more because it will become clear that the costs of an ultra-loose monetary policy have come to outweigh the benefits. This is a British issue but it is even more a global one. Global inflation looks like being 2.8 per cent this year, according to JPMorgan Chase, the second lowest since the Second World War. Yet central banks around the world have created a wall of money that is now desperately seeking a home. The rise in US house prices in the past year (up 13 per cent) and in prime property just about everywhere in the world, are examples of how this money has to go somewhere. The S&P500 is up 31 per cent over the past year; the FTSE 100 up nearly 20 per cent, notwithstanding that slither yesterday.

So we have a combination of low current inflation but high asset inflation. The social consequences of that have been to increase divisions in society by boosting the assets of the rich and sophisticated at the expense of the middle class and the less sophisticated. The rich have got richer but wages have stagnated. An emergency policy designed to pull the developed world economy out of recession was totally justified in that emergency. But though the emergency is now past, the political pressure to keep growth moving has prevented any major central bank in the developed world from shifting to a less expansive mode.

All this will change. But for our central bank not to be thinking about how to tighten policy in the most effective and least damaging way is absurd.

There will obviously be two strands to getting back to normal: increasing interest rates to normal levels and selling the Bank's stock of the national debt to secure and willing investors. For precedents you have to go back to the period after the Second World War, when active monetary policy was gradually introduced during the 1950s. To say that might seem alarming but actually it should be comforting, for the scale of the adjustment is much smaller and overall wealth levels very much higher. It has been done before – and the guidance the markets need from the Bank is how it proposes to do it.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies