If a long period of growth underpins equities, does it automatically follow that bonds will be undermined?

Economic View: Governments need a long period of very low rates to correct the still-overstretched balance sheets

So what else do you do with your savings? It is the tough question facing every fund manager whenever a long bull market in equities seems to be maturing, but it is one that is given particular legs by the unattractiveness of other asset classes, particularly bonds. Right now it is the question that anyone talking with money managers will hear again and again. The strength of developed market shares has surprised even the natural enthusiasts for equities, but the recent slight shading back (and the recovery in distressed European sovereign debt) has spurred some managers to ponder whether this is the time to hedge their bets.

Against this background it is intriguing that Goldman Sachs, at least, is reasserting its overweight equities position. It is a line that has proved very right over the past year, but the air is rarer now as prices have climbed. Its global asset allocation update makes the following calls for 12 months out: global equities will return 9.4 per cent; cash 0.5 per cent; five-year corporate bonds minus 1.7 per cent; commodities minus 5.5 per cent; and 10-year government bonds minus 7.6 per cent.

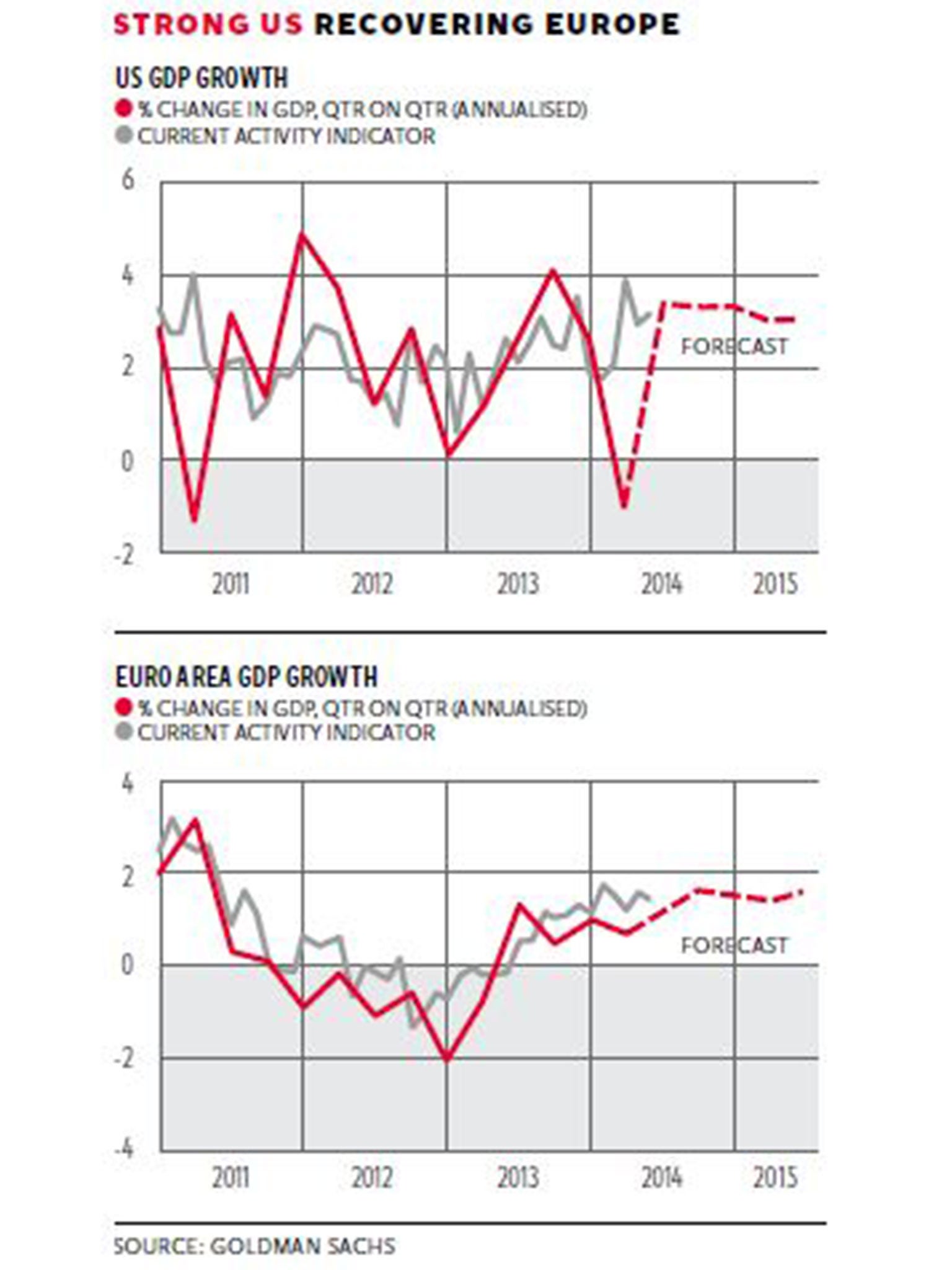

That is a pretty strong call, as strong on the negatives as on the positives, so what is the argument behind it? In a nutshell, it is that US and European growth will gradually strengthen through the year and that will drive higher corporate earnings, which will in turn underpin the higher share prices. You can see the growth projections in the two graphs, with much higher growth in the US as you would expect, but Europe escaping the renewed stagnation that some currently fear. The graph also shows Goldman's calculation of a current activity indicator, which gives a smoother and, in my view, more credible path for economic activity than the official GDP statistics. However, despite the higher expectations for US growth, Goldman is less positive about US equities than about European, largely because US valuations are already more demanding.

The negative view on bonds suggests that the US yields on 10-year Treasuries will rise from their present 2.6 per cent to 3.5 per cent, while in the UK gilts will go from 2.7 per cent to 3.4 per cent, and German Bunds from a bit above 1.3 per cent to 2.6 per cent.

Energy and commodities? Here the view is that a year from now Brent oil will come back to $100 a barrel, while West Texas Intermediate will be $90 a barrel. Most commodities will be off around 10 per cent, with a couple of notable exceptions: soya beans will be down particularly sharply and gold will be down to $1,050 an ounce – at the moment it is above $1,300.

Lastly, a word on currencies: here the view is that the euro will strengthen against the dollar, and the pound to stay roughly steady with the euro, maybe rise a bit – but no real fireworks on the exchanges.

Well, that is the view. What should the rest of us think about this? For a start, we should take the big economic call, that the developed world's recovery will broaden and strengthen for some time yet. Standing back from our own worries about an unbalanced recovery and all that, I think the general view stands. Common sense says that if you have a particularly deep downswing in the economic cycle and then a particularly weak recovery, you jolly well ought to get a long period of expansion. We have had six years of expansion already but it would be reasonable to expect, say, 10? There are quite understandable concerns about some asset prices, particularly property, but it is hard to see any real evidence of a lack of general capacity in labour markets or anywhere else. So the circumstances that bring an expansion to an end are not really evident yet.

If the idea that the long growth period will continue underpins equities, will that same idea undermine bonds, or at least undermine them to the extent that Goldman expects?

Here the question is really: what is normal? For US and UK government yields to be 3.5 per cent would, in any other period, seem pretty normal, arguably quite low. This only seems high when set against the backdrop of the past six years. The argument against this is that governments need a long period of very low rates to correct the still-overstretched balance sheets of individuals, and indeed themselves. But the argument that rates have to stay low because neither voters nor governments can afford to pay a reasonable return for the money they have borrowed is a dodgy one. Besides, the policy hasn't worked very well in Japan, has it?

Actually the argument is how quickly the world gets back to normal long-term interest rates: is it over the next year or will it be over the next several years? What is not really in dispute is that rates will eventually rise.

Against all this, how does the "buy equities, sell bonds" message stack up?

Well, it certainly fires a shot across the bows of British pension fund practice. Most occupational pension funds have followed the "safe" path of switching from equities to fixed interest, thereby missing out on one of the best equity rallies of all time. If the total return on gilts in the year ahead is anything like the minus 7.6 per cent expected for bonds as a whole, putting pensioners' money into this asset class, far from being safe, is profoundly dangerous. Yet the cover-your-tail incentives for pension fund trustees pushes them in this direction. Such is the way of the world, any rebalancing back to equities will come too late.

My own view, for what it is worth, is to be more confident of the negative story about bonds than the positive one about equities. We can be pretty sure bonds will be a bad buy; we can be only mildly confident equities will be a good one. But asset allocators have to allocate and the very long view, of course, favours equities.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies