Safety in numbers: time to spread the risk with some European equities

Economic View

Where is safety in a troubled world?

One of the effects, for British-based investors at least, of the rise of the FTSE 100 index past 7,000 has been to forward a question posed back in 2007: we are back to the previous peak, so ought we to be locking in our gains and de-risking our portfolios?

It is question that applies to all investors, not just UK ones. It is a question partly about economics: how long will the current growth phase last? And it is one partly about monetary policy: as interest rates go up, how might that affect different asset classes?

It seems to be one of those inexorable laws of economics that there is a business cycle and we can’t do much about it. Gordon Brown understood very well, arguing that governments should fund current spending with taxation over the business cycle, and only borrow for investment. Things did not turn out like that, for he broke his own golden rule. But the idea that there is an economic cycle and we cannot do much about it surely a valid one, and it applies to investment as well as government policy.

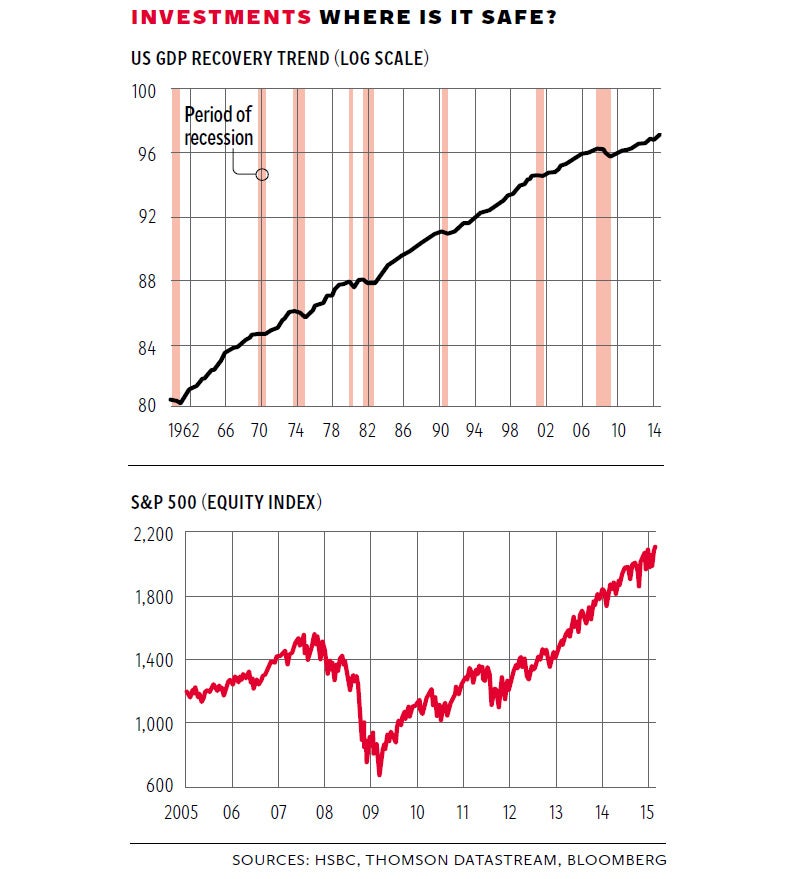

Have a look at the top graph. It comes from a study headed by Stephen King at HSBC on the world economic outlook and shows how US GDP has climbed solidly over the past half century, with periodic lapses into recession. If you look closely you can see how the most recent recession is rather more serious than the other ones, but also how in the late 1970s there was a long, flat period when not a lot happened.

Anyone interested in investment should focus on the US for two reasons. It is still the world’s largest economy and most valuable stock market; and it displays policy leadership, for policies developed in the US spread to the rest of the world. The dog wags the tail; the tail does not wag the dog.

As you can see from the bottom graph, the current upswing is reflected in US equities – a rise that in the past year has spread to European markets (notwithstanding Greece, around all-time highs) and in more muted way to the UK. But all our experience suggests caution. It has been a great run, so when do you take your money off the table? Some British equity holders decided yesterday was not a bad time to do so.

Perceptions of safety have been overwhelmed by what has been happening to the bond markets, which are behaving in a way they never have before. The yield on 10-year German Bunds yesterday was down to 0.23 per cent, while 10-year gilts were below 1.5 per cent. US 10-year Treasuries were 1.9 per cent. These yields only make sense if you feel that central banks will fail in their efforts to generate some modest inflation over the next few years. It is hard to see that failure happening, except in conditions of prolonged depression.

So you have conflicting signals from the equity and bond markets. Equity markets are saying that decent growth will continue for the foreseeable future, notwithstanding the past history of the business cycle. And bond markets are saying there is the prospect of prolonged depression. They cannot both be right.

To make this point might seem a bit banal. The inconsistency has certainly been widely noted, but to observe is not to explain. My own suggestion is that investors should think of what is happening in Europe as an aberration caused by the imposition of the common currency on very different economies. If there were no euro, the German mark would have been revalued and people would get return on their investments in the form of an exchange rate gain. Holders of bonds denominated in French francs and Italian lira would get a higher interest rate to compensate for exchange rate risk. Timing would be crucial: when to dart in and out of the different national markets. For the time being, however, ultra-low German yields have dragged all yields down, bar those of Greece, which the markets now give evens on leaving the currency union in the next couple of years.

So anyone interested in long-term value, or long-term safety, should look beyond Europe and in particular look to the US. Bond yields there are close to the bottom of their very long-term range, but not at it. They may not be a safe buy, because we know that US interest rates are heading up later this year, but they are not an absurdly risky one compared with their European equivalents. Anyone seeking to invest in Europe would be wiser to focus on equities rather than bonds.

The big point here, however, is that after several years of strong returns on most asset classes, history should prepare us for a year, maybe two, when asset prices fall. That is normality. So the answer to the question at the top – where is safety? – is that there is no such thing. Safety comes from spreading risk, not from trying to avoid it.

But how? I have been looking at a paper from Société Générale called “Reducing risk in an expensive world”, a title that catches the dilemma. It makes a number of market calls, including buying European equities, for German companies are doing particularly well, with domestic demand now coming in to support external demand. It also expects a lot of money to come out of European bonds, which has to go somewhere. In the US, share prices may be bumpy, once the Fed starts to tighten policy.

And here? We do have an election coming up with all the associated uncertainties. Large company shares will probably be all right because the FTSE 100 index is really a sterling bet on the world economy, but smaller British companies are more exposed. My own unscientific observation is that because people are worried about what might happen in the UK, investors can be a bit more relaxed. It is when people stop worrying, as they did in the boom years of 2006 and 2007, that it is time to head for the hills.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies