We should not be frightened of a return to volatility in the markets – provided it can be managed

Economic View: Good news comes in a gradual stream while bad news comes in chunks

It's quiet – too quiet. You know the classic movie scene where the hero observes how quiet things are just a moment before all hell breaks loose? It's a bit like that on the financial markets just now. Whether there is some shock about to hit us is anyone's guess, but the lack of volatility in the markets is quite remarkable. Shares in the developed world are pretty flat, currencies are pretty flat, bonds are pretty flat and most commodities are pretty flat too.

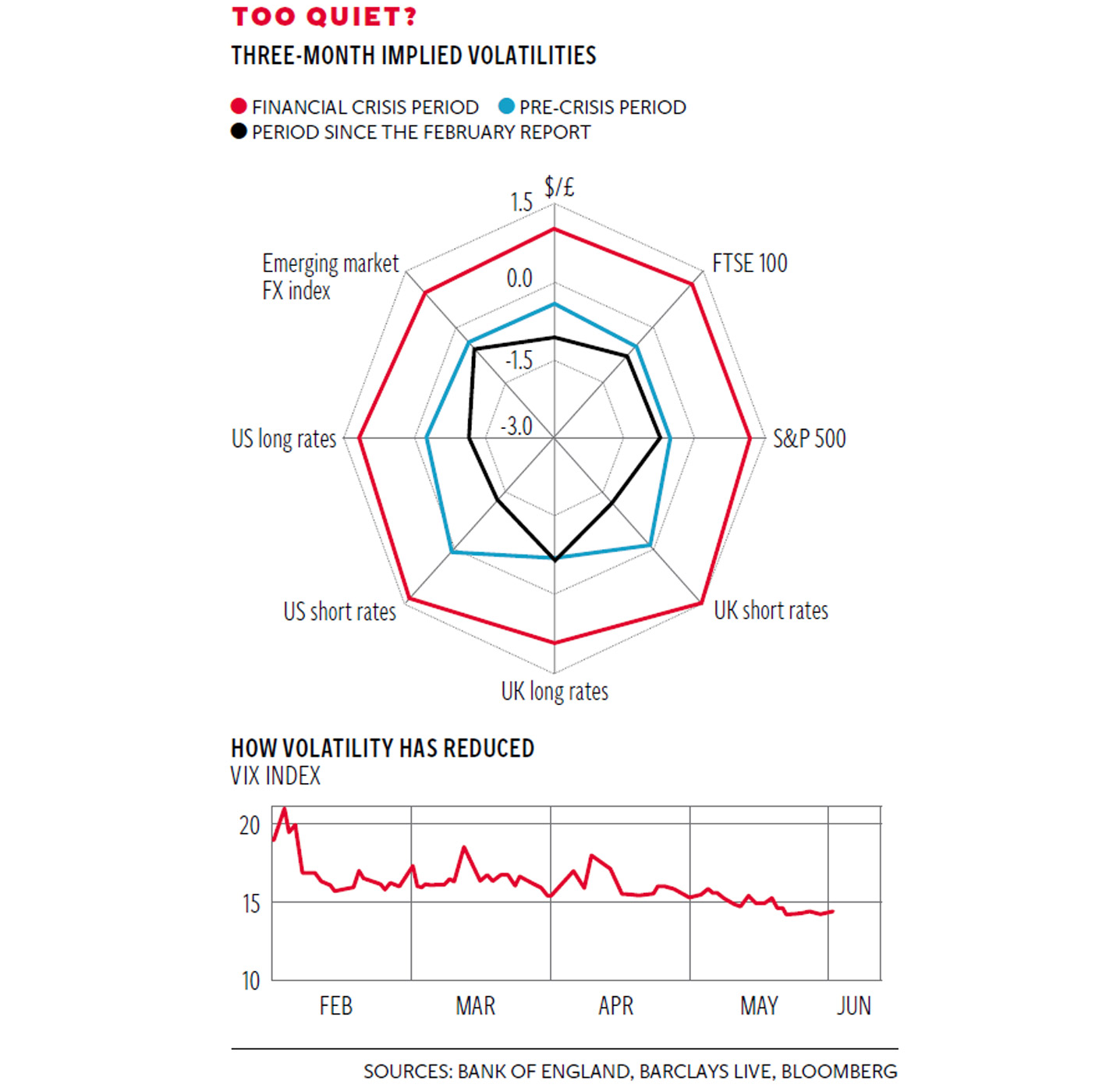

For anyone who makes money out of volatility, such as the shareholders of IG Index, the UK's largest spread-betting firm, this is already bad news. It noted a couple of weeks ago, when it produced its results, how subdued trading had been. It was also a key part of a recent speech at the LSE by Charlie Bean, a deputy governor of the Bank of England, on the future of monetary policy – how we get back to normal. He showed one of those spider's web graphs, reproduced here. This demonstrates that volatility in a number of different markets was much higher during the financial crisis (the red ring) than it was beforehand (the blue ring), as you would expect. But since the February Inflation Report it has been even lower than it was before the crisis (the black ring).

"Taken in isolation," he observed, "this is eerily reminiscent of what happened in the run-up to the crisis."

Another measure of volatility is the Vix, the so-called "fear gauge". This is the Chicago Board Options Exchange Volatility Index and it reflects a market estimate of future volatility based on the weighted average of the implied volatilities of a number of different markets. This is currently the lowest it has been for a year, and as you can see from the second graph, it has fallen further since February.

Why so quiet? There are two broad explanations and the answer will encompass some mix of them both.

One is investors can see that the world economy is in the early stages of a cyclical recovery. Although different countries are moving at different speeds – the UK, US and Germany well into it, France, Italy and Spain well behind – the recovery has a long way to run. Growth will enable countries/markets/companies to work through any difficulties they might face. This combination – an awareness that a lot needs to be fixed but also a confidence that it can be fixed – explains the calm in the markets. Both the good news and the bad are, so to speak, "in the market".

The other explanation, cited by Mr Bean in his speech, is that there is "a sense of complacency and an underestimation of market risk by investors". He continued: "It is inevitable that at some stage market perceptions of uncertainty will revert to more normal levels. That is likely to be associated with falls in risky asset prices and could be prompted by developments in Ukraine, the fault lines in the Chinese financial sector, monetary policy exit in the advanced economies, or something else. But it will surely come at some point."

It is implicit in that statement that the shock will be a negative one and given present level of asset prices this is probably right. Louise Cooper, the independent analyst, put out a post yesterday drawing attention to the way American investors were seeking protection against a fall in share prices: the ratio of "puts" relative to "calls" was at its highest level since 1955. Many more people were betting that the market would fall rather than rise.

That is certainly the balance of probability. But we should not exclude the possibility that the surprises will be positive ones: that the breakout will be on the upside, not the down. It is harder to make this case, largely because the world being what it is, good news comes in a gradual stream while bad news comes in chunks. It will be interesting to see today's statement by the European Central Bank, both for what it proposes and the market reaction to it. Expectations are very high and that itself must be a concern; but the ECB president, Mario Draghi, is not someone you want to bet against. If the negative surprises that might break this period of low volatility are the usual suspects noted by Mr Bean, the positive surprises must include better-than-expected performance from the eurozone.

For the US, the main positive surprise would be for employment to pick up. The rate of hiring has been unusually slow, given the OK economic performance. If that were to happen it would underpin rising consumption and spread the benefits of the recovery more widely.

And here in the UK? Well, all the data are very positive, particularly the prospects for employment growth (the CBI survey yesterday was strong) and the monetary indicators. Narrow money is pointing to good growth for the rest of this year. The question really is not about the economy, but about how much of the positive stuff is in the market already, and how seriously political risk is weighing on sentiment – political risk including the Scottish referendum as well as the general election next year.

One final thought. There is an implicit assumption that volatility in financial markets is bad and stability is good.

On the face of it that is true: you absolutely don't want the level of volatility associated with the financial crisis. But a return to more bumpy markets would create opportunities for companies as well as investors. We certainly should not be frightened of it, which is a good thing because that is what we shall surely get.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies