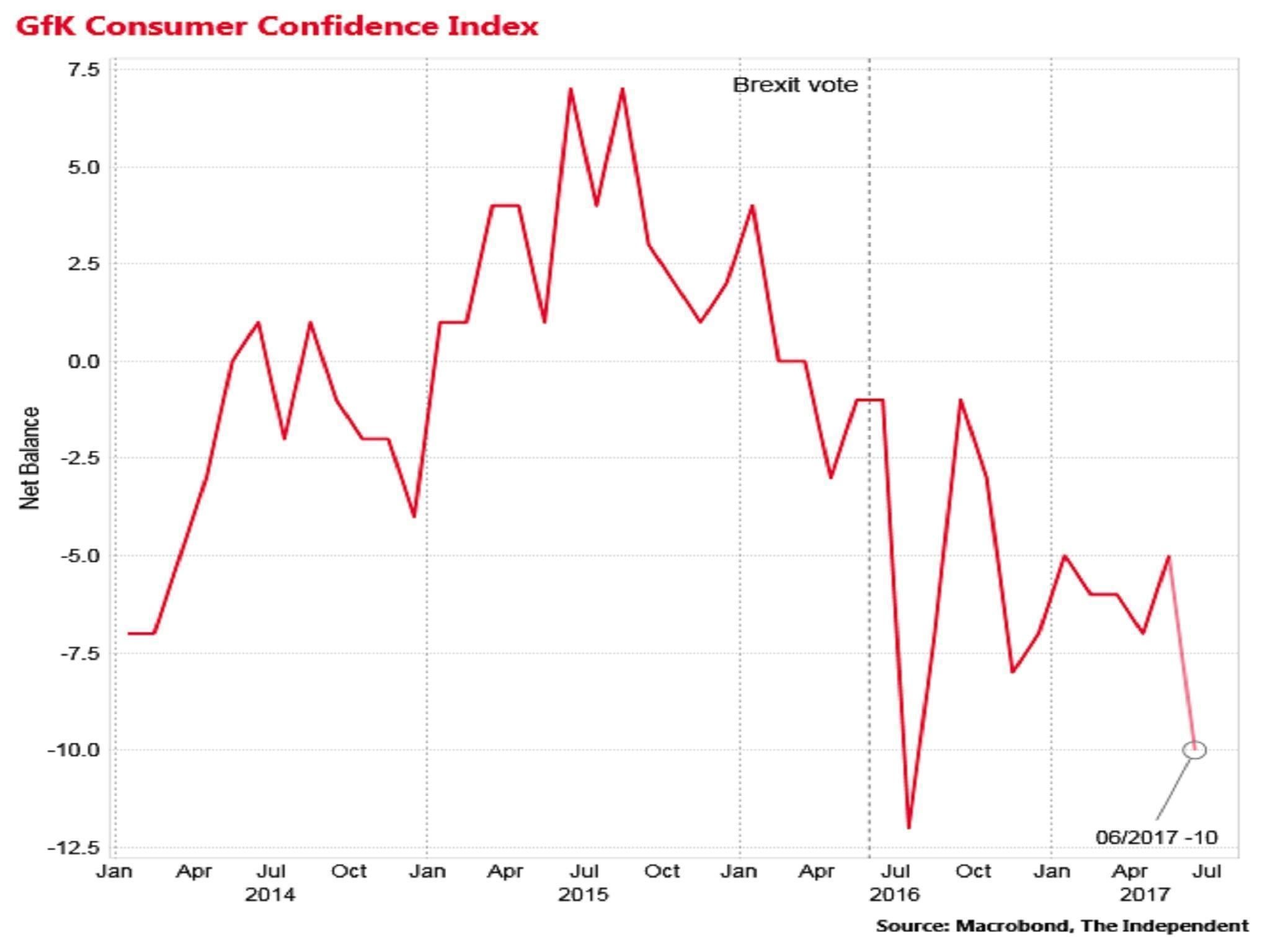

Consumer confidence is now almost back down to the lows seen in the wake of last June's Brexit referendum, adding to a picture of a wilting consumer in the face of fast rising inflation and weak wage growth.

The latest GfK Index slipped to -10 in June, down from -5 in the previous month, its lowest since last July.

All components of the Index were down, with the public expecting both weaker personal finances and a weaker general economy over the next 12 months.

There was a large drop in the major purchcase index from 9 in April to 1 in June.

The survey, which covered the period before and after the inconclusive general election, is conducted by GfK samples 2,000 individuals aged over 18.

"All this concern will worry the UK’s retailers," said Joe Staton of GfK.

"Strong consumer spending has propped up the economy since last June but now the twin pressures of higher prices and sluggish wage growth are squeezing household finances and adding to widespread fears of a Brexit-induced economic slowdown."

The GfK Index crashed from -1 before the Brexit vote to -12 in in July 2016 – its biggest single month plunge in 26 years.

But there was a remarkable recovery the following month and consumer spending largely drove the economy forward in the final two quarters of 2016, with the UK defying widespread predictions of a recesion.

But the GfK index has been trending down since last July, although it still remains above its long-term average of -8.7.

Weak across the board

Retail sales volumes fell 1.2 per cent in May, according to the ONS. following a major drop in the first quarter of 2017 which helped drag overall GDP growth down to just 0.2 per cent.

Inflation rose to 2.9 per cent in May, reflecting the slump in the pound since the Brexit vote, while average nominal wages are rising by just 2.1 per cent a year.

Consumer spending accounts for around 60 per cent of the economy and has been largely responsible for driving overall economic since last Summer.

But it has been financed by lower household saving and consumer borrowing.

Exports are still subdued despite the fall in the pound and business investment has been weak due to Brexit-related trade uncertainty leaving many economists are concerned that, as consumers rein in their borrowing and spending due to higher inflation, the overall economy will stutter over the coming quarters.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies