The 10 biggest business stories of 2015 including Greece, China, VW and tanking oil prices

From dealing with macroeconomic turbulence to the growing threat of cyber crime, 2015 was a year of highs and lows

Who would have guessed at the start of 2015 that Volkwagen would suffer and emissions scandal that would send it into meltdown, or that Greece would be locked in bailout disputes with European creditors for months?

We might have guessed that the oil price would keep tanking, or that the housing bubble would swell further. Many economists would have said with near-certainty that interest rates would rise, but they were only right by a whisker, when the Federal Reserve squeezed in the first US rate change since 2006 just before the end of the year.

From dealing with macroeconomic turbulence to the growing threat of cyber crime, 2015 was a year of highs and lows of in the business world. Here’s a look at our biggest business stories of the year:

1. China’s slowdown

Fears about a slowdown in the world’s second-largest economy finally bubbled over in 2015, triggering a one-day dive on China’s stock markets on August 24.

So-called ‘Black Monday’ prompted markets around the world to tumble and raised questions about Beijing’s stewardship of the economy, especially after China’s central bank only moved to cut interest rates the following day.

Since then downbeat economic data has continued to flow from China amid its attempts to shift from an export-led economy to one driven by consumer spending.

Reuters reported that a recent work paper by its central bank forecast growth at 6.9% for 2015, versus 7.3% in 2014 – slowest pace in a quarter of a century.

2. Greece goes to the brink

Europe had its fair share of turmoil, thanks to Greece and its debt-crisis.

Greece eventually secured its third bailout in five years from its creditors including the European Union after a stand-off that cast doubt on the future of the country’s Eurozone membership.

The ruling Syriza party, which stormed to power in January, eventually agreed to terms such as pension cuts and privatisations to receive the €86 billion (£61 billion) rescue package.

Though a deal was struck, it stirred up fresh tension within Europe, angered many Greeks and some of Syriza’s own MPs. Prime Minister Alexis Tsipras resigned before being re-elected in snap elections.

The agreement appears to be holding, however, and on December 22 Greece received another €1 billion payout from the European Stability Mechanism after completing a second set of reforms.

3. Oil

The oil price continued its plunge from a peak of $114 in summer 2014 to sit around $37 a barrel at the end of 2015 as a boom in US production added to a global glut of supply, while a rise in energy-efficient vehicles hit demand.

Both oil producing countries and oil firms felt the pain. Saudi Arabia revealed its highest ever deficit as a result of oil prices, while companies like Shell dramatically cut spending and axed thousands of jobs.

It has been good news for consumers, however, with the cost of petrol falling significantly. According to the RAC, the average price of petrol is 102.06p a litre — the lowest since August 2009. Meanwhile, supermarkets, which account for 16% of the UK’s forecourts but more than 40% of sales, are widely selling petrol below the £1 a litre mark.

4. VW’s emissions cheating scandal

The corporate villain of the year award could well go to Volkswagen, which admitted in September that a number of its cars were found to have cheated US emissions tests.

So-called “defeat devices” were used to mask the true emissions-levels of its vehicles’ engines, which could in fact emit nitrogen oxide pollutants up to 40 times above what is allowed in the US.

The scandal cost the chief executive his job, while the company slashed planned expenditure by €1 billion and set aside close to €7 billion to cover the costs, including refitting 11 million cars worldwide.

The Financial Times reported that analysts suspect VW could end up paying at least between €20 billion and €30 billion over the controversy, which has prompted a rethink in the way emissions are assessed.

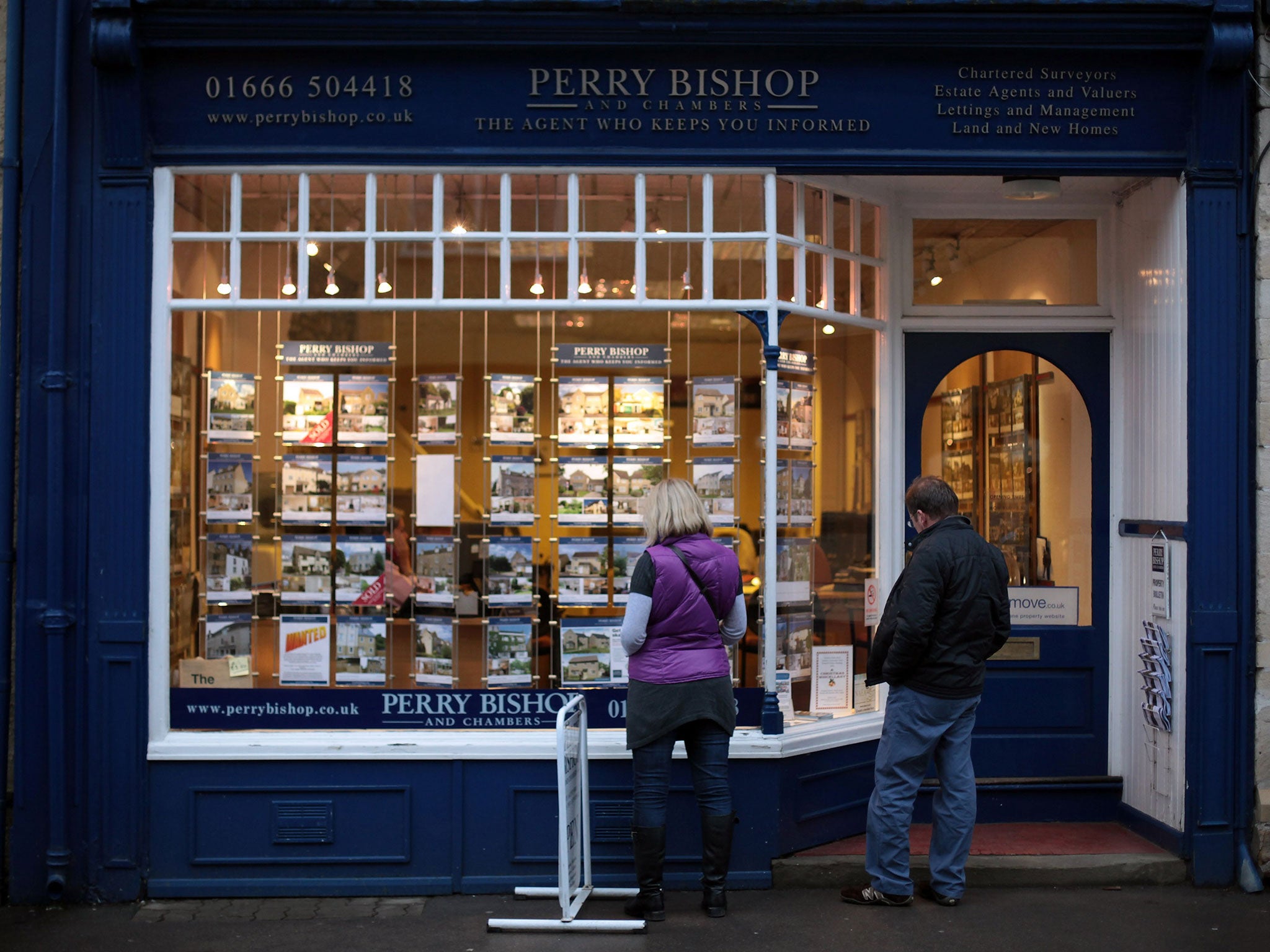

5. Housing market heat

Boom, surge, soar – just some of the words used to describe the UK’s housing market in 2015.

And it wasn’t media hype either. Before the traditional end of year slowdown, the price of the average home hit £205,240 in October, up 2.7% on its pre-recession peak, according to the Halifax house price index.

Mike Hussey, chief executive at developer Almacanter, claimed the UK is in the middle of a 15 year property boom, which is good news for London homeowners.

But the picture was less rosy for those trying to get on the property ladder. The scramble for a first home was such that in November, prospective buyers camped overnight at a new-build development in Hounslow where £1,000-deposits were being taken for £199,000 flats.

More of the same is anticipated in 2016. House prices are expected to rise 6% next year, while Rightmove has predicted that the capital’s average home will cost £1 million by 2020.

6. Unstoppable Aldi and Lidl

While the likes of Tesco and Morrisons floundered, German discounters Aldi and Lidl continued their explosive growth in the UK.

In November, for the first time ever, the grocers, which have profited from having smaller, cheaper stores and have been winning more middle class customers, claimed a combined market share of 10%.

And unfortunately for Britain’s Big Four the two have no plans to stay at 10%. Lidl is targeting 281 locations within the M25 for new outlets and has spent £10 million becoming the official supermarket of the England football team.

Aldi is readying an online launch for early 2016 after adding the equivalent of £31 million extra sales every week in its last financial year.

7. Hacking horrors

Cyber security breaches started to feel like a regular occurrence in 2015.

Everyone from infidelity dating website Ashley Madison to Hyatt hotels was targeted in a spate of attacks that catapulted cyber security to the top of corporate agendas.

In the UK, pub chain Wetherspoons revealed that 650,000 customers’ details were at risk, while TalkTalk’s systems were breached in a “significant and sustained cyber attack”.

The incidents exposed a lack expertise in senior management at UK companies and poor cyber skills in the workforce at large. As a result, the Cabinet Office backed a scheme to unearth talent that could fend off the threat.

And it looks like we’ll only hear more about the issue in the future. The cyber security market, worth $74.5 billion ($50 billion) in 2015, is predicted to grow to $170 billion by 2020.

8. No respite for banks

Although George Osborne and the Conservatives may have tried to tone down banker bashing this year, UK regulators remained intent on dealing out punishment for their past misconduct.

They handed out another £899 million in fines over scandals including PPI mis-selling and foreign exchange market rigging.

Barclays, which fired chief executive Antony Jenkins and brought in US investment banker Jes Staley, shelled out the most – £284 million, while HSBC paid £10.5 million.

Meanwhile, the first person was convicted over the manipulation of key interest rate Libor. Former UBS and Citi trader Tom Hayes’ 14-year jail sentence (though later reduced to 11 years) was viewed as a warning shot to the City.

No wonder Standard & Poor’s analysts think bank fines are now a “way of life”.

9. The year of the unicorn?

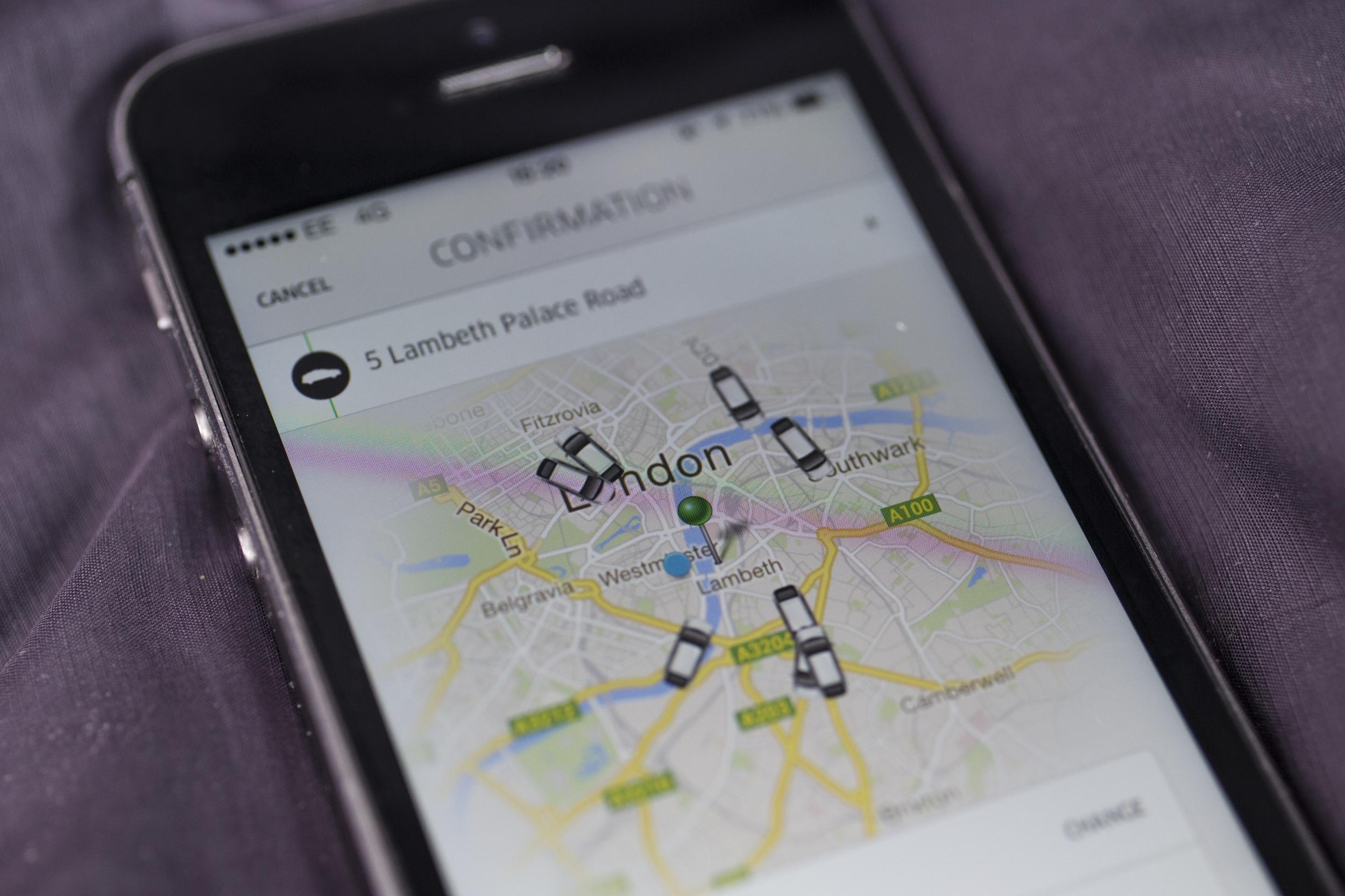

By 2015, the likes of Uber and Airbnb were already on our radars, but we almost couldn’t keep up with the growth of these companies, dubbed unicorns (startups with a valuation of over $1 billion), as the year unfolded.

Standout performer Uber marched ahead with its aggressive global expansion, ruffling many regulatory feathers along the way.

It has meant the controversial taxi hailing app has ended up being valued at over $50 billion (£33.8 billion), though it is facing a legal battle over the employment status over its drivers.

Airbnb meanwhile defeated a potentially damaging rule change in its hometown of San Francisco and its investors forecast that its bookings would double in 2015.

Impressive progress from likes of Spotify, Snapchat, Square, Pinterest and Dropbox also kept the blue-chips on their toes.

10. US interest rates rise

It finally happened. In December, the US equivalent of the Bank of England raised interest rates for the first time since 2006.

The Federal Reserve’s Janet Yellen and co nudged up rates by 0.25% after judging that the jobs market and economic activity in the world’s largest economy had improved sufficiently.

The widely expected and well-flagged move gave markets a lift, but put the Fed at odds with Europe, where the European Central Bank remained in easing mode.

It did not appear to heap pressure on the Bank of England to follow suit in the near future. Financial markets are still not fully pricing in a similar move from the Bank of England until early 2017, although rate-setters on the monetary policy committee have hinted a first rise since 2007 is likely to come earlier than that.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments