More borrowing, more tax on drivers and drinkers, but reward for pensioners

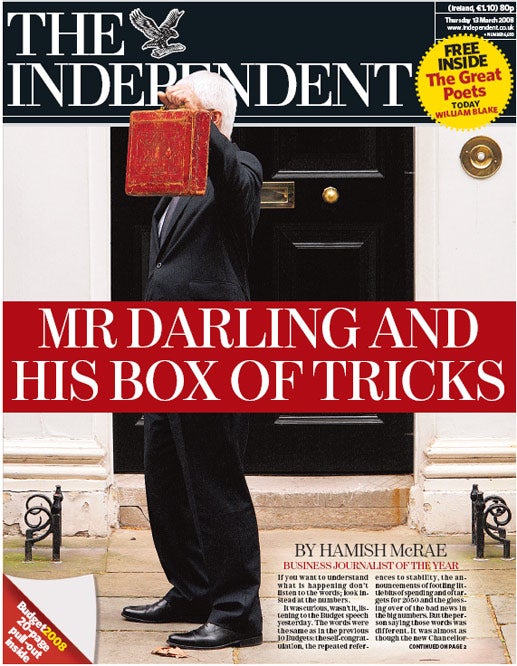

If you want to understand what is happening don't listen to the words; look instead at the numbers. It was curious, wasn't it, listening to the Budget speech yesterday. The words were the same as in the previous 10 Budgets: the self-congratulation, the repeated references to stability, the announcements of footling little bits of spending and of targets for 2050 and the glossing over of the bad news in the big numbers. But the person saying those words was different. It was almost as though the new Chancellor was reading out a speech written by someone else, his predecessor. Indeed I suspect in large measure that is what happened.

For those of us trying to get to grips with what matters and what does not, this is good news. We don't need to learn how the new Chancellor thinks, for we can simply apply what we know about the old one. And the prime rule is to ignore the words and focus on the numbers. So what do they tell us?

Start with the economic forecast because if that goes wrong, everything else goes wrong too. Alistair Darling cut the growth forecast for this year to 1.75-2.25 per cent, and the one for 2009 to 2.25-2.75 per cent. The immediate comment of most people is that this is overoptimistic. The consensus forecast for 2008 is 1.7 per cent, so below the bottom end of the Treasury's range.

Actually I am not too bothered about that for two reasons. One is that the Treasury has a good record on forecasting growth, so its view deserves to be taken seriously. The other is that growth is running at 2 per cent annual rate, spot on the mid-point of the range, and looks set to continue for the first half of the year at least. What concerns me much more is the forecast for 2009. That seems to me to be far too optimistic. The consensus is predicting a slight lift to 1.9 per cent, and I would not be surprised if growth in 2009 turns out worse than 2008. Were that to happen we really would be in a jam.

We are in a jam already this year. Borrowing is going up and is projected to rise to £43bn, which is 3.2 per cent of GDP. That is higher than the Maastricht ceiling of 3 per cent, though this was not mentioned in the speech. But even this seems overoptimistic, particularly on the revenues side. The Treasury has a poor record on forecasting tax revenue and has, I think, made its habitual mistake again. It thinks, for example, that corporation tax will rise next year, from £47bn to £52bn. Can that really be right in the face of a global slowdown? It accepts that stamp duty will fall, but housing activity has already fallen by one third. It thinks VAT revenues will rise, from £80.5bn to £83.8bn, which sounds too optimistic.

All that is in the main tables in the Financial Statement and Budget Report. Have a look at the borrowing numbers, which take into account support for Northern Rock, and things get really scary. On page 200 of the FSBR, I saw that once you allow for Northern Rock they have to borrow £59.3bn in the coming financial year. Other odds and ends bring the number balloons to £78.8bn. That is the net financing requirement for 2008-09, see table C13, page 201. Yelp.

I find it bizarre that when there are these very big numbers that need to be explained, the Chancellor spends his speech talking about spending an extra £10m over five years on teaching science. It is insulting for him to think that the British public is so innumerate that we will be impressed by couple of million a year of spending and not need to have the £78.8bn of borrowing explained to us.

That is this coming year. Come 2009 it is all supposed to get better. Well, maybe it will. Maybe global growth will rebound. Maybe tax revenues will recover. Maybe borrowing will come back down. But that did not happen in the last global downturn, or the one before, or the one before that. Reality says the Government is going to end up borrowing a lot more over the next two or three years and that extra debt will hang over the country not just for the rest of this parliament but the one beyond that and the one beyond that.

Add in all the off-balance sheet liabilities, such as public-sector pensions and privately financed hospitals, and the British taxpayer faces a decade of slog coping with this mountain of debt. The trouble is, we have our own debts too.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments