Obama summons party leaders to stave off US debt default crisis

Republicans insist on cuts as part of deal to let borrowing break $14 trillion ceiling

With a potential US debt default less than four weeks away, President Barack Obama has summoned Congressional leaders to the White House today in a new effort to break the deadlock over the budget deficit reduction package that Republicans insist must accompany an increase in the country's borrowing ceiling. But the prospects of an early deal still look dim. House Speaker John Boehner, the top Republican on Capitol Hill, warned that the discussions "will be fruitless unless the President recognises economic and legislative reality", while Jay Carney, the White House spokesman, told reporters yesterday that this latest debt summit was only a start, and that further meetings would be needed.

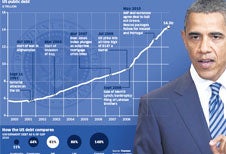

Click HERE to view graphic (114k jpg)

According to the Treasury, the US will hit the current debt ceiling of $14.3 trillion on 2 August, at which point, in theory at least, the government will be unable to make debt repayments or pay social security benefits to its own citizens. In reality, no one knows exactly what would happen.

What is clear is that, for the moment at least, neither side is budging. Both Democrats and Republicans roughly agree on the size of the savings needed, some $3trn over the next decade. But on the means to that end, they are as far apart as ever.

Democrats say they are ready to make substantial spending cuts, including to their cherished entitlement programmes of social security and Medicare. But, they insist, some tax increases are required, many of them to be achieved by closing tax loopholes. For Republicans however, tax increases in whatever form are off the table.

Driven by a shared acceptance that the federal deficit – set to hit $1.5trn for 2011 alone – is unsustainable, the parties have been holding intermittent talks for months on a long-term deal. But they suddenly gained urgency when, under pressure from the Tea Party movement, Republicans linked the issue with Congressional approval for a new debt ceiling – turning a vote that until now had gone through on the nod into a potential trigger for another global financial meltdown.

A fortnight ago, the most recent discussions, led by Vice-President Joe Biden, collapsed after Republicans walked out in protest at mooted tax increases. Now Mr Obama has stepped into the fray in person, and negotiations have entered the make-or-break phase. "Both parties have to get out of their comfort zone," the President declared as he announced today's meeting. "Both have to agree on real compromise."

More significantly, however, he rejected Republican calls for a stop-gap short-term deal increasing the ceiling, but which would kick the real argument, over the tough fiscal measures needed, into the heart of the upcoming election campaign.

For Democrats especially, that would be a disaster, by forcing another awkward vote on the debt ceiling a few months before the 2012 elections. Having lost the House in 2010, overwhelmed by a Tea Party-led tide of protest against "big government", the party is now at serious risk of losing the Senate too. Not surprisingly, Mitch McConnell, the current Senate minority leader, is a vocal advocate of the short-term solution.

Even so, and for all the political heat it is generating, the controversy has a somewhat surreal quality. Though economists warn that the financial consequences of even a partial US default would be devastating – especially amid the worries about Greece and other weak eurozone countries, the political game of chicken here has not yet frightened the markets.

The latter are convinced that, precisely because of the enormity of those consequences, even the most intransigent Republicans will acquiesce in an 11th-hour deal. But for the feuding parties, the 11th hour is virtually upon them.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments