How the tax facts get in the way of the Tory story

Tory leaders are too incompetent to persuade us that they don't favour the rich

Since the Budget seven months ago, the Government has been fighting its way uphill. Partly because it started to seem incompetent, not just in the Budget but ever since, and partly because it made a big mistake.

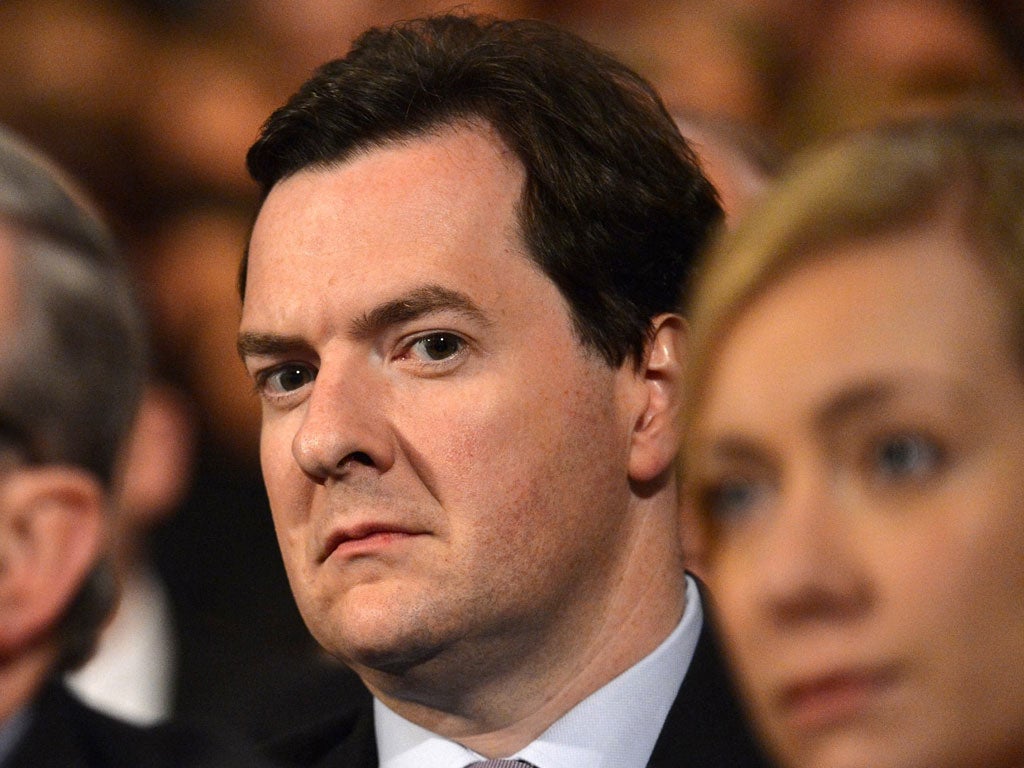

The error was to announce a cut in the top rate of income tax to take effect next April. At a stroke, the Chancellor undermined his claim that "we are all in it together" and that the broadest shoulders would bear the greatest burden.

George Osborne argues, of course, that a lower top rate will raise more money from the better-off, although this is impossible to prove, because you can never know what would happen if the rate were different. Economists can try to estimate from past changes in tax rates how many people would work harder, or abandon plans to leave the country, or pay themselves now rather than later. Yet the Treasury's own study, which the Chancellor published to justify the cut in the rate, suggested a minimal effect and admitted that its estimates were uncertain.

No wonder Ed Miliband seized with such enthusiasm on the "tax cut for millionaires", as he clumsily and inaccurately calls it. (It is a cut in the tax rate on income over £150,000 a year.) The coalition Government appears to be cutting taxes for the rich when living standards for people on middle and lower incomes have dropped further than at any time since the 1930s.

So I was interested when, in his speech to the Conservative Party conference in Birmingham, the Chancellor said: "In every single year of this Parliament the rich will pay a greater share of our nation's tax revenues than in any one of the 13 years that Labour were in office." Really? I wondered why, in that case, he and other ministers, especially Liberal Democrats, did not make more of it.

Fortunately, the Tory press office had put out a briefing with the text of his speech, so I assumed that I would find in there the figures on which the claim was based. No such luck. The briefing consisted of endorsements by business people of Osborne's ridiculous headline-grabbing scheme to offer people shares in exchange for their employment rights. So I asked Osborne's press officer if he could let me know on what numbers that part of the speech was based.

I had not had an answer when, two days later, the Prime Minister repeated the claim in his conference speech: "The rich will pay a greater share of tax in every year of this Parliament than in any one of the 13 years under Labour."

This was obviously an important claim, then, that would be used to counter Miliband's claim to "one nation". Naturally, the Tory party would have the figures ready to back it up. I renewed my request, and was puzzled by the further delay. Finally, on Thursday last week, more than two weeks after the speeches were given, the Treasury provided me with a table of income tax receipts – a table that I had found on the HM Revenue and Customs website on the day of the Chancellor's speech, but which I had rejected because it so plainly failed to provide all the facts to back up Osborne's words. It showed that the tenth of taxpayers with the highest incomes were forecast to pay a higher share of income tax in two of the first three years of this Parliament. But not in the first year, 2010-11, when their share went down. And the figures were only for income tax, which raises just a quarter of the "nation's tax revenues" of which the Chancellor had spoken.

You must have figures for the estimated share of total tax to be raised from the rich, I said. They are published by the independent Office for National Statistics (table 14), but only up to 2010-11, the first year of this Parliament. Again, those figures show a fall in the share of tax paid by the top 10 per cent in that first year. But perhaps, when Treasury modellers projected the figures to 2015, there was another way of looking at them.

But no. I was told that the Chancellor and Prime Minister were referring in their speeches to those income tax figures, projected by the Treasury to the last two years of this Parliament. "It is reasonable to say", said a Treasury spokesman, that the tax year 2010-11 "was based on the plans of the previous government", so it does not count. He has a point, but it is not one that Osborne and Cameron seemed to be making. They were, after all, responsible for tax policy for 11 months of that year.

The plain meaning of the words of the Chancellor and Prime Minister, then, is either contradicted or unsupported by the figures.

It would seem that sloppy drafting has destroyed what could be a good story for the Government. After its first year, in which the share of all taxes paid by the rich fell, the rich may well now be paying a greater share than they paid under Labour. That seems likely, based on the income tax figures and on the increases in other taxes – capital gains tax and stamp duty – that fall on the better-off. But VAT falls more heavily on the poor and it went up last year, and the Treasury has not produced the numbers to show that this is outweighed by taxes on the rich.

It is not that Cameron and Osborne favour the rich, but that they are too incompetent to be able to persuade us otherwise.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies