The Big Short has made people more reluctant to buy subprime bonds, says Morgan Stanley

The film won best screenplay at the Oscars

While that old chestnut ‘any press is good press’ may be true in many cases, for financial firms, a Hollywood film focusing on subprime bonds and the 2008 housing crises has only had negative effects.

In a recent briefing, American financial services firm Morgan Stanley blamed Oscar-winning drama The Big Short for investors’ reluctance to sign up for subprime bonds.

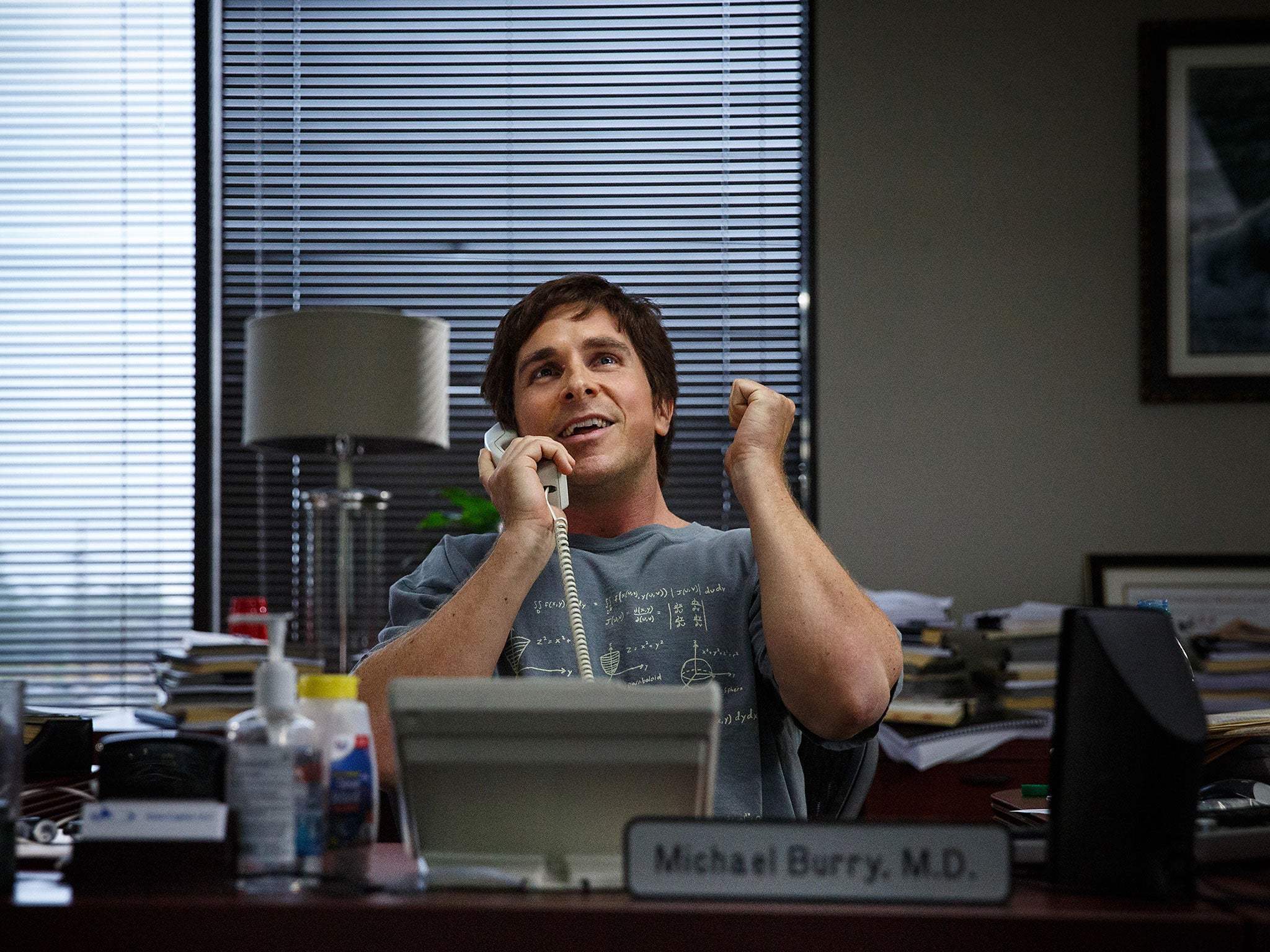

The Christian Bale-starring flick follows an eccentric hedge-fund manager as he attempts to profit from the housing crisis which resulted from risky subprime loans with low returns.

“Concerns about growing recessionary risks – and perhaps even the popularity of the recent movie The Big Short – have motivated investors to investigate any potential source of weakness,” Morgan Stanley’s briefing reads, as noted by Bloomberg.

“Consumer sectors that involve large initial outlays, such as housing and autos, provide a natural place to start.”

This wouldn’t be the first time a Hollywood blockbuster had major effects on the financial industry. After the release of Martin Scorsese and Leonardo DiCaprio’s The Wolf of Wall Street there was a sudden influx in people wanting to be stockbrokers.

The Big Short, which was directed by Adam McKay - previously best known for Anchorman and Step Brothers - won best screenplay at the Oscars but lost out on best picture, director and supporting actor for Bale.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments