Hunt’s higher taxes could be here to stay for ‘several decades’, IFS warns

The Institute for Fiscal Studies warned that the biggest drop in living standards will ‘hit everyone’ but that ‘Middle England is set for a shock’.

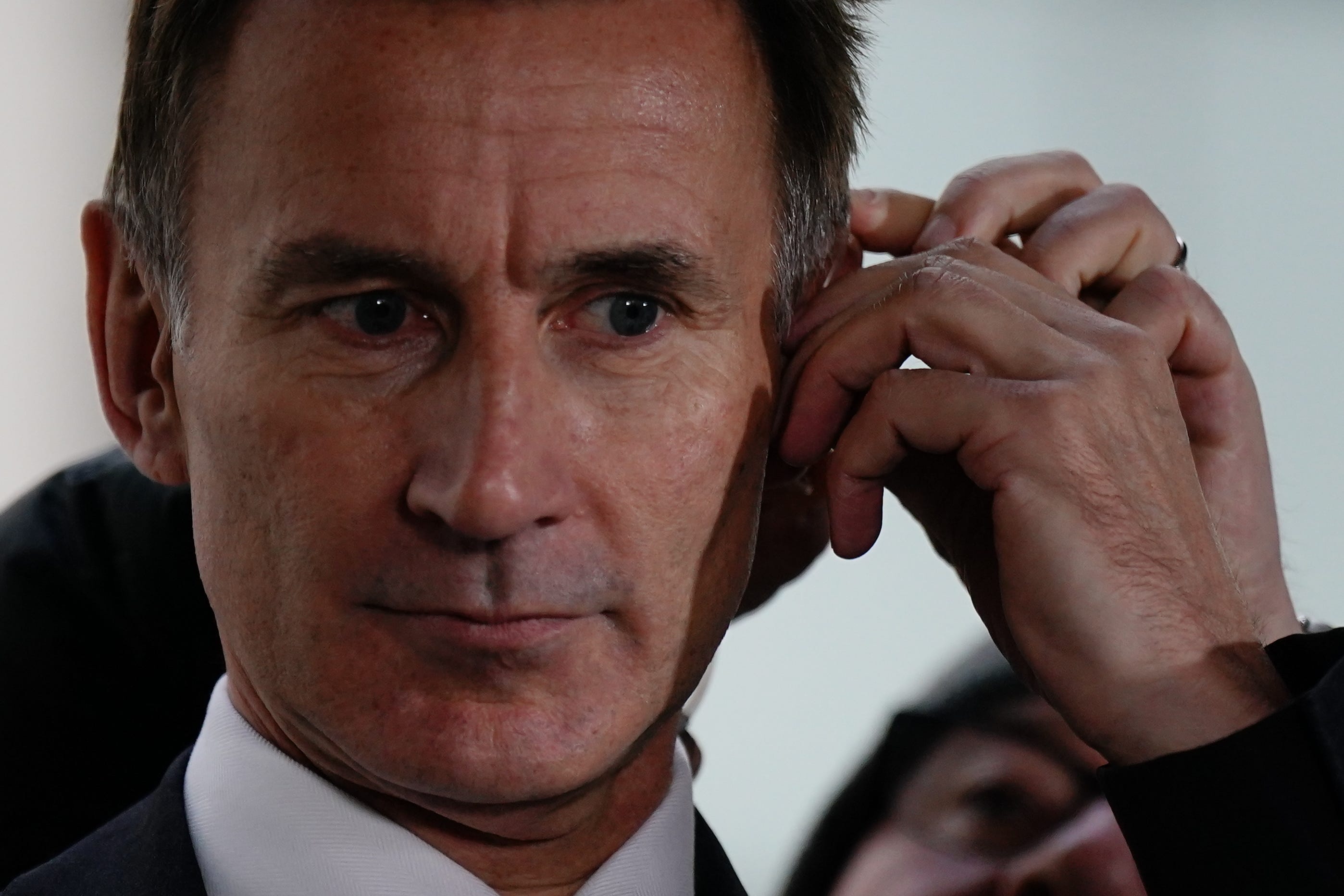

A “series of economic own goals” has worsened Britain’s “long, hard, unpleasant journey”, economists have warned as they forecast Chancellor Jeremy Hunt’s record-high taxes are “here to stay”.

The Institute for Fiscal Studies (IFS) said on Friday the biggest drop in living standards will “hit everyone” but that “Middle England is set for a shock” as taxes are hiked as wages fall.

“The truth is we just got a lot poorer,” the economic think tank’s director Paul Johnson said.

In comments that will further enrage Tories angered by the plans, he said “higher taxes and a bigger state” are likely to stay for the “next several decades”.

He listed the self-inflicted wounds to growth as including Brexit, austerity-era cuts to education spending and Liz Truss’s disastrous mini-budget, which he described as a “large own goal”, as well as the general political chaos of recent months.

Jacob Rees-Mogg is among the senior Conservatives who have criticised the £25 billion of tax rises unveiled by Mr Hunt in his autumn statement on Thursday as he acknowledged that the UK was already in recession.

The Chancellor has hit back, defending his “very Conservative package to make sure we sort out the economy” and arguing there is “nothing Conservative about ducking difficult decisions”.

Mr Johnson warned that the drop in living standards forecast is the “biggest fall in living memory” and comes “off the back of very poor income growth for many years”.

“This will hit everyone, but perhaps it will be those on middling sorts of incomes who feel the biggest hit,” he said.

“They won’t benefit from the targeted support to those on means-tested benefits. Their wages are falling and their taxes are rising. Middle England is set for a shock.”

Mr Johnson said the Government is “reaping the costs of a long-term failure to grow the economy”, the effects of an ageing population and high levels of borrowing in the past.

“The truth is we just got a lot poorer. We are in for a long, hard, unpleasant journey; a journey that has been made more arduous than it might have been by a series of economic own goals,” he added.

The economist said “very clearly Brexit was an economic own goal”, particularly “the hard type of Brexit we’ve had, distancing ourselves from the single market” of the European Union.

“Obviously the mini-budget of a couple of months didn’t help. In fact that was another large own goal,” he said.

Mr Johnson said the “general economic and political instability and uncertainty” over recent years including “reversing policy here, there and everywhere” and the downfalls of Boris Johnson and Ms Truss have also hit growth, as have cuts to education and investment spending.

“I would be most surprised if the tax burden gets back down to its long-term pre-Covid average at any time in the next several decades. Higher taxes and a bigger state look to me to be here to stay unless something quite radical changes,” he added.

He said that the post-election spending plans are “really pretty austere”, and combined with high taxes and borrowing “that’s a pretty nasty place to be”.

Mr Rees-Mogg, the former business secretary, strongly criticised the Chancellor’s approach, warning the increases will hit many people who are not particularly well off, including some who are receiving benefits.

“I think we need to look at the efficiency of government to make sure money is well spent before reaching for the easy option of putting up taxes,” he told Channel 4 News.

“What we actually need to be doing is having a strategy for growth and looking to lower taxes.”

But Mr Hunt struck back, telling BBC Radio 4’s Today programme that “sound money matters more than low taxes”.

“What I would say to my Conservative colleagues, is there is nothing Conservative about spending money that you haven’t got,” he told Sky News.

“There is nothing Conservative about not tackling inflation, there is nothing Conservative about ducking difficult decisions that put the economy on track.

“And we’ve done all of those things and that is why this is a very Conservative package to make sure we sort out the economy.”

Independent analysts said Mr Hunt’s promised £30 billion of spending cuts would mean a prolonged squeeze on public sector pay despite a growing clamour in many services for real-terms increases after the years of austerity.

Meanwhile, economists at the Resolution Foundation warned that workers are living through a two-decade wage stagnation costing £15,000, piling further pressure on those in the “squeezed middle”, who face a permanent 3.7% income hit – higher than the very richest.

Mr Hunt denied his plans are a raid on workers, telling Today: “No, it’s a plan that gets us through very difficult times that are being faced by other countries all over the world and it gives people certainty.

“It’s not possible to raise £25 billion of taxes just focusing on a very small group of very rich people.”

The IFS said much of the cuts that have been pushed back to past the next general election “should be taken with a large pinch of salt” as economists questioned their credibility.

But Mr Hunt said he was “not guilty” of putting off cuts until after the next general election.

“I mean you can accuse me of many failings but looking at the front pages of the newspapers today, to say we have ducked any of the difficult decisions facing the British economy is the one charge we are not guilty of,” he told BBC Breakfast.

Mr Hunt set out his plans against the backdrop of a bleak set of economic forecasts from the Office of Budget Responsibility (OBR), underlining the damage wreaked by the war in Ukraine.

It said that rampaging inflation as a result of the energy price shock meant living standards are set to fall by 7% over the next two years – taking them back to where they were in 2014.

The economy is predicted to contract by 1.4% next year, unemployment is expected to rise by more than 500,000 while taxes are set to reach their highest level as a share of national income since the end of the Second World War.

In the Commons, Mr Hunt said that because of the measures he was taking the downturn in the economy would be “shallower” than would have otherwise been the case.

Spending on health, education and defence will be protected, support for energy bills will continue although at a lower level, while benefits and pensions will rise in line with inflation.

Much of the increase in taxes will come from extending the freeze on thresholds – seeing more people drawn into paying the basic and higher rates of tax, although different rates apply in Scotland.

IMF managing director Kristalina Georgieva told Mr Hunt in a call that his autumn statement “strikes the right balance”, following the UN financial institution’s criticism of Kwasi Kwarteng’s mini-budget.

Mr Hunt said that she described the UK’s economic plans as “balanced and fair”.

Nevertheless there is likely to be concern some among ministers that his intervention could signal trouble ahead, with many Tory MPs worried about raising taxes as the country enters a recession.

Former minister Esther McVey, who had warned she could not support tax rises if the Government continued to press ahead with the HS2 rail link, was highly critical of Mr Hunt’s strategy.

She said that the “stealth” taxes could end up having “far less scrutiny than it had of been increases in basic levels”.

“Like I’ve said, I can’t be supporting these rises,” she added.

Bookmark popover

Removed from bookmarks