Wages rise at record rate but increases stagnate in real terms, new figures show

The Office for National Statistics said that after accounting for CPI inflation, real pay was down 0.6% compared to a year ago.

Wage increases have soared to a new record high but are still being outpaced by inflation, figures show.

Official statisticians also revealed that the rate of unemployment in the UK increased from 3.9% to 4.2% in the three months to June, and the number of people with long-term sickness has increased to a record high.

The new data will likely give Bank of England decision makers a “migraine” as it heaps further pressure on them to keep hiking interest rates, one analyst said.

The Office for National Statistics (ONS) on Tuesday said regular pay growth, which excludes bonuses, reached 7.8% compared to a year earlier.

“This is the highest regular annual growth rate we have seen since comparable records began in 2001,” it said.

But inflation ate away all of this growth, and once Consumer Prices Index (CPI) inflation had been taken into account, pay actually dropped by 0.6%. That is the smallest reduction since November 2021.

When accounting for CPIH, a measure which includes the housing costs of owner-occupiers, wages grew 0.1%, the ONS said.

The growth in wages is likely to fuel fears that inflation might stick around for longer than hoped.

When prices go up, workers often ask for pay rises to make up for that. However this could force their employers to put up prices in order to get enough money to pay their staff more.

This has the ability to feed a spiral where wages and prices keep rising to match each other.

The Bank of England, aware of these pressures, will now face extra pressure to hike interest rates from 5.25% to 5.5% in September, said CMC Markets analyst Michael Hewson.

“This morning’s numbers have not just given the central bank a headache, but a migraine,” he said.

Liberal Democrat Cabinet Office spokeswoman Christine Jardine said: “These figures will be of cold comfort for families struggling to keep their heads above water.

“Spiralling mortgage bills are wiping out any progress on pay rises.”

The ONS said the unemployment rate hit 4.2% during the quarter, up 0.3 percentage points from the previous three-month period.

It is the highest since the three months to October 2021, the ONS said, and brings the measure above pre-pandemic levels.

According to the ONS estimates, a large part of the increase in unemployment was because many people without work who were previously not looking for jobs – so-called economically inactive people – have now started to seek work.

It might have become a little more difficult for these people to find employment as the estimated number of vacant positions fell for the 13th time in a row to 1.02 million, a reduction of 66,000.

The number of people who are economically inactive because of long-term sickness is now at a record 2.5 million, up 400,000 since the start of the Covid-19 pandemic.

“The drop in those neither working nor looking for work is mainly among those looking after their family or home,” said ONS director of economic statistics Darren Morgan.

“Meanwhile the number of people prevented from working by long-term sickness has risen again to a new record.

“Earnings continue to grow in cash terms, with basic pay growing at its fastest since current records began.

“Coupled with lower inflation, this means the position on people’s real pay is recovering and now looks a bit better than a few months back.”

The data shows unemployment was highest in the West Midlands at 5.2%, and lowest in Northern Ireland at 2.7%.

In Scotland, the rate was 4.0% and it was 4.8% in Wales. The biggest increase in the unemployment rate was 1.3 percentage points in the East Midlands, and the largest decrease was in Yorkshire and the Humber at 1.1 percentage points.

The pay rises hide a difference between those who work for the Government and those who work for businesses.

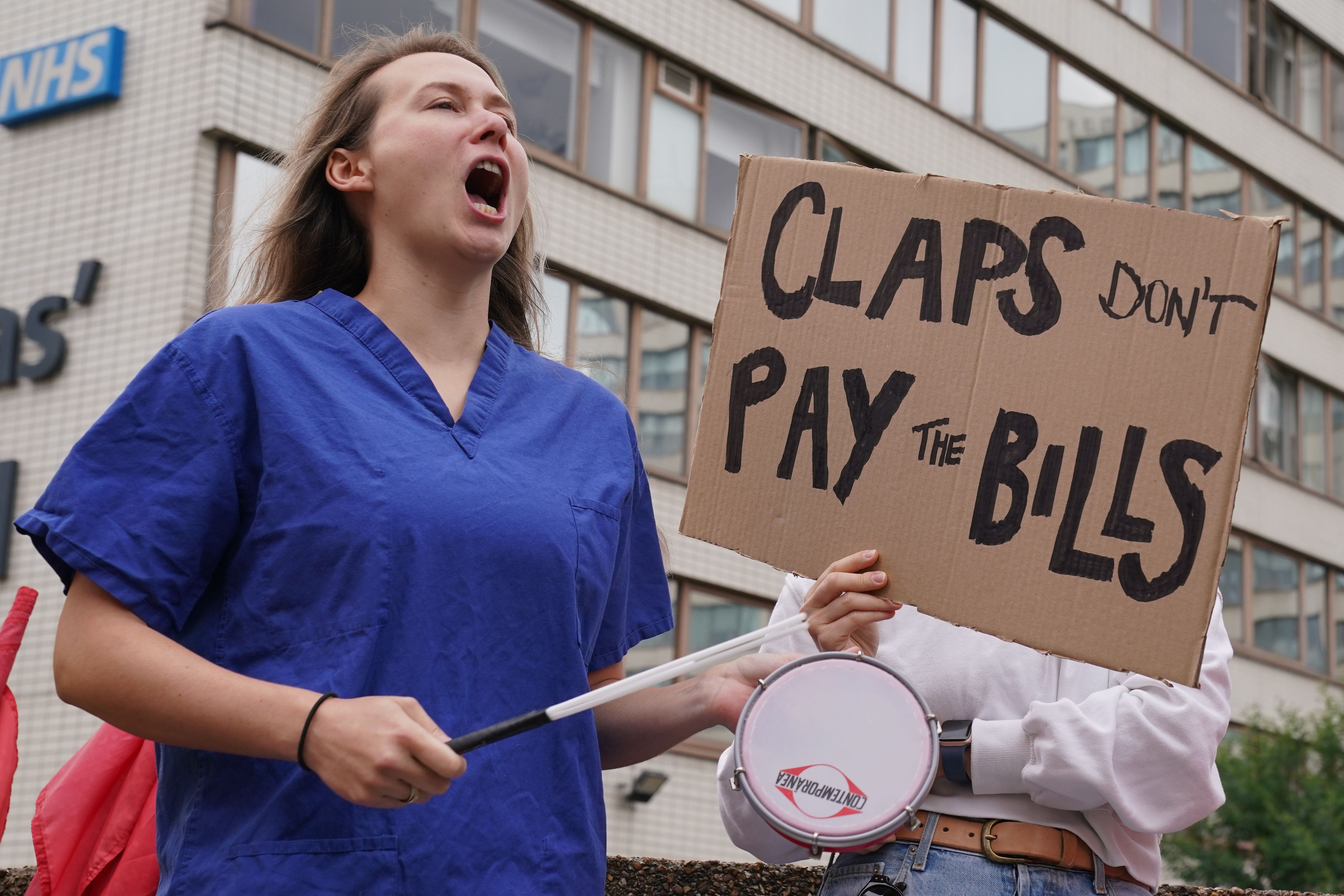

While average pay growth for the private sector was 8.2%, public sector workers were given a 6.2% increase.

Those working in finance and business services saw their wages go up the fastest, by 9.4%, while the manufacturing sector saw a 8.2% rise.

The data shows the number of payrolled employees increased by 97,000 to 30.2 million in July, although the ONS said this is a “provisional estimate and is likely to be revised when more data are received next month”.

Chancellor Jeremy Hunt said: “Thanks to the action we’ve taken in the jobs market, it’s great to see a record number of employees.

“Our ambitious reforms will make work pay and help even more people into work – including by expanding free childcare next year – helping to deliver on our priority to grow the economy.”

Labour shadow work and pensions secretary Jonathan Ashworth said: “These figures confirm once again that the Tories are failing working people and businesses across Britain.

“Families are struggling to get by, there are record numbers of people out of work due to long-term sickness, and the employment rate for over-50s is still below pre-pandemic levels – yet Tory ministers have no solutions to get people back to work. The consequence is thousands written off and a rising benefit bill.”

Bookmark popover

Removed from bookmarks