The hunt for ‘holy grail’ of clean energy buried beneath the ground

While solar arrays and wind turbines are now commonplace, there are smaller, riskier niches within the clean energy sector. One of these, if it pans out, could be no less than transformational on a global scale, advocates say. Senior Climate Correspondent Louise Boyle reports

In 1974, “Diamond” Glenn McCarthy sat down to reminisce about the highs and lows, the fortunes made and squandered, by the “wildcatters” of American oil.

“They risked and sometimes they won,” Mr McCarthy, the gregarious risk-taker dubbed “King of the Wildcatters” told Texas Monthly. In the early 20th century, he had bet big on drilling wells in places ignored or considered unproductive by major oil companies. By the 1940s, he had 400 wells and a $200million fortune (about $2.5billion in today’s money).

Today, a new energy revolution is in motion: an unprecedented, multibillion-dollar sprint towards renewables and away from burning oil and gas which have helped crank up the planet’s temperature, leaving it a cauldron of dangerous extremes.

While solar arrays and wind turbines are now commonplace, there are smaller, riskier niches within the clean energy sector. One of these, if it pans out, could be no less than transformational on a global scale, advocates say.

Welcome to wildcatter 2.0 and the race for natural hydrogen.

In Africa, Europe, Australia and the United States, a growing number of start-ups are staking their fortunes and reputations on finding vast, underground deposits of hydrogen.

Like fossil fuels, natural hydrogen can be used as a primary source of energy. Unlike fossil fuels, the gas produces no carbon emissions. What’s more, hydrogen is constantly renewing underground when water and iron minerals react under high temperatures. Early research says there may be enough accessible natural hydrogen to power the planet’s clean energy needs for generations.

“There’s a wildcatting phenomenon to it and risk-taking,” Dr Michael Webber, professor of mechanical engineering at the University of Texas at Austin, told The Independent. “But now it’s super scientific and sophisticated.”

Until relatively recently, it was commonly accepted that natural hydrogen (also called geologic, white or gold hydrogen) didn’t exist on Earth. Or at least, it didn’t exist in places that humans could reach, or in large accumulations.

Then in 2012, a discovery was made in Bourakébougou in the West African nation of Mali. A Malian businessman, Aliou Diallo, had funded tests of a water well in the small village which had been plugged in the late Eighties after an unfortunate worker leaned over the hole while smoking a cigarette and was badly burned. The tests revealed that the borehole was releasing 98 per cent natural hydrogen.

Bourakébougou subsequently became the first place in the world to get its electricity from a source of natural hydrogen, which was run through a retrofitted Ford engine.

For the village, it was a game-changer, giving people lights in their homes and public spaces for the first time. Children did better in school as they were able to study into the evening.

“We were called crazy when we went to conferences,” Asma Diallo, Aliou Diallo’s daughter and development director of Hydroma, the Montreal-based company which emerged from the discovery, told The Independent. “But we decided this was still an interesting discovery, and that we wanted to see what was possible.”

Beneath Mali, a layer of impermeable rock traps hydrogen in highly-concentrated, large quantities fairly close to the surface. In the past decade, Hydroma has drilled 30 wells across an area about twice the size of Singapore, all of which have yielded high concentrations of hydrogen, Diallo says.

Hydroma has estimated that there are 630 billion cubic meters of hydrogen (around 60 million tons) of natural hydrogen in the Mali field, and the company is forging ahead with plans to become commercial, Diallo says. First, they plan to provide electricity to bolster Mali’s unreliable power grid, and in the long-term, pipe natural hydrogen to neighboring countries and possibly export to Europe.

Development, however, is hampered by a volatile political situation. Mali has experienced three coup d’etats in the past decade and 30,000 people have been displaced.

“In a politically insecure location, it doesn’t make it easy. But from a geological and scientific standpoint, it’s the perfect scenario of how natural hydrogen makes sense,” Diallo said.

Some have needed no convincing.

Viacheslav Zgonnik first became interested in natural hydrogen while at university in Ukraine, and what he learned had such an impact that he switched his postdoctoral studies from chemistry to geochemistry. “The Mali discovery happened when I was doing my post-doc. It was extremely encouraging to see that happen,” he told The Independent.

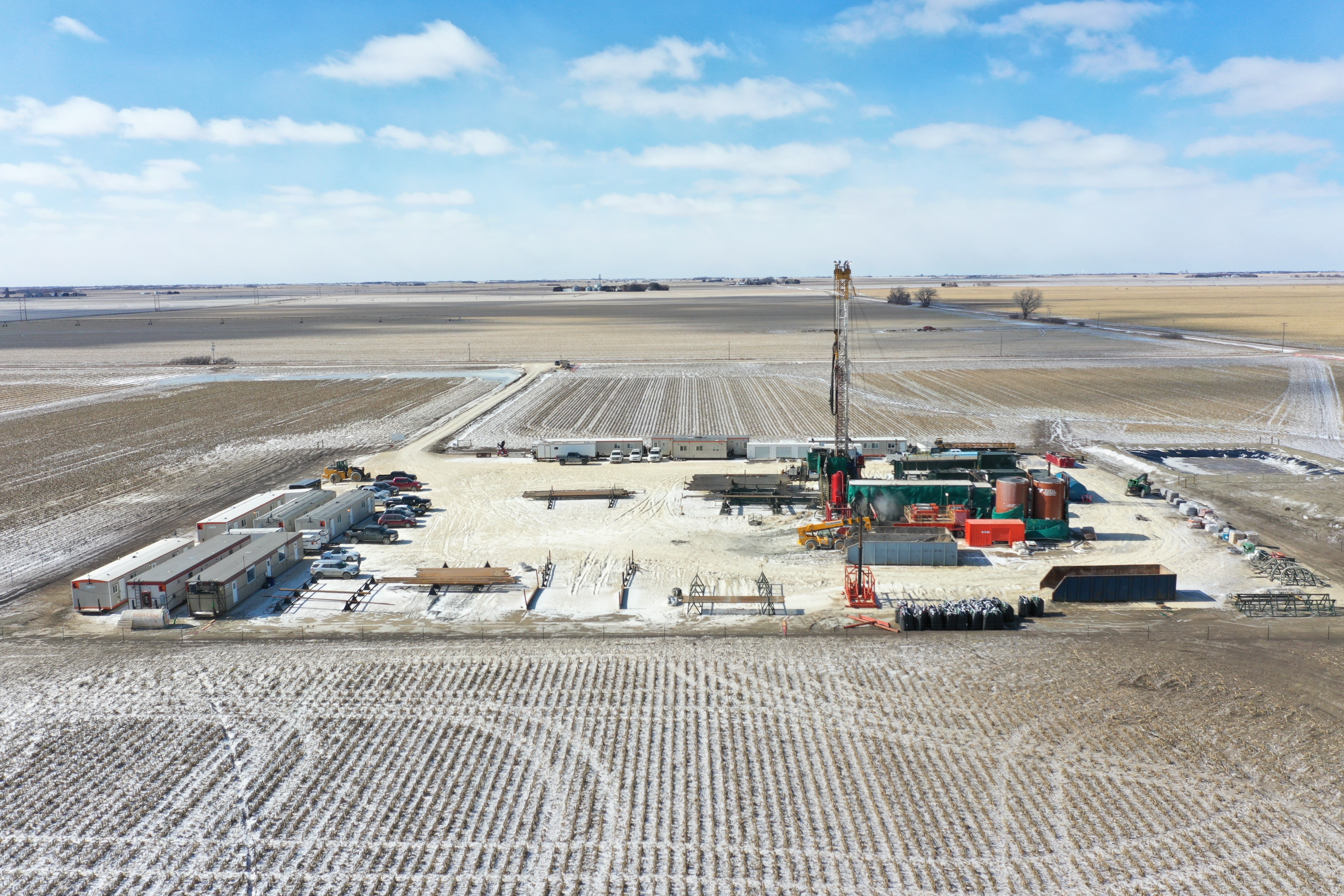

A decade ago, he founded Natural Hydrogen Energy (NH2E) in the US. And in 2019, the company established its first hydrogen borehole near the tiny town of Geneva, Nebraska, and now says it is working towards commercial production.

Zgonnik estimated that five years ago, only a handful of companies were working on natural hydrogen. “This year, I counted around 50 already,” he said. “I believe that next year, that growth will be even faster and we will see hundreds of companies.”

Hydrogen, which releases only water and heat when burned, is already a $150billion industry. But it must be separated from other elements — like the oxygen in water — and that takes vast amounts of energy, still mainly powered by fossil fuels. There are more sustainable ways of producing “green” hydrogen but the process remains expensive.

Still, governments have invested billions in hydrogen production and storage, particularly in the wake of Russia’s invasion of Ukraine, an event which showed the danger of relying on an authoritarian regime’s supply of natural gas to power economies.

One tech company estimates that natural hydrogen could be a $75billion industry by 2030 even though it remains to be seen whether it can work at a commercial scale.

Companies from Spain and the UK to Australia are racing to prove it’s possible, and investors with deep pockets and an appetite for risk are flocking. Hyterra, an Australian investment company, has a stake in NH2E. Koloma, a Colorado-based natural hydrogen company, recently received $91m from a group that includes Bill Gates’ Breakthrough Energy Ventures.

So far, it’s mainly venture capital funds and wealthy individuals that are involved. “There are unknowns associated with exploration, and larger companies are still waiting,” Zgonnik said.

“Small companies are much more agile and willing to take risks to crack the code, so to speak, on how to drill and where to drill. When they find the sweet spots, then I believe bigger companies will put much larger amounts of money in, and accelerate the development significantly.”

Some startups claim that natural hydrogen has the potential to be produced for much lower costs than other forms of hydrogen — one dollar a kilogram and as low as 50 cents — making it cheaper than green hydrogen currently, and comparable to gray hydrogen, which has a chunky carbon footprint.

‘It’s better to work with the Earth’

Last month, the International Energy Agency said that it was the “unprecedented” acceleration in clean energy keeping the Paris Agreement temperature limit of 1.5C within reach, for now — countering emissions from oil and gas, which continue to rise.

But even with an increasing array of clean energy options, reaching global net zero emissions by 2050 is dogged by some serious problems — particularly on how to decarbonize major sectors like shipping, aviation, long-haul trucking and steel manufacturing.

Amid a daily montage of climate disasters, the arrival of natural hydrogen seems an almost Hollywood plot twist.

“I get very philosophical, so excuse me, but of course it’s better to work with the Earth. We just have to know where to look,” said Webber, who has written hundreds of articles and books about energy and advises the US government.

“I’m an engineer but we don’t always have to engineer a solution. That’s been true for coal, oil, gas, wood, wind, solar, water, you name it. Why wouldn’t the Earth make hydrogen as well?”

Webber learned about natural hydrogen when he joined French energy company Engie as chief science and technology officer in 2018. There, he met geologist Isabella Moretti, the chief science officer, who he called the “godmother” of natural hydrogen.

Webber said he was “blown away” by what he learned from Moretti, one of a small band of scientists who has been studying natural hydrogen for decades.

“Instead of torturing nature to liberate hydrogen from water, or methane, you can go look for it,” Webber said. “There’s a lot of it, and it’s in a lot of places. As you dig into it, you discover that, actually, we’ve been stumbling over hydrogen for decades but it was a nuisance.

“What if we just change our mindset? It is a remarkable, transformational moment for the globe potentially.”

It’s hard to fathom in a world where atmospheric geoengineering — aka manipulating how much sunlight reaches Earth — is considered a climate solution, that we are only beginning to understand what is beneath our feet.

Dr Geoffrey Ellis, a geologist with the US Geological Survey [USGS] in Colorado, offered a theory. Hydrogen doesn’t exist in the same places as oil and gas and because it is a diffusive and reactive, it was thought it couldn’t accumulate in large amounts.

“Companies weren’t looking for it, or did see it and it wasn’t what they were exploring for, so they walked away from those places,” he told The Independent.

With more time on his hands during the pandemic, Ellis re-read a study, written by Alliou Diallo and colleagues, on the Bourakébougou discovery. Since then, he and a few others at USGS have focused their efforts on figuring out natural hydrogen’s potential.

As you dig into it, you discover that we’ve been stumbling over hydrogen for decades but it was a nuisance.

A USGS simulation model estimated between tens of millions and tens of billions of megatons of hydrogen are in Earth’s crust. But an important caveat: much of that would be inaccessible to humans, either too deep or too far offshore, or too small amounts to exploit, Ellis said.

But if just 1 per cent was recoverable, that would be enough hydrogen to keep the world going for at least two centuries, even if there was a surge in demand for hydrogen.

“There’s still a lot of learning to be done to understand this better,” Ellis said. “But I think we could do it. We just need to do the research and figure it out.”

Despite growing enthusiasm, the challenges surrounding natural hydrogen are immense as even those heavily invested acknowledge.

There is still much to learn about how hydrogen forms and accumulates underground. “There is the prospect of a valuable new primary and even renewable energy source, but for long-term success, the industry will need new subsurface imaging technologies and new data processing techniques to identify potential hydrogen accumulations efficiently,” Rod Davies, hydrogen lead at net zero consultancy, Marakon told The Independent in an email.

He also noted that there may be “potential public resistance to a new form of energy that relies on the extraction of resources”.

Mining laws would need to be adapted in countries where hydrogen does not yet fall into any category that would allow an exploration or production permit to be requested, Moretti explained in a recent interview.

Even if large amounts could be tapped underground, the next challenge would be storing and transporting hydrogen over long distances. Hydrogen is the lightest of all atoms and loves to make its escape into the atmosphere, so wastage becomes an issue. And it takes up a lot of space unless pressurized or liquefied, which are expensive.

There is a “mismatch” where natural hydrogen is being discovered and where it could be used, which would require massive investments in completely new infrastructure, said Dr Emre Gençer, a principal research scientist at the MIT Energy Initiative.

“I think it will be part of the solution but we need to take it with a grain of salt,” he told The Independent.

For now, the oil and gas industry remains on the sidelines. “It’s not that they don’t believe in it, it’s more a stage and maturity thing,” Webber said. “If people figure it out, then they buy it. The wildcatters don’t mind that either, that’s how you get rich.”

Zgonnik suggested natural hydrogen is a “gift” for the fossil fuel industry and one that could provide new jobs. “It presents an opportunity to pivot from fossil fuels, using their skills, existing infrastructure and tools,” he said.

“Switching to renewables requires building new infrastructure, which is expensive and takes time. We need to make the clean energy transition much faster and leverage existing infrastructure for transmission and distribution to end users.”

But the initial problem is finding the stuff. The largest accumulation of white hydrogen to date was stumbled upon this summer by scientists who were studying methane at a mining basin in France.

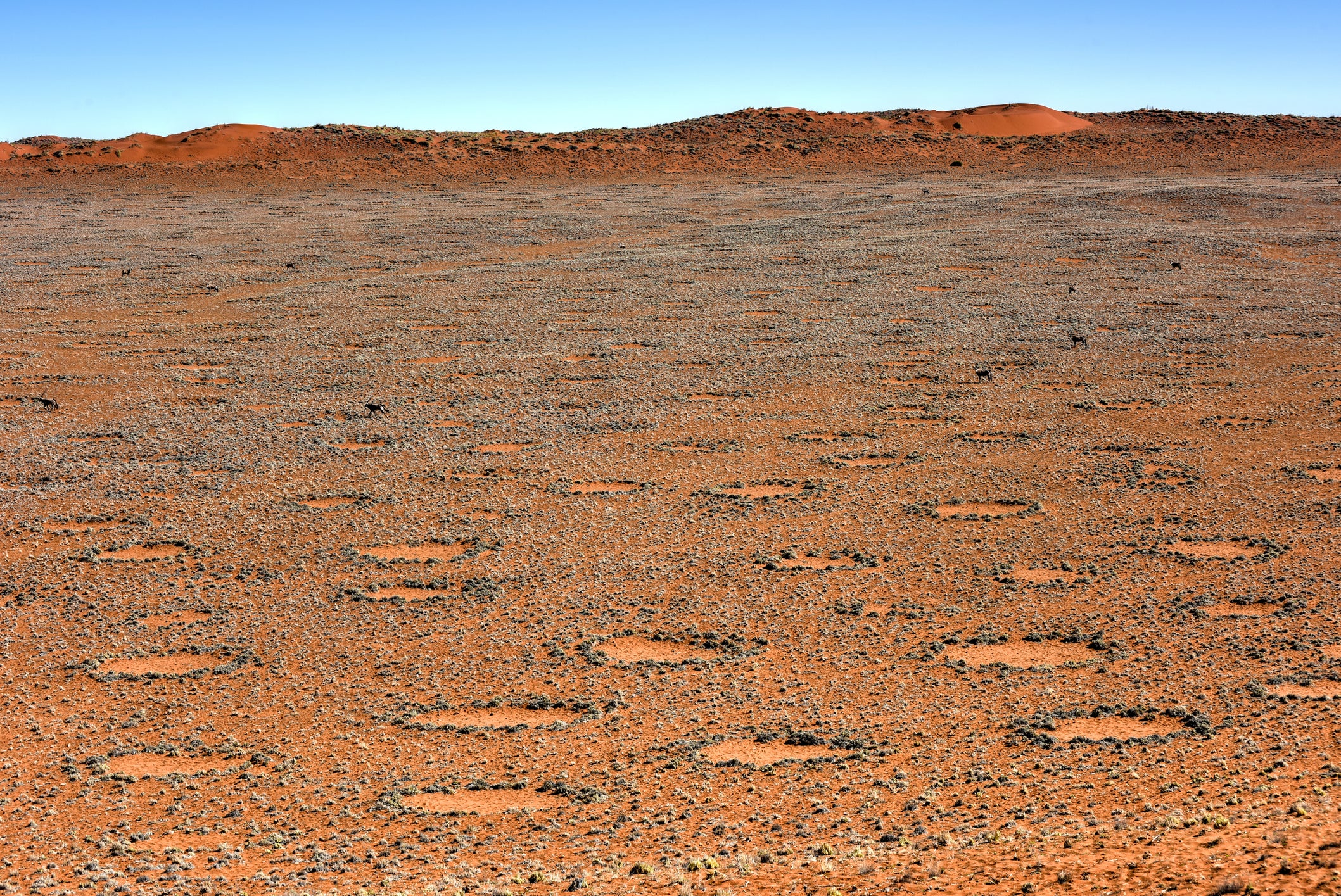

Fairy circles, which appear across landscapes where hydrogen is present, are a giveaway, but in hundreds of other locations hydrogen has been seeping unnoticed out of the ground for decades.

The USGS plans to publish a map next year of promising US locations of natural hydrogen. The east and west coasts are likely prospects along with the Mid-Continental rift which runs from Minnesota down through Iowa and into Kansas.

But don’t grab a shovel just yet. “The map is at national scale, and very coarse resolution. You’re not going to be able to look at the map and say, ‘I’m going to buy a lease and put a well right there,’” Ellis said.

Whatever the difficulties, the potential remains tantalizing for those on the frontlines of the experimental field. “We don’t know yet how efficient it will be, how quickly we will be able to scale up,” Zgonnik said. “But because the reserves of hydrogen on Earth could potentially supply all we need for the clean energy transition, and even more that, then it’s worth trying at least.”

And it’s hard to underestimate the potency of natural hydrogen in a country like Mali. More than 50 per cent of the population do not have electricity, and even for those who do, power can be curtailed up to eight hours a day. This not only makes daily life harder for its citizens but a lack of stable electricity has hampered the country’s economic progress.

“If you live in the Western world and had to think of living without electricity, you wouldn’t imagine what that means for quality of life,” said Asma Diallo, who took up her role at Hydroma after working in the green hydrogen industry in France.

“I saw hydrogen as having real potential for economic development in the African continent.

“This is an African project that was founded by an African, that has the potential to really change the energy mix in the region. It is very exciting and empowering.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks