US Federal Reserve announces biggest interest rate rise in nearly three decades

It follows an emergency meeting of the European Central Bank

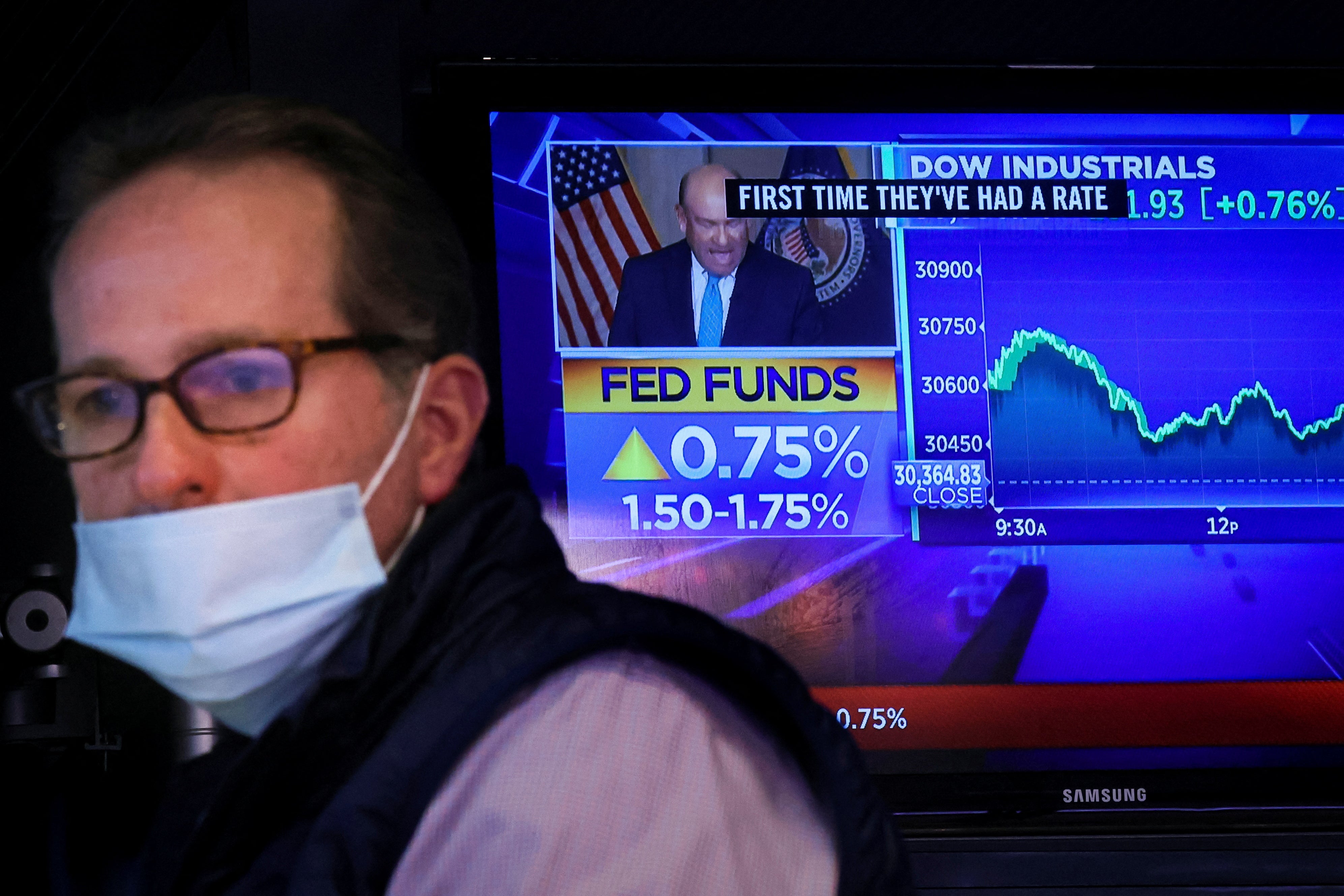

America’s Federal Reserve announced the highest interest rate rise in nearly three decades on Wednesday, signalling further increases that could risk another recession.

The move comes as the United States tackles soaring inflation, and followed an emergency meeting by the European Central Bank (ECB) called in response to market turmoil.

The Fed said rates would rise 0.75 per cent — the biggest increase since 1994.

It is ramping up its drive to tighten credit and slow growth with inflation having reached a four-decade high of 8.6 per cent, spreading to more areas of the economy and showing no sign of slowing.

In the US, experts have warned that a closely watched indicator is pointing towards a looming recession.

The “yield curve”, which plots the amount investors are willing to receive in exchange for lending money to governments, turned negative on Tuesday. It means that investors are pessimistic about the health of the economy.

Earlier, the ECB pledged to create an unspecified market backstop that could be used to buffer some countries against a debt crisis similar to the one that shook the eurozone more than a decade ago.

The promise came after an unscheduled meeting of the bank's governing council and aims to address a selloff in Italian and Spanish government debt in the wake of the bank's decision to start raising interest rates in July for the first time in 11 years.

ECB bond purchases and record low interest rates have kept borrowing costs down for businesses and governments. But those measures are coming to an end as the bank pivots to deal with record inflation of 8.1 per cent.

The bank last week announced the interest rate hikes in July and September to cool rising prices but did not offer a specific measure to halt market turbulence involving suddenly higher borrowing costs for the more indebted EU member countries, such as Italy.

Several eurozone nations are highly indebted, with debt figures equivalent to more than their entire annual economic output.

The cost of Covid support programmes has added to debt built up after the financial crisis that has yet to be paid down.

The Bank of England is widely expected to increase interest rates when its Monetary Policy Committee meets on Thursday. That will mean higher borrowing costs for homeowners on variable or tracker mortgages.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks