The bitcoin craze is using up so much energy

The reason bitcoin uses a lot of energy is rooted in the way the bitcoin network operates

The exploding price of the cryptocurrency bitcoin this year – and its subsequent recent fall – has triggered doubts not only about its financial stability, but also the environmental sustainability of the currency itself.

One alarmist article in Newsweek said that bitcoin computer operations could consume “all of the world’s energy by 2020”. The website Digiconomist claims that bitcoin operations use as much energy as Denmark, or enough to power 3,071,823 US households.

Other analysts say the true figure is smaller, albeit hard to measure because it is spread around the world, generated by an unclear mix of machines and co-mingled with other sources of electricity demand. But several experts told The Washington Post that bitcoin probably uses as much as 1 to 4 gigawatts, or billion watts, of electricity – roughly the output of one to three nuclear reactors.

That would amount to less than 1 per cent of US electricity.

That won’t devour the world’s entire electricity resources, but it’s a significant drain – and it’s growing fast. Moreover, some of the electricity used, in China in particular, may come from burning coal – a fossil fuel that contributes most heavily to climate change.

The reason bitcoin uses a lot of energy is rooted in the way its network operates. A digital currency, bitcoin is not controlled by any central bank or commercial clearinghouse but by a network of users who expend large amounts of computing power, and thus energy, building a so-called “blockchain” of bitcoin payment transactions.

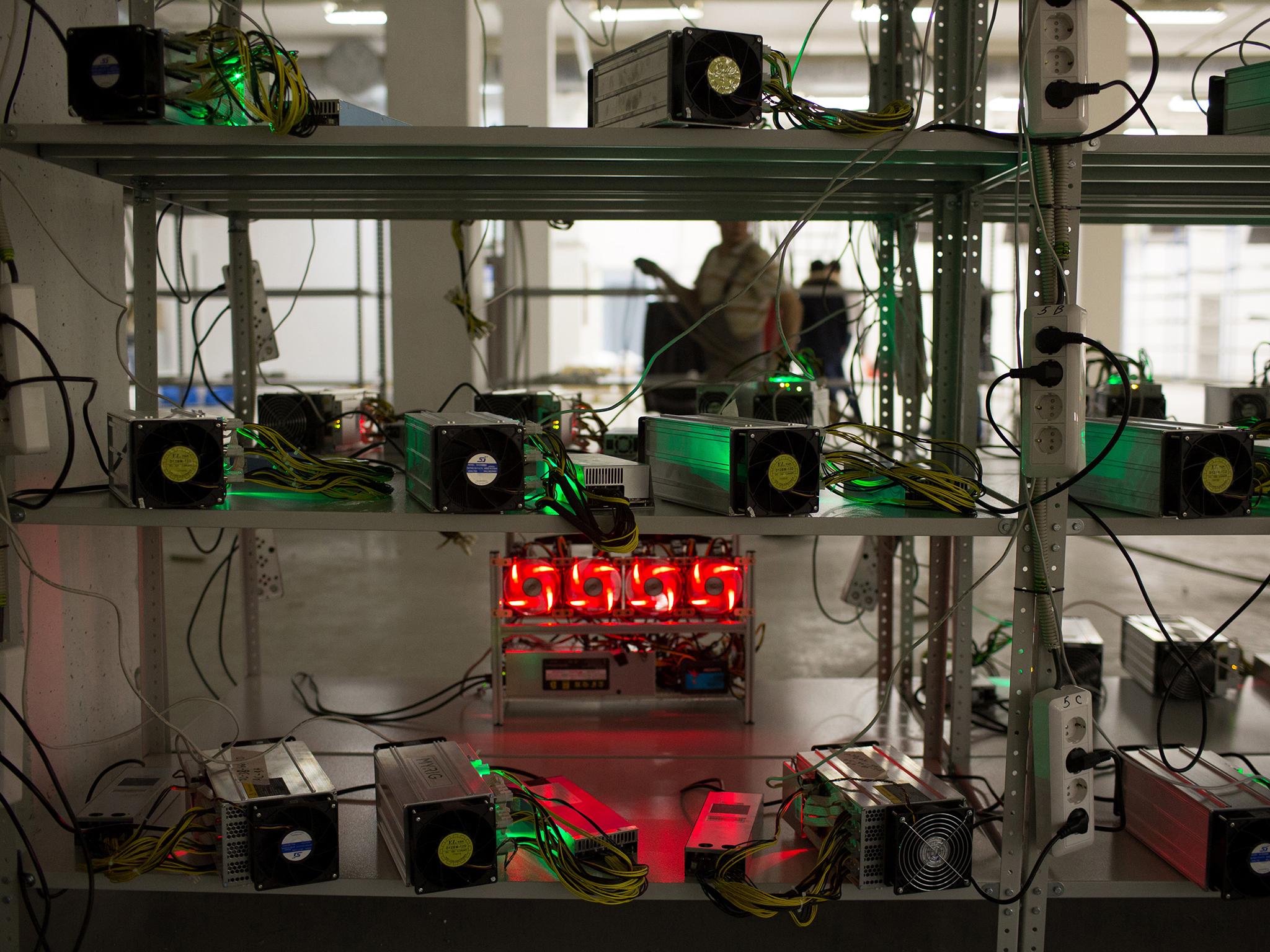

To compile this comprehensive record, the bitcoin network relies on “miners”. Bitcoin miners have to perform a phenomenally large number of computer calculations to track and verify transactions and solve complex puzzles to obtain bitcoin rewards. As bitcoins became more popular and valuable this year, the puzzles miners face grew more difficult, and therefore the demand for high-powered computer processing grew as well. That means more energy usage.

“If the price of bitcoin continues to rise, it will continue to use more energy,” said Mike Reed, director of the Blockchain Programme Office for Intel. The reason, he said, is that the price represents “an economic incentive to add more mining equipment to the network ... and that incentive is built in.”

Bitcoin’s soaring prices earlier this year were driven by everything from a craze in South Korea to the international CME Group electronic exchange which started trading bitcoin futures on 18 December. And although it may have taken a tumble recently, most observers are expecting it to recover its value in 2018, meaning demand should remain high.

“At the moment ... a lot of people want to get into the mining game,” explains David Malone, a lecturer at Maynooth University in Ireland who co-authored a paper in 2014 finding that at that time, the bitcoin network was using up about as much electricity as his entire country. “And then ... bitcoin responds by making the problems more difficult.”

The difficulty of uncovering a new block has increased along an exponential curve of late, even as the number of calculations per second has grown sharply as well since late last year. The bitcoin network is now generating some 14 million trillion “hashes”, or possible solutions to a problem, per second.

How much energy is being consumed?

Malone and a colleague calculated in 2014 that the total power required for bitcoin calculations could be between 0.1 and 10 gigawatts, or billion watts, of instantaneous power. Ireland at the time was consuming about 3 gigawatts steadily, so he compared the two in terms of order of magnitude.

But since then he thinks the usage is a lot more. Computing efficiency has increased, but the number of calculations has gone up even more, meaning he thinks that 1.2 gigawatts is now probably the lowest the number can be, and that assumes everyone is using the most efficient computing hardware, which they certainly are not.

“That really is the lower bound,” said Malone. “It’s really unlikely everybody in the network is using that, so the 1.2 is the lowest it can possibly be.”

That’s roughly comparable to the electricity generated steadily by one of the larger utility-scale nuclear reactors in the United States. But there are 99 US nuclear reactors in total, which provide about 20 per cent of the nation’s electricity – so while bitcoin is clearly a large energy consumer, it would still be relatively small scale in the context of a major country like the United States or China.

Harald Vranken, a professor of management at the Open Universiteit in the Netherlands, has calculated a similar number. On 1 January he calculated the energy usage at 0.1 to .5 gigawatts, but with the bitcoin explosion this year, he thinks it has increased to between 1 and 4 gigawatts.

“It will only go up if things increase like they have been doing in the last four months,” said Vranken. “So at some point in time, I think, this situation cannot hold. I think that is clear.”

Still, there are skeptics. Jonathan Koomey, an energy researcher and lecturer at Stanford University who studies the energy consumption of data centres, has found that they consume about 1.8 per cent of US electricity, of which he sees bitcoin as a small fraction.

“While bitcoin mining electricity use may have grown, it is a tiny part of all US data centre electricity use, and that conclusion is true for the world as well,” said Koomey by email. “As we transition more and more workloads to the cloud, it is unlikely that total data centre electricity use will grow much in the next few years.”

Still, that bitcoin mining is energy intensive is shown not just in the calculations by experts, but in the stark reality of how this business works. Energy consumption is a major factor governing the strategies behind where, and how, miners conduct their work.

“The economics of bitcoin mining mean that most miners need access to reliable and very cheap power on the order of 2 or 3 cents per kilowatt hour. As a result, a lot are located near sources of hydro power, where it’s cheap,” said Sam Hartnett, an associate at the Rocky Mountain Institute, a non profit energy research and consulting group.

“The amount of energy going into mining is largely a product of the price of bitcoin and the type of hardware being used,” Hartnett said. “As the price goes up, there are stronger incentives for miners to add new computing power or new hardware or attract new operations to mining. In either case, you’d be adding to total computing power of the network, which influences the difficulty of the hash problems that miners are raising.”

If bitcoin’s price, and concurrent energy consumption, rose in a similar way next year, that could be a serious problem. But it’s less clear whether the current rate of growth in consumption would continue.

Claire Henly, a manager at RMI, said “there are two ways this problem can be solved.” There can be changes to the protocol of bitcoin that would allow for reduced energy spent, or users could switch to other cryptocurrencies that require less energy expenditure.

She said that ethereum, the second most widely used network, is changing its protocol to reduce energy use.

She said that bitcoin, unlike many other digital currencies using blockchains, is difficult to change because it is decentralised. However, she added, “there are definitely changes that can be made that would reduce energy use and not make this a fatal flaw for bitcoin.”

Christian Catalini, assistant professor for technological innovation, entrepreneurship and strategic management at the Massachusetts Institute of Technology, said that the current energy trends of bitcoin are not permanent.

“The first thing to keep in mind is that the system is not in equilibrium,” he said. “What you’re looking at is the expansion and growth phase of the [bitcoin] network. The reason miners are investing so much in bitcoin from the start is that they were hoping to earn tokens that would appreciate dramatically in value over time. They are willing to invest capital and electricity to be early in this race to manufacture bitcoin.”

Currently, as many as half of the biggest bitcoin miners are believed to be Chinese firms, which tend to have low capital and energy costs.

However, Catalini said, over time there will be fewer bitcoins left to find, a feature of the original plan by bitcoin’s mysterious founder. “Once we’re at scale and so few bitcoins are being mined that it is essentially irrelevant for the system, the revenue for the miners will have to come from transaction fees. So in equilibrium, the energy and security provided by the network from this wasteful computation will have to be equivalent to the transaction fee.”

He also said that “different miners will have different cost structures depending on how advanced their hardware is.” He said that most mining takes place using highly efficient chips customised just to mine bitcoin.

“The days when you or I could buy desktop and mine off on the side and have a chance of doing proof of work that bitcoin uses, is a pretty small chance,” said Gerald Gray, technical executive at the Electric Power Research Institute. “Now guys have large data centres specifically designed for this.”

Gray said his group at EPRI has discussed whether utilities could use excess data centre capacity to mine for bitcoins in their unregulated businesses. But he said he would have to do the maths on whether that made economic sense.

But at the Rocky Mountain Institute, Henly is most interested in blockchain technology as a way to monitor and control electric power generation in a more sophisticated energy grid.

For Intel, the broader blockchain technology holds huge potential in commercial transactions, and the company is designing technologies to support these applications. But Intel’s Reed is not sure whether bitcoin can easily change away from its energy consuming ways, and also points to ethereum as the next currency in line and one that is more sustainable.

“If it were to continue to ... become more costly to mine, there are other networks that could displace it,” said Reed. “Ethereum, for instance, has a cryptocurrency to it as well, and has [a] more energy efficient way to mine. And therefore, that network will have basically less friction as it grows and could overtake it as an alternative.”

© Washington Post

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks