Food bills to rise by around £180 a year, shoppers warned

Inflation in past four weeks is higher than December levels, latest data shows

The cost of food in shops is set to soar by around £180 per year, new figures show, as sales continue to plummet and push up grocery prices in the UK.

Despite the loosening of Covid restrictions in recent months, mounting prices come as sales have continued to falling compared with a year ago when lockdown restrictions saw restaurants, pubs and non-essential retailers closed.

The purchasing habits of Londoners have undergone the greatest transformation, Kantar noted, with take-home sales of food and drink down 11 per cent.

There was however a significant surge in sales of vegan and low-alcohol products as customers embraced Dry January and Veganuary.

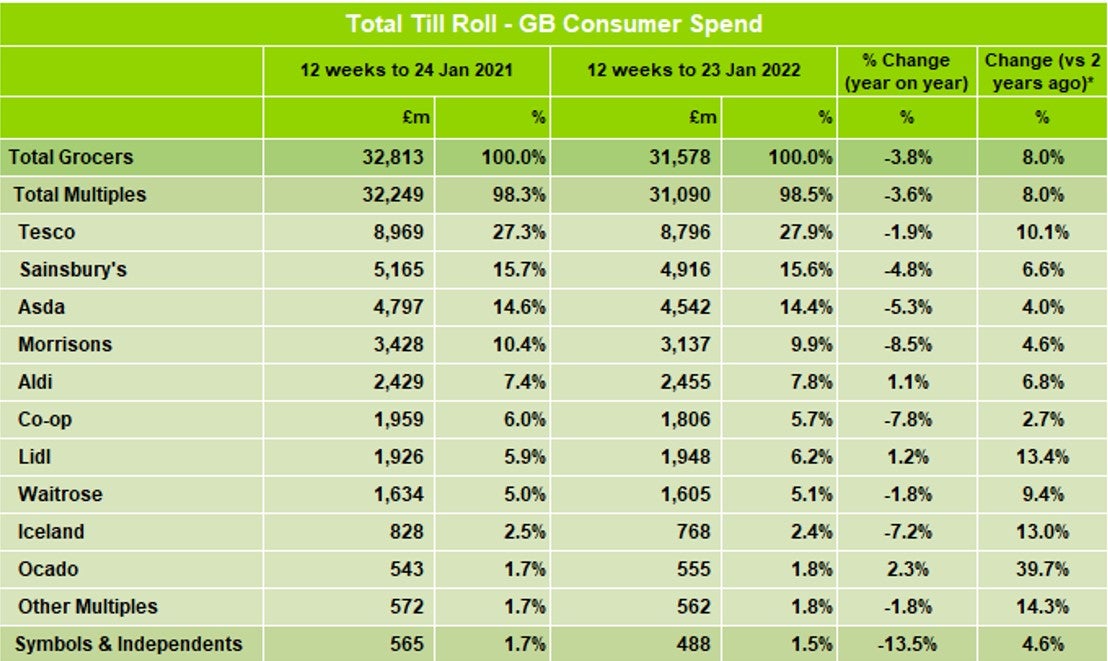

In the 12 weeks to 23 January overall sales fell 3.8 per cent, although they remain eight per cent higher than pre-pandemic levels, Kantar said.

Fraser McKevitt, head of retail and consumer insight at Kantar, said: “Prices are rising on many fronts, and the weekly shop is no exception.

“Like-for-like grocery price inflation, which assumes that shoppers buy exactly the same products this year as they did last year, increased again this month.

“Taken over the course of a 12-month period, this 3.8 per cent rise in prices could add an extra £180 to the average household’s annual grocery bill.

“We’re now likely to see shoppers striving to keep costs down by searching for cheaper products and promotions. Supermarkets that can offer the best value stand to win the biggest slice of spend.”

The market growth figures do not include on-the-go food and drink purchases, which are likely to be higher than last year.

The company behind Irn-Bru said on Tuesday that that prices for its drinks were going up due to inflation.

Bosses at AG Barr said they have seen rising costs for raw materials, including packaging and energy bills, leading to cost-cutting measures, adding that they have "adjusted our pricing with customers where appropriate".

Kantar’s report noted the end of lockdown rules and a return to the office means pre-pandemic shopping patterns were starting to return.

Mr McKevitt said: “Since the first lockdown in March 2020, shoppers have been buying in bulk and visiting the supermarket less often.

“But basket sizes are now 10 per cent smaller than this time last year, hitting their lowest level since the beginning of the pandemic, while footfall increased by five per cent as every major retailer was busier in their stores.”

The return to work also saw an increase in sales of personal hygiene sales, Kantar found, with razor blade sales up 14 per cent and deodorant up 20 per cent.

There was also strong growth in plant-based products, with shoppers embracing vegan diets in January. Around 10.7 million households bought at least one dairy-free or meat-free alternative.

Whilst those embracing Dry January by avoiding alcohol helped push alcohol-free sales up five per cent.

Only Aldi and Lidl recorded year-on-year growth during the period, up 1.2 per cent and 1.1 per cent respectively, although all supermarkets enjoyed rises on a two-year basis.

The discount supermarkets enjoyed growth for the first time since June last year and both grew market share, along with Tesco and Waitrose.

Sainsbury’s now holds 15.6 per cent of the market, Asda 14.4 per cent and Morrisons 9.9 per cent. Co-op share stands at 5.7 per cent and Iceland at 2.4 per cent.

There were heavy falls in online grocery sales as shoppers opted for trips to supermarkets instead, with online purchases down 15 per cent year-on-year.

But online orders remain above pre-pandemic levels, with orders accounting for 12.5 per cent of all grocery spend.

Bookmark popover

Removed from bookmarks