Budget 2021: Tax and benefits tinkering offers temporary fix

The chancellor has given one of the most important Budgets in living memory. So what was in it and what will it mean for you?

In normal years we typically write a “winners and losers” piece after the Budget speech, detailing who will pay more and who might benefit.

But this year that would be misleading. The chancellor is still spending a vast amount in the hopes of helping the economy recover but a list of “winners” would be misleading – it’s money that has to be spent because the crisis is so gargantuan.

Essentially, the more being spent on any single group, the more likely that group is to have suffered excessively in this crisis.

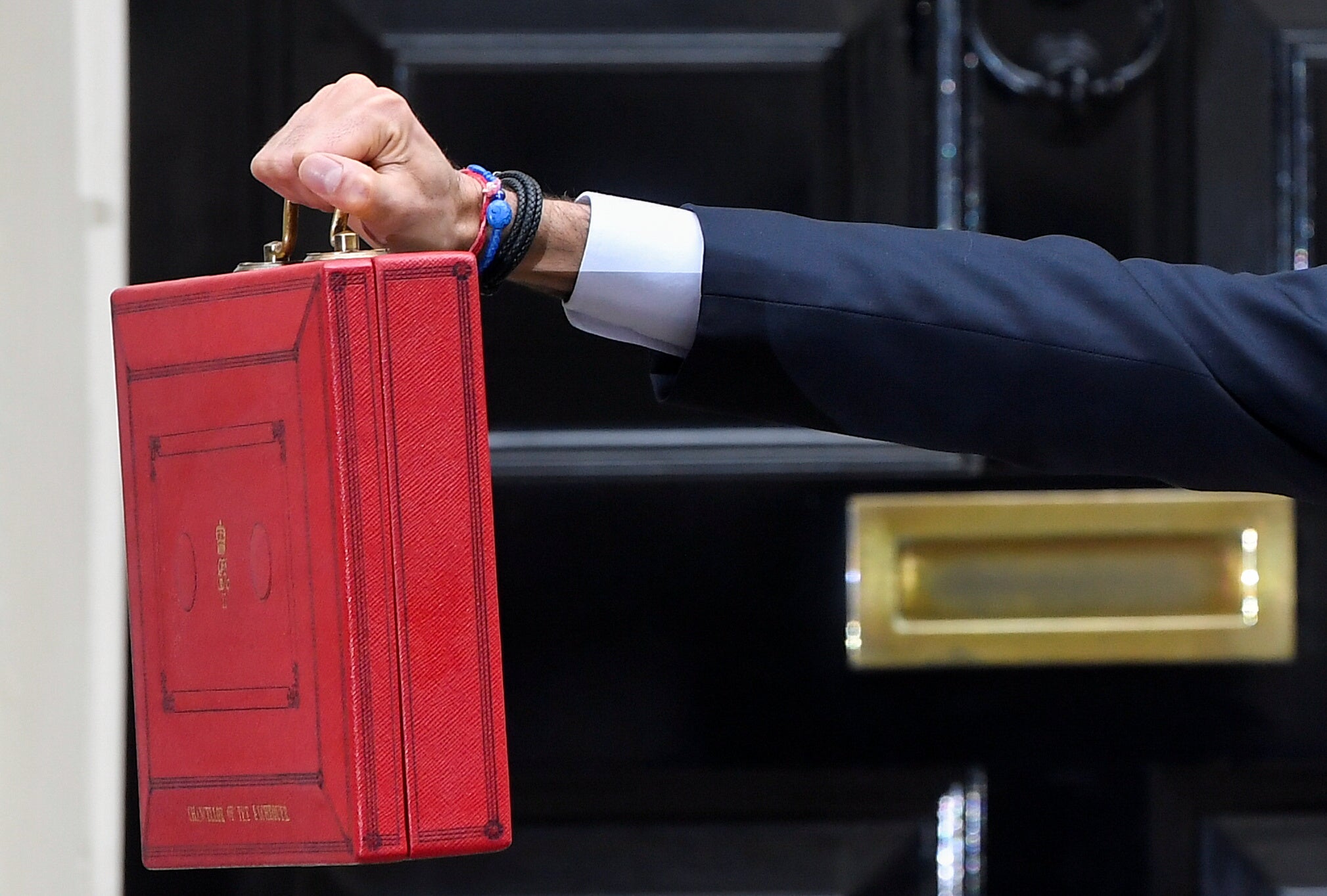

So what was in his briefcase and will it be enough?

Universal credit

The £20 monthly uplift will continue for a further six months, instead of coming to an end at the end of April.

However, there’s still a lot of concern from charities and campaigners that stripping it away in six months might mean many more households are plunged into difficulties.

Action for Children’s director of policy and campaigns, Imran Hussain, says: “It makes no sense to cut this lifeline in six months when the furlough scheme will have ended and unemployment is expected to be near its highest – exactly when families will need it most. Families need help and certainty, not a stay of execution.”

£500 payments for tax credit recipients

The government says it will make a one-off payment of £500 to eligible working tax credit recipients across the UK.

Rise in the minimum wage

The National Living Wage, which is currently the name of the minimum rate paid to people aged over 25, will rise to £8.91 from April. But the age it applies to actually falls in April too, meaning this will be the new minimum rate payable to anyone over the age of 23.

No rise in duty on fuel and booze

Planned increases for duties on spirits, wine, cider and beer will all be cancelled, for the second year in a row. That will be welcomed by pubs and restaurants anxious to get people spending again.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

However, a planned increase in fuel duty has also been cancelled. That may be a relief to motorists but there will be many environmental campaigners who are worried about the message this sends.

Far more for furlough

There had been real concern that when the furlough scheme ended in the spring there could be a huge spike in unemployment as so many businesses are still struggling. Those that will be among the last to reopen will have been particularly hard hit.

And there are still some 4 million workers whose wages are being paid or subsidised by the scheme so this had been a real concern.

Now we know the government will extend the furlough scheme until the end of September. It will remain at the original levels, with 80 per cent of furloughed employees’ wages for hours not worked being paid, but capped at £2,500 a month.

From July, employers will be expected to pay 10 per cent, rising to 20 per cent in August and September.

A fourth self-employment grant

While self-employed workers who qualify for the self-employment income support scheme (SEISS) knew there was another payment coming to cover February, March and April, they had not known what amount would be available.

The chancellor has announced that the payment will be available from next month and will be 80 per cent of three months’ average trading profits, once again capped at £7,500 in total.

There will also be a fifth and final grant for the three months from May onwards, again worth three months of average profits. This time it will be more tailored, with the amount available depending on the extent to which turnover has fallen.

Importantly for some, this grant will be available to some 600,000 new people. There has been an issue with the SEISS in that it was only available to people who had filed tax returns – and who met the other criteria.

The latest round of payments will take into account recently filed tax returns for the 2019-2020 year, meaning hundreds of thousands of newly self-employed people can claim it – although they can’t retrospectively claim the previous payments.

Frozen income tax thresholds

The chancellor said the government will not be increasing income tax, national insurance or VAT.

However, the allowances will be frozen, which means that over time more people will be dragged into paying it as wages rise. The personal income tax allowance will rise to £12,570 next year and remain at that amount until 2026, while the higher rate threshold will rise to £50,270 and then also freeze until 2026.

Future tax hikes

Sunak did sound a note of caution in his speech. The schemes and extensions outlined today will cost vast amounts of money and most agree that spending is clearly necessary to support the country through the crisis.

Not spending it could result in significant economic scarring and mean the economy spends decades in recovery.

However, Sunak did nod toward a future where the nation’s finances would have to reset to a more sustainable level.

There was also £100m promised to set up a new HMRC taskforce of 1,000 new investigators to clamp down on evasion and fraud in the tax system.

Of course, a country’s debt is not the same as a household’s debt. References to “maxed-out credit cards” or “living beyond our means” don’t really make sense when discussing a country’s finances.

But today the chancellor made it clear that at some point he’s going to adjust the balance – by reining in spending and potentially raising taxes.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks