Money roundup video: Energy bill rip-off and cut-priced insurance

The Independent’s Personal Finance Editor Simon Read talks over the latest Money news

This week: Energy bill rip-off; cut-priced insurance; and exit fees warning for investors.

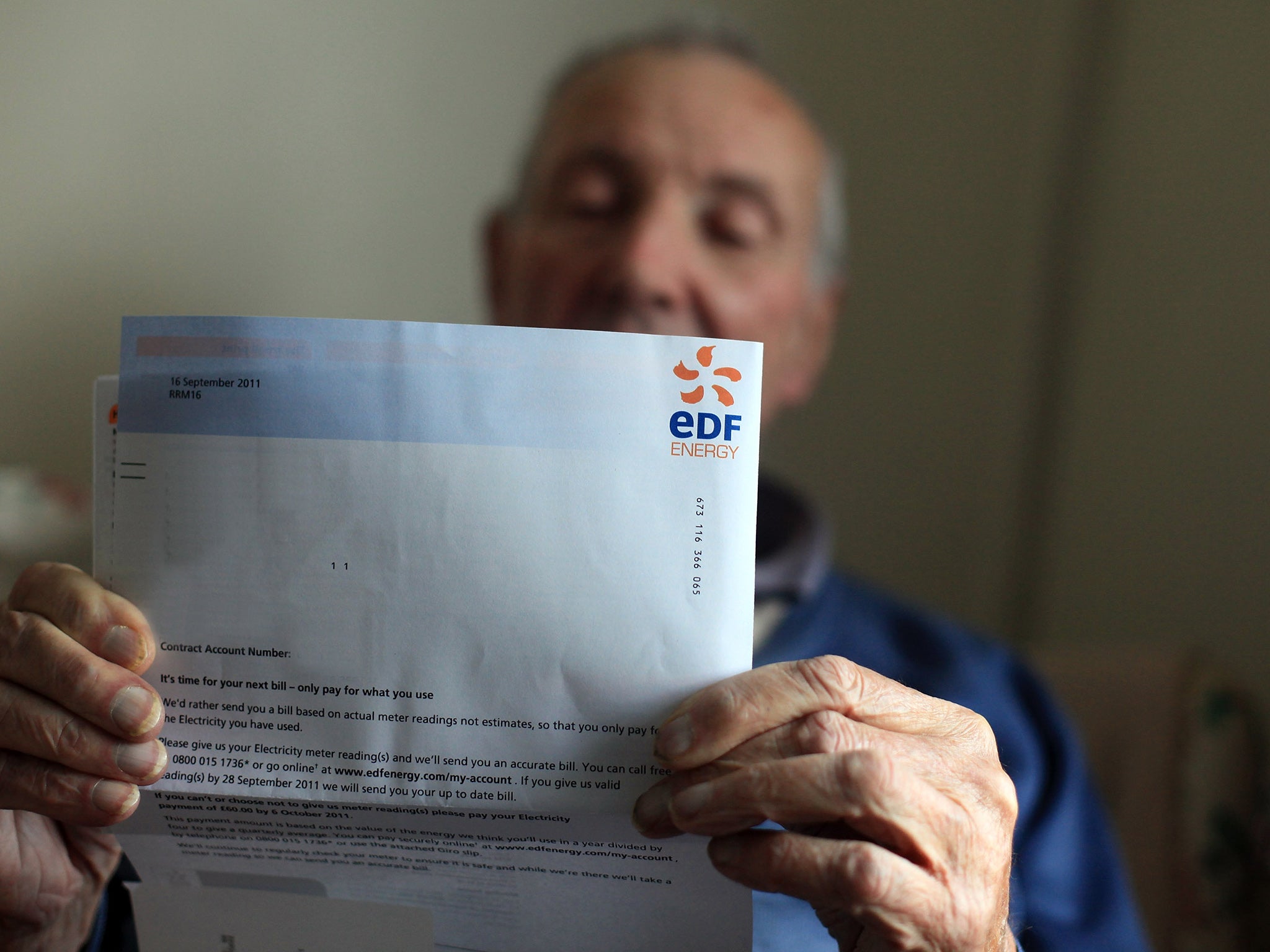

Energy bill rip-off: suppliers have overcharged us by £145 a year

The big energy companies are cutting gas prices but still overcharging consumers by £145 a year, analysis shows.

Their recent flurry of price cuts are half as much as the savings they made in the wholesale gas market while energy firms are also accused of failing to pass on cuts to electricity bills despite being able to reduce electricity prices by 10 per cent.

And the price increases in winter 2013 were unnecessary, the report concludes, adding millions to UK bills while boosting profits by the same amount.

Their refusal to pass on the full extent of price drops in the wholesale cost of gas and electricity has cost UK consumers £2.9bn over the last year.

The new allegations of profiteering by the Big Six suppliers have been made by consumer group Which?. They follow last Friday’s predictions from energy watchdog Ofgem that gas and electricity firms’ profit margins will climb from £105 to £114 per customer over the next 12 months despite planned price cuts.

Insurance falls but renewal rate may be higher

The cost of home and car insurance is falling. The average annual buildings and contents policy was £291, or £5.60 a week in 2014. That was down 3 per cent over the year, according to the Association of British Insurers premium tracker.

Meanwhile the cost of buildings insurance dropped by 6 per cent over the year and contents insurance fell 5 per cent.

Car cover also fell, by 4 per cent over the year to £372.

But lower prices may not always be passed on to loyal customers. If your insurer hasn’t offered you a lower premium at renewal, it’s almost certainly worth getting a quote from a rival to save money.

Investor’s warning: watch out for unexpected exit fees on Isas and fund transfers

Fund broker TD Direct Investing has today weighed into the investment exit fee debate by scrapping the charge on its online platform.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Since investment firms were forced to make charges more clear by the City regulator in 2013, a few have scrapped unfair exit fees, which often hit investors by surprise when they switch Isas or unit trusts to different online platforms.

Firms such as Fidelity, Cavendish Online and Axa Self Investor have already scrapped the charge and TD Direct joins them today and calls on others to follow.

“Investors should have the freedom to make their own investment choices, including which platform to use,” said John Tracy, head of TD Direct.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks