New homes sought for century-old stamp presses being decommissioned by HMRC

From mid-July, an electronic process will be adopted for remaining transactions which still need stamps, HM Revenue and Customs said.

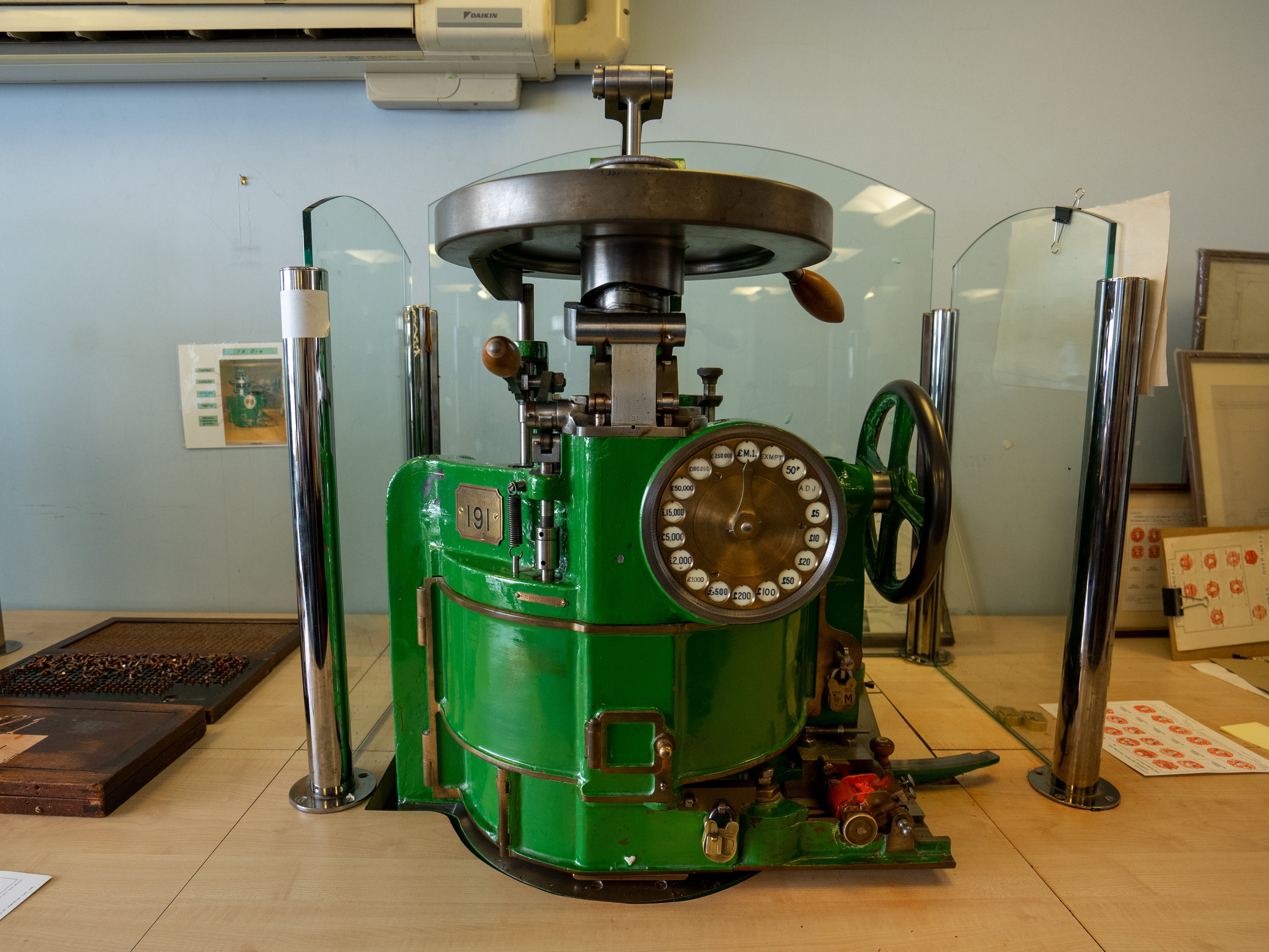

Antique stamp duty press machines used by the taxman are being decommissioned, bringing a chapter of financial history spanning more than 300 years to an end.

The presses are about 100 years old and their origins can be traced back to the Victorian era.

From mid-July, an electronic process will be adopted for remaining transactions which still need stamps, such as duty paid on shares purchased on a stock transfer form.

The new process began during the coronavirus pandemic and, having worked well during lockdowns, HM Revenue and Customs (HMRC) has decided to stick with the new approach.

This changeover, which will mean the old machines are officially retired from service on July 19, will leave the defunct presses needing new homes.

Three will be kept by HMRC, but they are looking for suitable institutions which are keen to have one of five remaining decommissioned presses, preserving them for their historical significance.

The presses were designed by the Stamp Office and built by the internal engineering section using parts supplied by Grover and Co, an engineering firm once based in Britannia Works, Wharf Road, London.

They were able to stamp various denominations and tally the stamps they embossed every day.

People often associate stamp duty with buying a house – but various duties where payment has been indicated by stamps have been devised and withdrawn over the years, applying to dice and playing cards, hats, gloves and mittens.

The process of stamping documents to show that tax had been paid began in England long before the presses existed.

The first stamp duty was introduced in 1694 as a temporary measure to fund the war on France.

It was paid on all paper, vellum or parchment to be used for legal documents – and payment was indicated by an embossed, colourless stamp.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

When ink technology improved in the 1870s, stamp presses were developed and redesigned to stamp many different values and be more efficient and secure.

In many ways it is sad to see the presses go, almost like seeing a life-long colleague retire

The range of items subject to stamp duty has shrunk over the years.

One of the biggest recent changes was in 2003, when the stamp duty land tax on land and property was introduced. Physical stamps were not required, leading to the closure of many regional stamp offices across the country.

Angela MacDonald, HMRC’s deputy chief executive and second permanent secretary said: “The new digital process operated well during national lockdown when it was much easier to use virtual rather than physical stamping.

“As this effectively amounted to a successful trial it convinced us that this was the right time to end the process of physical stamping and decommission our presses.

“In many ways it is sad to see the presses go, almost like seeing a life-long colleague retire, but it is wonderful that HMRC is able to keep and enjoy the stamp presses themselves in so many of our new offices, where they will make decorative and informative talking points, acknowledging our past in the very places that are so important to our future.

“Now what we’d most like to do is secure long-term homes for the remaining pieces, which are well crafted and represent elements of both British industrial history and financial history.”

The presses weigh 685kg and will require careful handling and strong flooring. They would be ideally suited to museums or financial institutions with sufficient space, HMRC said.

Any organisations interested in rehoming a decommissioned stamp press should contact stamp.presses@hmrc.gov.uk.

Bookmark popover

Removed from bookmarks